The listed company holds responsible for periodic disclosure of information to inform investors and shareholders about material information taken into account for making investment decisions.

Summary of disclosure requirements

Summary of disclosure requirements

- Information disclosure about operating results and financial positions

- Submission/disclosure of other information

1. Disclosure about operating results and financial positions

1. Disclosure about operating results and financial positions

| Report | Submission deadline * | Information submission to SET via SETLink only | Information submission to SEC (documents) |

1. Annual financial statements (audited)

| 2 months 3 months |

| Documents in hard copies are no longer required. The reports submission to SET via SETLink is also regarded as report submission to SEC. |

| 2. Quarterly financial statements (reviewed) | 45 days | ||

| 3. Form of 56-1 One Report | 3 months | Submit online via SETLink |

* Remarks

- If the deadline falls on holiday, it will be postponed to the next working day.

- For the listed companies with different accounting period, duration will be as mentioned above.

Except for the leap year when February has 29 days, the annual financial statements without submission in Q4 will have submission deadline on February 29.

1.1 Guidelines on MD&A information disclosure |

Explanatory analysis as per the senior management’s perspectives on the following topics:

- Financial positions and operating results which are significant to the company in the past year, and

- Factors/causes/events that affect or might be potentially affecting the company’s financial positions significantly.

- Objectives of MD&A disclosure:

1. Investors will be able to learn and understand the causes and factors affecting company’s financial positions to:

- Analyse their investments, both new and current investors

- Assess investment returns

- Forecast future returns

- Monitor/examine whether the management has managed to achieved goals or in satisfactory levels

Tips

- Write in explanatory language and analytical style Ex. Revenue from ………. in 20xx worth xxx million Baht , increasing X% was due to ….. (analyse the cause by distinguishing the price and volume, or product/business/segment/SBU)

- Use numbers, graph, or table to better explain and visualize the content, making it easy to understand

- Explain and analyse clearly about the cause and effect on financial positions, in appropriate and easy-to-understand format

- Use simple language, trying to avoid technical or accounting terms if not necessary

- Produce 3-year financial statements for the analytical explanation, for example, Statements of Financial Position, Statements of Comprehensive Income, Statements of cash flow, and key financial ratios

- Explain and analyse qualitatively e.g. indicating related factors or reasoning, not general factors. Also, analyse the pros and cons side of factors as well.

- Analytically explain key information such as:

- Items on the financial statements which have significantly changed, by income type, product line, or SBU, etc.

- Current financial information compared to the past or competitors’, same industry, comparing own and industry’s Key Performance Indicators (KPIs), and also using ratios to explain.

- Trends and factors affecting the financial positons in the future such as plan, target, operational performance which have been disclosed in the past year, investment plan, plus an analysis on funding, including the constraints, and its effects on liquidity.

- Acquisition or disposition of important assets during the year, or after the date that the financial statements have been disclosed.

- Obligations and special items; in case there was a breach of contract, specify the preventive measures.

- Progress of operational plan or the estimated budget disclosed in the filing or Form of 56-1 of the past year.

- When trend or forecasted figures of operating results has been presented to analysts or investors, they have to be reported in Form of 56-1 form as well.

(Based on the SEC website; Seminar on “Disclosure of MD&A Information” on January 30, 2013)

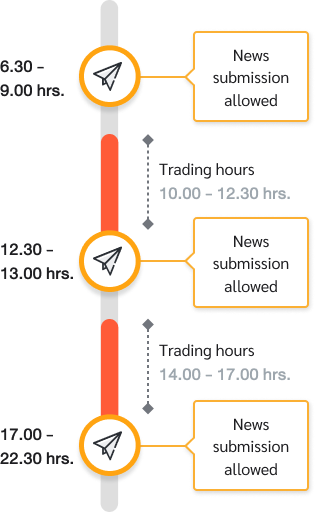

1.2 Time interval for information disclosure via SETLink system |

Tips

To facilitate smooth transmission via SETLink, the listed company can submit these documents in order as follows:

