| Increase stock demand, which may lead to a share price increase |

| Reduce the number of shares on the market, resulting in higher earnings per share |

| Can use it as an effective tool to manage excess liquidity |

| Capitalize on a capital gain if the company is confident in its future performance and believes that its share price is significantly lower than its fundamental value, reselling shares at the right time will generate profitable returns, with the capital gain recorded in the shareholders' equity as a premium on treasury shares |

| Earnings per share (EPS) and Return on Equity (ROE) are higher because repurchased shares are not factored into the EPS calculation |

| Have opportunities of receiving a higher dividend per share |

| There is also a possibility that the share price will rise due to the higher earnings per share |

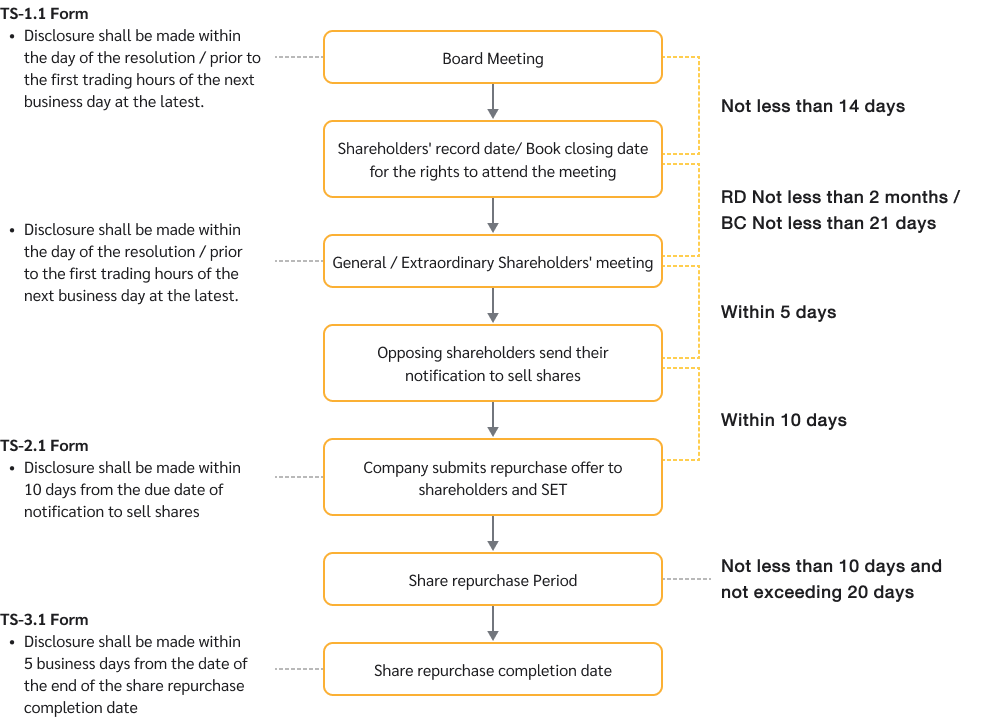

| In case the shareholders vote against the resolution of shareholders’ meeting to amend the company’s articles of association in the matters related to voting rights or rights to receive dividends; and | ||

| For the purpose of financial management when the company has accumulated profit and excess liquidity. | ||

- Share repurchase is permitted under the articles of association of the company:

