The Securities and Exchange Act B.E. 2535, amended version, effective on August 31, 2008 (Section 89/29), prescribed the Securities and Exchange Commission (SEC) to specify details and monitor the transactions on assets acquisition and disposition of the listed companies. The SEC has thus issued the Capital Market Supervisory Board Announcement Tor.Jor. 20/2551 about the regulation on significant transactions subjecting to be an acquisition or disposition of assets that the listed companies should be abide by as per SET’s requirement.

When the listed company or its subsidiaries have acquired or disposed an asset of significant value or size, the listed company will have to disclose information about the transaction to the investors. If such transaction has high value or significant size which could affect the company’s financial positions and operational performance, the shareholders will then have to take part in the decision process to enter into the transaction.

When the listed company or its subsidiaries have acquired or disposed an asset of significant value or size, the listed company will have to disclose information about the transaction to the investors. If such transaction has high value or significant size which could affect the company’s financial positions and operational performance, the shareholders will then have to take part in the decision process to enter into the transaction.

Definition |

Assets refer to tangible or intangible items owned by a person or business, have value and can be transferred.

- Tangible items are such as land, building, equipment, investment, and warrants.

- Intangible items are such as leasehold right on land or building, concession right, business permit, transfer or forgo the benefits as well as forgoing the claim over people who cause damages to the company. This applies to either case when the benefits are related to the company or subsidiary.

- The following assets will be excluded:

1. Current assets used in business operation e.g. raw materials, account receivables, inventory, cash, deposits, etc.

2. Investment for liquidity managements such as the investment in equity securities and debt securities.

- A purchase or sale of assets or

- An agreement/entering into contract to acquire or sell assets or

- Acquisition or forgoing the rights to acquire or sell assets or

- Receiving the transfer or transferring the claim to possess assets in the long-run or

- Investing or cancelling investment

Considering whether the transaction is subject to an acquisition or disposition of assets |

1. Consider whether the transaction is subject to the above mentioned definition of “assets” and “acquisition or disposition of assets”

2. Calculate the size of transaction as of the day when the board of directors has reached a resolution

3. Proceed to take action according to size and significance of the transactions, for example:

2. Calculate the size of transaction as of the day when the board of directors has reached a resolution

3. Proceed to take action according to size and significance of the transactions, for example:

- Not required or required to disclose information to SET

- Must gain approval from the board of directors or the shareholders

Calculation of the transaction size |

- Calculate the size of transaction to evaluate its potential effects on the company’s financial positions and operational performance in various aspects

- Four bases of calculation:

| Type of assets | Investment in ordinary shares | Land, building, and equipment | ||

| Method of payment for the assets | Cash | Share issue | Cash | Share issue |

| Basis of transaction size calculation | ||||

| 1. Value of the net tangible assets | | | ||

| 2. Net operating profits | | | ||

| 3. Total value of consideration paid or received | | | | |

| 4. Value of securities issued for the payment of assets | | | ||

| Required basis of calculation |

How to calculate a transaction size for each basis |

1. Calculation based on the value of net tangible assets

- Calculation formula:

- Calculation formula:

(NTA* of investment in the company x Proportion of assets acquired or disposed) x 100

NTA of the listed company**

* Net tangible assets (NTA) = total assets – intangible assets – total liabilities – non-controlling interests (if any)

(Intangible assets are such as goodwill and deferred expenses. Exceptions from deduction are for intangible assets that generate major income such as the concession and patent permit.)

* * In case the company produces consolidated financial statements, use NTA from consolidated financial statements (data should be extracted from the latest financial statements)

(Intangible assets are such as goodwill and deferred expenses. Exceptions from deduction are for intangible assets that generate major income such as the concession and patent permit.)

