Par value (Par) means the value of the securities indicated on the share certificate,

which is in accordance with the requirements of the issuing company's memorandum of association

Determination of the minimum par value for listed companies

Listed companies

Par > 0.5 baht

Exemptions from the Minimum Par Value

1. Listed securities with a minimum daily closing price of 100 baht for six consecutive months

2. A company in the process of rehabilitation or debt restructuring with a financial institution; or

3. A company's restructuring is approved by the SET

In cases 2 and 3, however, the company must have a Par value of 0.5 baht within 12 months of the date the Par falls below the specified threshold or before there is no ground for delisting, whichever comes first.

1. Stock Split

- A stock split increases trading liquidity for the stock by issuing more shares at a lower price, making the share more appealing to retail investors.

| Expand investor base |

| Increase stock liquidity |

| Be more appealing to investors |

| It will be easier for shareholders to trade the company's shares, and there is also the possibility of capital gains |

2. Reverse Stock Split

A reverse stock split has the opposite effect of the stock split. In some cases, the consolidation may stabilize the share price due to the lower number of shares, whereas the subsequent increase in share price may reduce trading volume and consequently decrease stock volatility.

- A reverse stock split may reduce the number of shareholders because, after the consolidation, there may be odd shares left, allowing some shareholders to trade those shares for cash instead of holding the shares

| Create stability by lowering stock price volatility |

| Used as a tool for shareholding restructuring (for a company that does not want to have a large number of minority shareholders) |

| Have stock price stability, which is appropriate for certain types of investors, such as long-term investors with a buy-and-hold investment strategy or those who are risk-averse |

| Stock Split | Reverse Stock Split | |

| Par value | Lower | Higher |

| Number of shares | Higher | Lower |

| Liquidity | Higher | Lower |

Stock splits and reverse stock splits have no effect on shareholders' equity or the market capitalization of the company.

Changing the par value has no effects on the shareholders’ equity. However, the company may consider it as an approach to increase trading liquidity.

Type of par value change

- Splitting par value

Old 100 million Bath paid-up capital composing of 10 million common shares at a par value of 10 Bath each After the par value has been split to one Baht per share, the new 100 million Baht paid-up capital will be composing of 100 million shares at a par value of 1 Baht each - Merging the par value

Old 100 million Baht paid-up capital composing of 10 million common shares at a par value of 10 Baht each After the par value has been merged to 100 Baht per share, the new 100 million Baht paid-up capital will be composing of one million shares at a par value of 100 Baht each

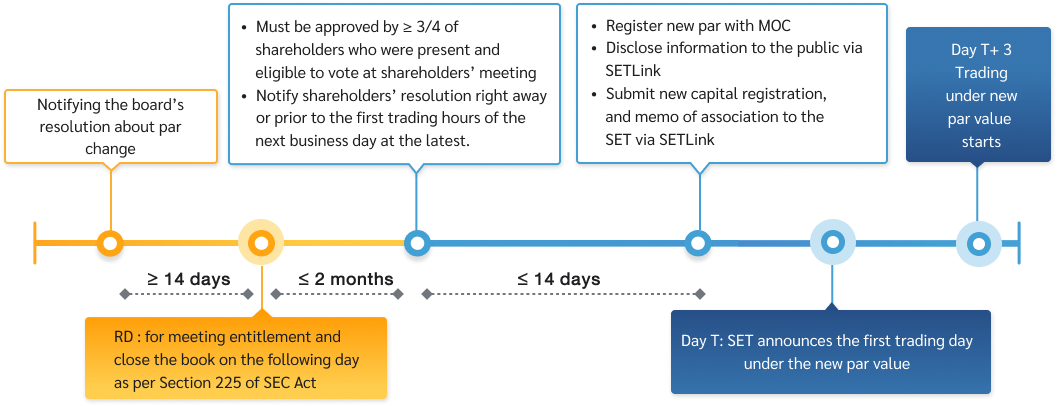

Information disclosure

- The company must disclose via SETLink about the board’s resolution on par split or merge immediately on the day the board’s reached the resolution or prior to the first trading hours of the next business day at the latest.

- Material information required

- The day the board has made a resolution about par value change

- Suggestions by the board to split or merge the par value, and the par value before and after adjustment

- Shareholders’ meeting date, the record date (RD) or book closing date (BC) for the rights to attend the meeting, by which related information about meeting agenda should include

- Change in par value (Par split or merge) and mention the par values before and after the change

- Adjustment of the Memorandum of Association

Notification of shareholders’ resolution

Within the shareholder meeting date, or prior to the first trading hours of the next business day at the latest, via SETLink

Registering the par change

• After the company has registered with MOC, it has to disclose information about those changes to SET, so that the par value of stocks traded in the system will be changed accordingly. Information required for disclosure is

1. Reference to the shareholder meeting resolution about par value change

2. Par value before and after change

3. Date of registering the par value change with MOC

4. For SET reference, please certified true of these documents by authorized directors and submit them via SETLink system

4.1 Memorandum of association

4.2 Copy of par value change registration, following the shareholder meeting.

News announcement by SET

SET will announce the effective of par change in the trading system, which is normally the 3rd day after SET makes announcement.

Changing Par Value

Related rules and regulations

Q&As

In general, if investors hold shares in the same proportion before and after the stock split or reverse stock split, there will be no dilution effect in both price and control. In a reverse stock split, however, investors with odd shares may sell them, resulting in a lower share ownership proportion.

A stock split or reverse stock split is simply an increase or decrease in the liquidity of the stock that has no effect on the stock's fundamentals.