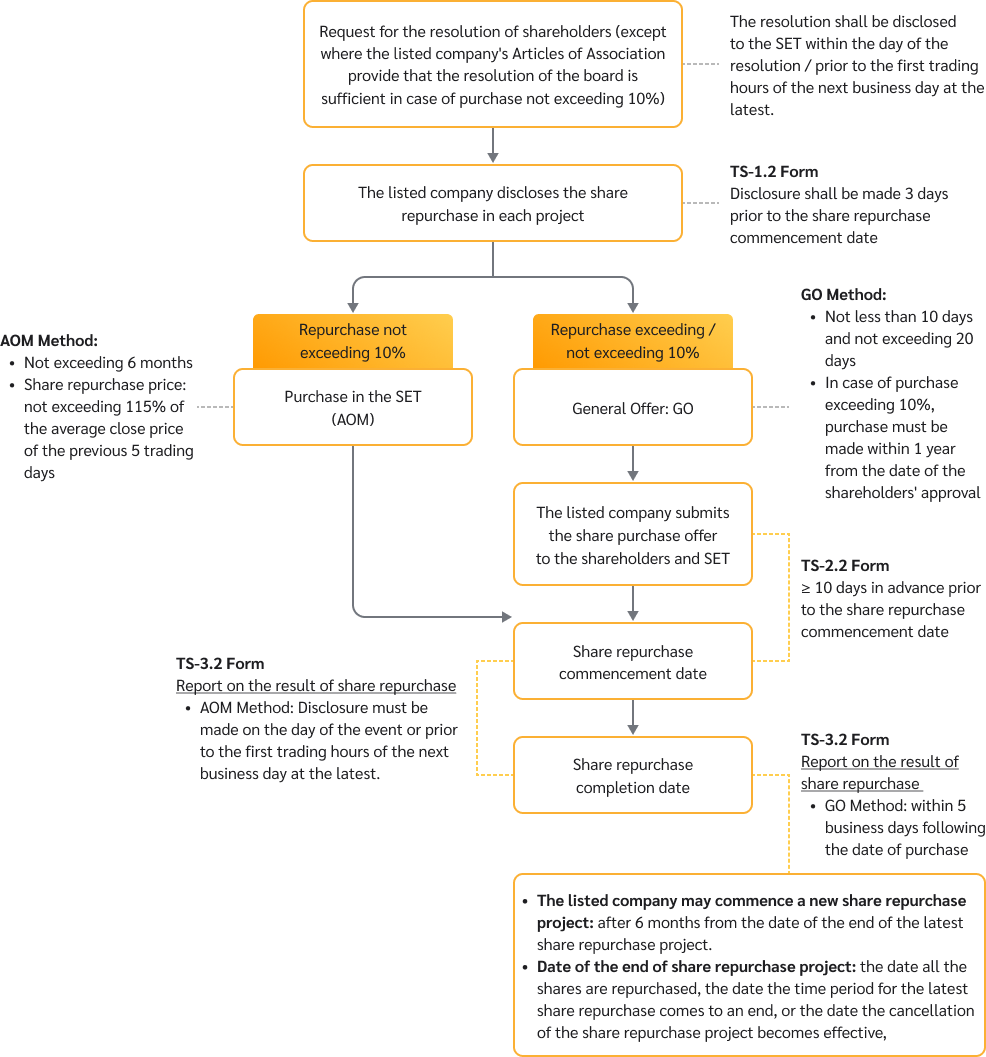

- If the repurchase of shares ≤ 10% of the paid-up capital, the board of directors may be granted the power to determine the repurchase of shares.

- If the repurchase of shares >10% of the paid-up capital, approval from the shareholders’ meeting must be obtained and the shares must be repurchased within 1 year.

Additionally, a listed company who will repurchase shares for the purpose of financial management shall also have the following qualifications:

- have accumulated profit on the separate financial statement: the repurchase limit shall not exceed the company’s unappropriated accumulated profit which shall be reserved until the repurchased shares are wholly distributed or upon the decrease of capital to deduct the remaining repurchased shares after the distribution;

- have excess liquidity: considering from the ability to repay the debts within the next 6 months from the date of the share repurchase commencement date and the share repurchase does not affect the company’s ability to repay debts; and

- the free float proportion must not be reduced to lower than the minimum threshold stipulated by SET i.e. not lower than 15% of the paid-up capital. If there are less than 150 minority shareholders, the shares cannot be repurchased.

| 1 | In case of share repurchase in case the shareholders vote against the resolution of shareholders’ meeting to amend the company’s articles of association in the matters related to voting rights or rights to receive dividends: the company shall adopt General Offer method (General Offer : GO). | ||||||||||||

| 2 | There are 2 methods in case of share repurchase for the purpose of financial management:

|

- Repurchase price ≤ 115% of the average close price of the previous 5 trading days

- Distribution price ≥ 85% of the average close price of the previous 5 trading days

| 1. | Upon the passing of board of directors’ resolution on the share repurchase on Day T |

| In case the shareholders vote against the resolution | In case of financial management |

1. Period where the resolution must be disclosed

| 1. Period where the resolution must be disclosed

|

2. Information that must be disclosed (Form TS-1.1)

| 2. Information that must be disclosed (Form TS-1.2)

|

- listed company shall disclose the share repurchase project or distribution of repurchased shares 3 days before the commencement date of share repurchase / distribution of repurchased shares / the date the amendment or cancellation of the share repurchase project comes into effect. The disclosure must be done without delay on the date of the board of directors’ or shareholders’ resolution, as the case may be, and in case of amending or cancelling the project, the reason and necessity for such amendment or cancellation shall also be disclosed.