* * In case the company produces consolidated financial statements, use NTA from consolidated financial statements (data should be extracted from the latest financial statements)

2. Calculation based on net operating profits

- Calculation formula:

- Calculation formula:

(Net operating profits of the investment x Buying or selling ratio) x 100

Net operating profits of the listed company*

*In case the company produces consolidated financial statements, use the net operating profits from consolidated financial statements (data should be extracted from the latest financial statements)

3. Calculation based on total value of consideration paid or received

- Calculation formula:

- Calculation formula:

Value of transaction paid or received* x 100

Total assets of listed company**

* 1) In case of assets disposal, compare total value of consideration paid or received and its book value. Whichever is higher will be used for the calculation

2) In case the consideration is listed securities, compare the market value of securities or NTA. Whichever is higher will be used for the calculation

3) In case of investment disposal to the extent that a subsidiary or affiliate no longer viable, calculate total value of consideration by incorporating the cash loans, guarantees, and other liabilities as well.

** In case the company produces consolidated financial statements, use total assets from consolidated financial statements (data should be extracted from the latest financial statements)

2) In case the consideration is listed securities, compare the market value of securities or NTA. Whichever is higher will be used for the calculation

3) In case of investment disposal to the extent that a subsidiary or affiliate no longer viable, calculate total value of consideration by incorporating the cash loans, guarantees, and other liabilities as well.

** In case the company produces consolidated financial statements, use total assets from consolidated financial statements (data should be extracted from the latest financial statements)

4. Calculation based on value of equity shares issued for the payment of assets

- Calculation formula:

- Calculation formula:

Equity shares issued for the payment of assets x 100

Paid-up shares of the company *

* Excluding equity shares issued for the payment of assets

Procedures upon the size of transactions |

- After calculating from all different bases, choose the highest value to proceed

- Summary of the process according to the calculated transaction size:

- Summary of the process according to the calculated transaction size:

| Transaction size (X) | Procedure | |||

| Notify the SET | Sending a circular notice to shareholders* | Seek approval from Shareholders**and have IFA | File for new securities listing | |

| X < 15% | | | ||

| X < 15% and issue shares to pay for assets | | | ||

| 15% ≤ X < 50% | | | | |

| 50% ≤ X < 100% | | | | |

| X ≥ 100% (Backdoor Listing) | ||||

* Sending the circular notice to shareholders within 21 days from the day that the company has notified SET with required minimum information.