- Financial statements

- F45

- Interim MD&A

Tips

To facilitate smooth transmission via SETLink, the listed company can submit these documents in order as follows:

- Financial statements

- F45

- Interim MD&A

1.3 In the event that a listed company has not submitted information within specified period, SET may consider taking the following steps |

| Type of information | Sign posted | Subject to possible delisting |

| Annual or quarterly financial statements | SP will be posted immediately until the financial statements submission occurs |  (Late > 6 months) |

Moreover, the SEC may consider imposing a fine for late submission, or for incomplete information, or incompliance to the rules. The listed company may be subject to 100,000 Baht fine, plus another 3,000 Baht per day for through the period of non-compliance.

- The event that the auditor was unable to express opinions on the financial statements submitted to SET (disclaimer of opinion)

The SET may post an SP sign for a day to provide sufficient period for people who are using financial statements information to carefully consider the auditor’s opinions and published figures. Also, this is to provide an opportunity for the public to be widely informed. Securities trading will be allowed on the following business day. Then, the CS /1 sign will be posted until it is finalized whether the financial statements will be revised or not.

The SET may post an SP sign for a day to provide sufficient period for people who are using financial statements information to carefully consider the auditor’s opinions and published figures. Also, this is to provide an opportunity for the public to be widely informed. Securities trading will be allowed on the following business day. Then, the CS /1 sign will be posted until it is finalized whether the financial statements will be revised or not.

- The event that submitted financial statements had auditor’s opinions as incorrect (adverse opinion)

The SET will post an SP sign to suspend trading of securities until the listed company has submitted a revised financial statements and disseminated to the investors, or until it is finalized that the listed company is not required to revise the financial statements.

The SET will post an SP sign to suspend trading of securities until the listed company has submitted a revised financial statements and disseminated to the investors, or until it is finalized that the listed company is not required to revise the financial statements.

- The event that the audited financial statement submitted to SET presented shareholders’ equity less than zero

The SET will announce that the listed company is subject to possible delisting.

The SET will announce that the listed company is subject to possible delisting.

Remark

/1 Please study the posting of CB CS CC and CF signs which are signs that the SET uses to inform the investors of listed companies with risks in connection with financial position, operating result, financial liquidity, or with qualification not being in compliance with the prescribed criteria. The investors shall purchase such securities through Cash Balance account.

2. Submission/disclosure of other information |

| Item | SET schedule | Submit the information via SETLink | |

| Submit online to inform investors | Submit online as information for SET | ||

| Report on the use of fund from capital increase | Every 6 calendar months; within 30 days from the end of June and end of December each year |  (Thai and English) |  |

| Form of the distribution of ordinary shares report | Within 14 days from the last day that the listed company is required by law to hold its annual shareholders’ meeting |  |  |

| Invitation letter to shareholders’ meeting | To be delivered along with an invitation letter to the shareholders |  |  |

| Report of the shareholders’ meeting | Within 14 days from the day that the meeting has finished |  |  |

|

|

|

|

1. The listed company should submit those statements via SETLink within 30 days from the accounting period ends. They should be submitted along with F45 and Interim MD&A (similar to the submission of reviewed and audited financial statements)

2. In the event that there is a significant difference (20%) between reviewed/unaudited figures and reviewed/audited figures from the auditor, the management and auditor must provide the clarifications when submitting the reviewed/audited versions.

3. In the event that the listed company will voluntarily submit its reviewed/unaudited financial statements, the company should regularly follow this practice.

2. In the event that there is a significant difference (20%) between reviewed/unaudited figures and reviewed/audited figures from the auditor, the management and auditor must provide the clarifications when submitting the reviewed/audited versions.

3. In the event that the listed company will voluntarily submit its reviewed/unaudited financial statements, the company should regularly follow this practice.