- For offer for share repurchase in case the shareholders vote against the resolution to amend the company’s articles of association in the matters related to voting rights / rights to receive dividends and the general offer for share repurchase for the purpose of financial management, the offer for share repurchase form shall be submitted to the shareholders and submitted via SETLink system to be disclosed to investors as follows:

- In case the shareholders vote against the resolution, offer for share repurchase form (Form TS-2.1) shall be submitted to the shareholders who vote against the resolution within 10 days from the date the period for notifying the offer has expired whereby the repurchase time period shall be 10 - 20 days.

- In case of general offer for share repurchase for the purpose of financial management, the offer for share repurchase form (Form TS-2.2) shall be submitted to the shareholders 10 days before the share repurchase commencement date whereby the repurchase time period shall not be less than 10 - 20 days.

| 2. | Report on the result of share repurchase |

| In case the shareholders vote against the resolution and in case of general offer | In case of share repurchase via SET |

1. Period of disclosure

| 1. Period of disclosure

|

2. Information that must be disclosed (Form TS-3.1)

| 2. Information that must be disclosed (Form TS-3.2)

|

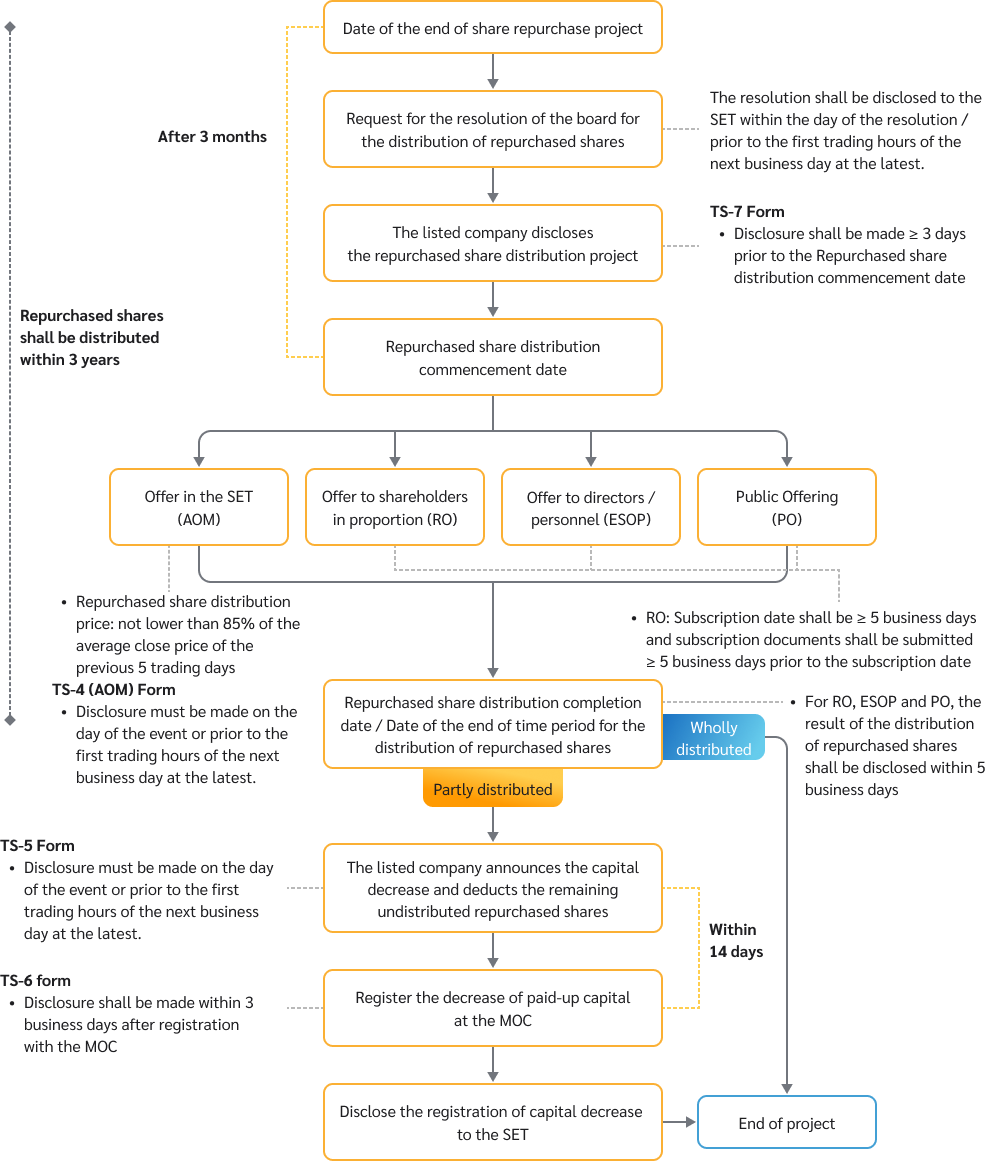

| 3. | Upon the passing of board of directors’ resolution on the distribution of repurchased shares on Day T |

| In every case |

1. Period of disclosure

|

2. Information that must be disclosed (Form TS-7)

|

In case distribution of repurchased shares via RO: To proceed the same as in the case of Right Offering for newly issued shares i.e. the listed company shall disclose the date for share subscription to the existing shareholders not less than 14 days in advance including sending notice of rights >5 business days in advance and stipulate period for subscription > 5 business days etc.