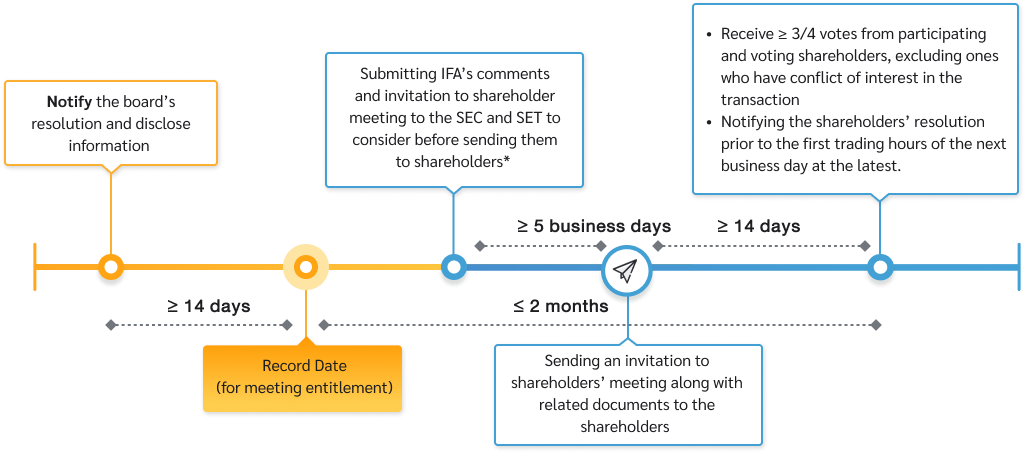

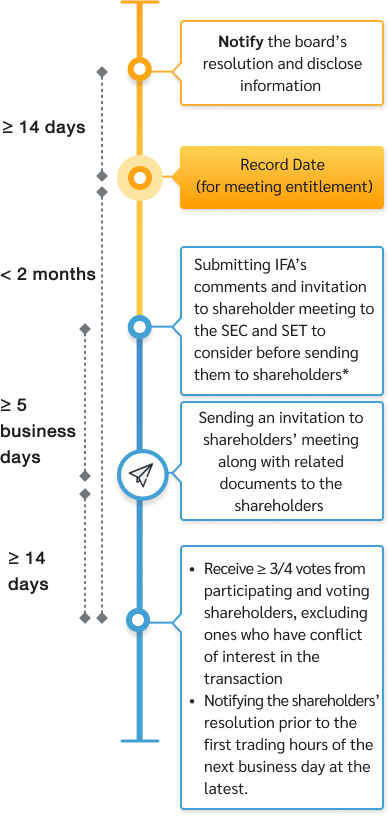

** Seeking approval at the shareholders’ meeting, from ¾ participating and voting shareholders and excluding the shareholders who have conflict of interest in the transition. In doing so, the company must appoint Independent Financial Advisor (IFA) to express opinions on the purchase or sale transaction of assets. The IFA should be expressing views on, for example, the rationality of transaction and benefits to the company, fair pricing and conditions.

** Seeking approval at the shareholders’ meeting, from ¾ participating and voting shareholders and excluding the shareholders who have conflict of interest in the transition. In doing so, the company must appoint Independent Financial Advisor (IFA) to express opinions on the purchase or sale transaction of assets. The IFA should be expressing views on, for example, the rationality of transaction and benefits to the company, fair pricing and conditions.

Combination the size of transactions |

Combination of multiple acquisition or disposition transactions can be made to compare the volume of transactions, if such transactions have been separated to intentionally avoid the rule. The combination includes the following:

- Transactions made during 6 months prior to the day the company agreed to enter into transaction, except for the acquisition or disposition of assets already approved from the shareholders’ meeting.

- The transactions relating to an acquisition of securities in the takeover or merger of business, or resulting from an acquisition of securities in the takeover or merger of business.

Backdoor Listing |

- Backdoor Listing is when the company or subsidiary acquires assets of a non-listed company, making transaction of these following features:

- Transaction size ≥ 100% or

- Transfer the controlling power to a non-listed company or to the asset’s owner (including the transfer of power within 12-month period, except for an action to intentionally avoid Backdoor Listing rule which could combine transactions of more than 12 months) or

- Existing shareholders of the listed company collectively hold less than 50% of the paid-up capital of the merged entities combined. In other case, the controlling power might be transferred to those of the non-listed company.

- SET may combine the size of transactions made within 12 months into one single transaction.

- In case, the acquisition of asset does not fit into a backdoor listing according to the above mentioned features but the substance of such acquisition is to avoid compliance with this rule, SET may consider the transaction as a backdoor listing.

- SET may consider the transaction as Backdoor Listing without requiring new listing application if all of the following apply:

- The acquired business is similar or support existing business and

- The company does not have any policy to make a significant change in its major business and

- The group of companies gained from acquisition of assets is qualified for listing on SET and

- There is no significant change to the board of directors and the controlling power of the company, or the controlling shareholders.

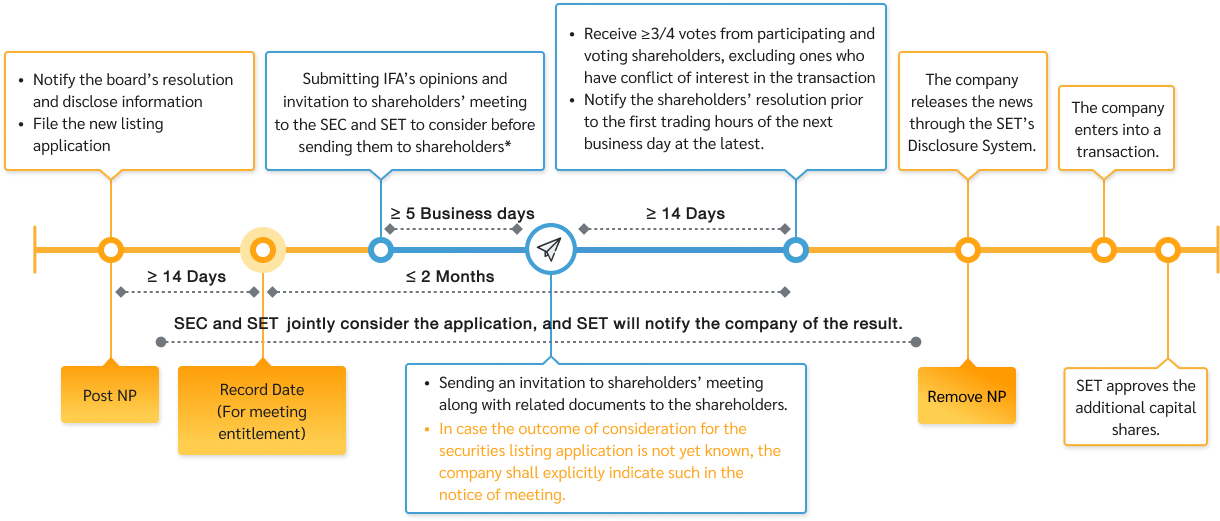

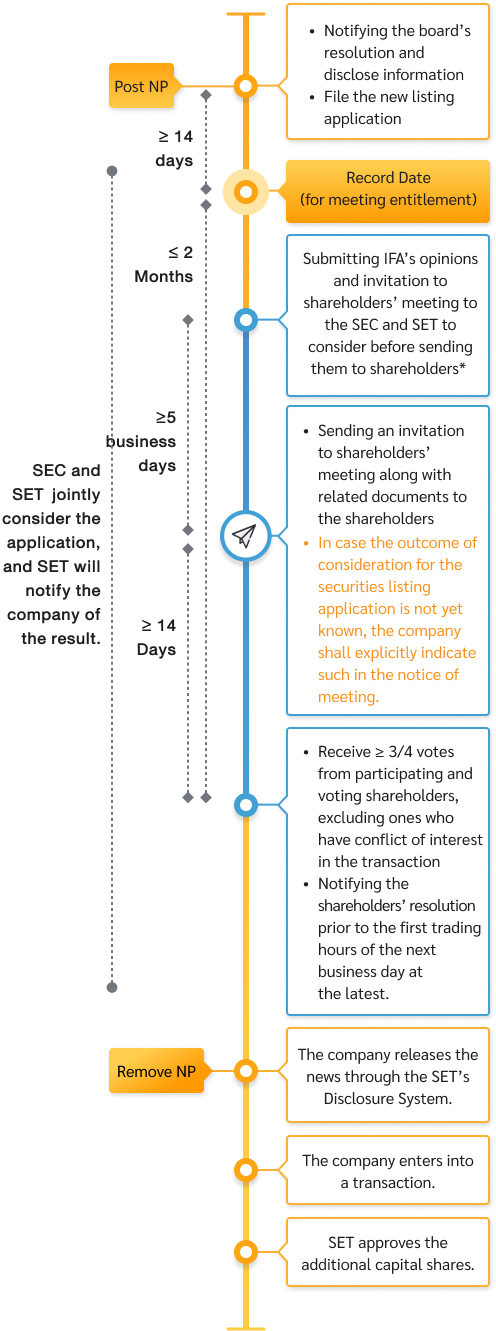

- Actions to proceed when the company is subject to Backdoor Listing rule :

- 1) Inform the board of directors’ resolution for entering into Backdoor transaction to SET. SET will post NP sign until the company has informed the outcome of SEC and SET’s consideration of Backdoor Listing transaction to the investors.

- 2) Submit application for SET’s consideration of new securities listing, where a financial advisor shall be engaged to jointly prepare the application. The Exchange will consider the application as application for listing of new securities, being as follows:

- 2.1 Subsequent to the acquisition of assets, the listed company shall possess qualifications according to the criteria for listing, except with respect to shareholding distribution and operating result, as follows:

- (a) having Free Float of ≥ 150 persons and holding shares in aggregate of ≥ 15%

- (b) having operating result in accordance with the Profit Test, or operating a basic infrastructure business.

- 2.2 The operation of company’s assets which are not listed company shall be conducted under the same majority group of directors and managements and having a continuous period of operation pursuant to the criteria for listing of securities.

Nonetheless, SET may submit the application for approval of the transaction to SEC for joint consideration as if it is a listing of new securities.