| 4. | Report on the result of distribution of repurchased shares |

| In case of offer via PO, RO or ESOP | In case of distribution via SET |

1. Period of disclosure

| 1. eriod of disclosure

|

2. Information that must be disclosed

| 2. Information that must be disclosed (Form TS-4)

|

| 5. | Upon the passing of board of directors’ resolution on the deduction of the repurchased shares and capital decrease on day T |

| In every case |

1. Period of disclosure

|

2. Information that must be disclosed (Form TS-5)

|

| 6. | Upon the completion of capital decrease registration with the Ministry of Commerce by the company |

| In every case |

1. Information that must be disclosed (Form TS-6) within 3 business days after the capital decrease registration

|

| Note : | - In case of the amendment to or cancellation of the share repurchase, the listed company shall disclose the information ≥ 3 days in advance prior to the date the amendment becomes effective. - AOM (Automatic Order Matching) is a purchase method by means of automatic matching via the trading system of SET |

| Note : | - In case of amendment to the repurchased share distribution method, the listed company shall disclose the information ≥ 3 days in advance prior to the date the amendment becomes effective. The offer for sale by via ESOP and PO methods shall be in accordance with the rules of the Office of the SEC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonetheless, in case the company wishes to amend the method for the distribution of repurchased shares or stipulate time period for the distribution of repurchased shares, it may do so depending on the request for approval for such particular share repurchase project. If the share repurchase project is approved by the board of directors, the amendment to the method for the distribution of repurchased shares or the stipulation of the time period for the distribution of repurchased shares may be effected through the board of directors’ resolution whereby such information on the amendment shall be disclosed to the public. Moreover, the Office of the Securities and Exchange Commission has also stipulated additional criteria for the company to comply with the rules of the Office of the Securities and Exchange Commission.

Nonetheless, in case the company has become the owner of certain portion of the repurchased shares and there exists necessity which prevents the company from repurchasing the remaining portion of the shares, the company may amend the share repurchase project by reducing the number of repurchased shares in accordance with the remaining portion of the shares which have not been repurchased. As for the portion of the shares which have been repurchased by the company, the company must proceed with the share repurchase project as announced until the end of the project..

In this regard, the payment of dividend must be done within 1 month from the date the shareholders’ meeting or the board of directors’ meeting passes the resolution pursuant to Section 115 of the Public Limited Companies Act B.E. 2535 (1992).

As for offer for sale to the company’s directors or personnel pursuant to the laws on securities and exchange at the market price and which does not constitute concentration, the company’s board of directors can consider the allocation of the shares without requesting for approval from the shareholders’ meeting.

Therefore, when the board of directors or the shareholders’ meeting passes the resolution for offer for sale to be made to the company’s directors or personnel pursuant to the laws on securities and exchange, the resolution of the board of directors or the shareholders’ meeting (as the case may be) must be notified to the stock exchange immediately whereby disclosure must be made at least 3 days in advance before the offer for sale of repurchased shares.

- In case of sale in the SET, the information shall be disclosed before the trading session on the following business day.

- In case of RO / PO / offer for sale to the company’s directors or personnel pursuant to the laws on securities and exchange, the information shall be disclosed within 5 business days from the date all the repurchased shares are distributed whereby the result of the sale shall be reported to the Office of the Securities and Exchange Commission within the following time period:

- In case of offer for sale to the company’s directors or personnel pursuant to the laws on securities and exchange, within 15 days from the date of closure of the offer for sale.

- In case of PO, within 45 days from the date of closure of the offer for sale.

Offer for sale to the company’s directors or personnel pursuant to the laws on securities and exchange: The price must be clearly stipulated.

The stipulation of the price must comply with the relevant criteria, which are prescribed to be within the power of the shareholders or the board of directors, as the case may be, and the shares cannot be given for free regardless of the methods of distribution.

2. The share repurchase or sale of repurchased shares with a connected person.

3. Anti-takeover, unless approval is obtained from the shareholders.