- 2.1 Subsequent to the acquisition of assets, the listed company shall possess qualifications according to the criteria for listing, except with respect to shareholding distribution and operating result, as follows:

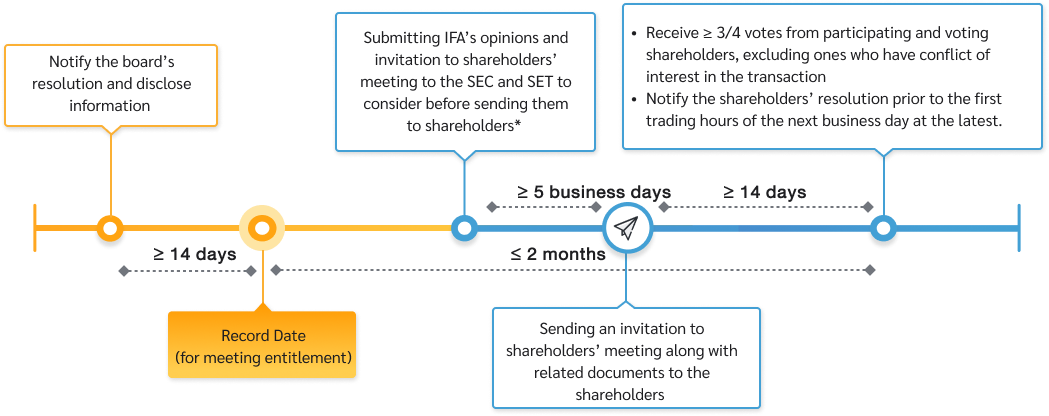

- 3) Seek approval from the shareholder meeting by gaining 3/4 votes from participating and voting shareholders and excluding shareholders who have a conflict of interest in the transaction. The IFA should also express their views toward the transaction.

In case the company has gained approval at the shareholders’ meeting before getting the result of listing application from SEC and SET, the company will have to specify in the invitation letter to shareholders that it is waiting for the result of listing application and has to send the invitation to SEC and SET before the shareholders.

- When SET receives outcome of consideration from SEC, and SET has approved entering into the transaction, the listed company shall proceed as follows:

- The strategic shareholders of company which is not a listed company, or the original owner of the assets acquired by the listed company shall be restricted from selling its shares (silent period) pursuant to the criteria for listing of securities.

- Hold opportunity day at least once within 1 year from the date which the company’s shares commence for trading in the Exchange after the Backdoor transaction

When the listed company has all or nearly all assets in cash (Cash Company) /1 |

- Cash Company refers to the listed company or subsidiary which has disposed all or nearly all of its assets used for normal business operations, making all or nearly all of its assets are now in cash or Short-term securities.

- Actions to proceed when the company is subject to Cash Company rule

- Notify the SET

- Seek approval from the shareholders’ meeting by gaining 3/4 votes from participating and voting shareholders and excluding shareholders who have a conflict of interest in the transaction. The IFA should also express their views toward the transaction.

- Submit a report on financial positions, which has been reviewed by an auditor, to the SET within 30 days from the day assets are disposed. The SET may suspend trading of the company’s securities until the company has reported complete and clear information as required by the SET.

- The listed company shall take actions to ensure that it is no longer Cash Company within 6 months from the date the SET has received the statement of financial position. While the listed company takes such actions, the SET shall post CC (Non-Compliance)* signs.If the company is unable to rectify the issue within the prescribed period, SET will proceed according to the criteria for possible delisting ground and the release from possible delisting ground in case all/nearly all of the company’s assets are in form of cash or Short-term securities (Cash Company).

- Once the company has a qualified business for listing, it can submit a listing application for SET to consider according to the new listing rule.

Information disclosure |

- The company has to notify, via SETLink, about the board’s resolutions on an acquisition or disposition of assets immediately upon making the transaction (normally on the day the board has given an approval), that is within the day the board has made the resolution or prior to the first trading hours of the next business day at the latest.

- Significant information of the board resolution are:

- Date, month, year of the transaction

- The counterparty and relation with the company

- Type and description of the transaction

- Details of assets

- Total value of consideration, payment method, and other key conditions agreed upon

- Value of assets acquired or disposed

- Basis for determining the value of consideration

- Net profits excluding special items related to asset acquisition or disposal for two years before entering into the transaction if necessary.

- Benefits that the listed company will gain.

- Source of fund for buying the assets. In case of loan from the financial institutions, the conditions affecting shareholders’ rights must be specified.

- Specify a plan on the use of fund received from asset sale

- In case new securities are issued to pay for the assets, specify the type of securities, amount and price of the shares issued.

- Other prerequisite conditions for the acquisition or disposition of assets such as gaining approval from SET or the Bank of Thailand.

- In case the listed company has invested in a company of which major shareholders are connected persons, and that business is related to the listed company’s business, specify the reasons and the need to conduct this transaction. Also, specify the measure to prevent any possible conflict of interests in the future.

- The views of the board of directors about an agreement to enter into the transaction (in terms of the rationality and benefits to the company, as well as associated risks, and other emphasis matters). In case the transaction needs an approval from shareholders, the board of directors must express their views clearly about whether the shareholders should pass an approval and provide reasons.

- Views of an audit committee or of the directors whose views differ from the board of directors in (15), including the case when the director abstained from voting

Views of the IFA |

- IFA must express his/her opinions on the transaction to the company’s board of directors on the following aspects:

- The rationality and benefits to the listed company

- Fairness of the price and conditions

- Reasoning about whether the shareholders should pass an approval of the transaction

- Views regarding the adequacy of additional working capital, in case the transaction is subject to the Backdoor Listing rule.

- The company must send the IFA’s opinions along with an invitation to shareholders’ meeting to the SEC and SET to consider about an adequacy of information. The submission can be in either one of these two ways:

- Sending the documents at least 5 business days before sending them to the shareholders

- Sending the documents at the same time as sending to the shareholders

Delivering invitation letter to shareholders |

- Delivery period

An invitation must be sent to shareholders at least 14 days before the shareholder’s meeting date - Information to be included in the invitation are the IFA’s opinions and the following documents:

- Information disclosed to SET once the company agrees to enter into the transaction

- Statement regarding the responsibility of the board of directors in producing the information

- Views of independent professionals e.g. assets appraiser

- Details of the company’s liabilities such as the debt instruments, loans, and any possible debt obligations in the future

- Summary of company information e.g. list of executives and major shareholders, business operations and trends of the business, 3-year financial summaries and latest financial statements with MD&A, risk factors, and financial forecasts (if any).

- Views of the board of directors regarding sufficiency of working capital. In case it is insufficient, specify the source of funds to be used.

- Legal case or claims with material information

- Connected transactions

- Summary of key contracts in the past two years

- The company must nominate at least one audit committee member to be a proxy of the shareholders.

Tips

In case of investment or cancellation of investment in a company causing the company can have or end its subsidiary status, the company has to notify about the investment or cancellation of investment, in line with the Information Disclosure Rule for the case when investment or cancellation of investment.

Tips

In case of investment or cancellation of investment in a company causing the company can have or end its subsidiary status, the company has to notify about the investment or cancellation of investment, in line with the Information Disclosure Rule for the case when investment or cancellation of investment.

Note:

/1 Please study the criteria with respect to possible delisting in case of Cash Company.

/1 Please study the criteria with respect to possible delisting in case of Cash Company.

Process of getting shareholders’ approval for an acquisition or disposition of assets

*The company may choose to submit the IFA’s opinions and the invitation to SEC and SET at the same time as with the shareholders

Procedure for a Backdoor Listing Case

* The company may choose to submit the IFA opinion and the shareholders' meeting invitation to the SEC and the SET at the same time as sending them to the shareholders.

Process for the Cash Company Case

* The company may choose to submit the IFA’s opinions and the invitation to SEC and SET at the same time as with the shareholders

Related Regulations

|

|

|

|

Forms

|

|

|

* Immediately: information to be disclosed by 9 a.m. on the next working day or on the event date (The date of the board of directors or shareholders meeting's have resolution)

3 working days: Information to be disclosed within 3 working days after the event date