It is the issuance of new shares with the same rights and benefits as existing shares to interested parties such as existing shareholders, institutional investors, or general investors.

Types of Capital Increase

1. Capital increase with specific objectives

The fund's utilization, allotment, and issuance are all clearly defined.

2. Capital increase under general mandate

Shareholders approve the new share number and type of allotment in advance and authorize the board of directors to decide on the issuance and allotment of new shares as deemed appropriate, but the board of directors must disclose full information each time capital increase shares are allotted

How to offer newly issued shares

- Offer to existing shareholders in proportion to their shareholding (Right Offering: RO)

- Offer to existing shareholders in proportion to their shareholding, excluding shareholders whose ownership of such shares would bind the company to any international laws (Preferential Public Offering: PPO).

- Offer to specific persons (Private Placement: PP), with the nature of offers is as one of the following:

- Offer to no more than 50 investors within 12 months or;

- The value of the offer does not exceed THB 20 million within 12 months or;

- Offer to institutional investors

- Offer to the public (Public Offering: PO)

Benefits of Capital Increase

Company

| To improve the financial structure, debt-to-equity ratio, and financial costs to appropriate levels | |

| To address financial liquidity issues by utilizing the funds to pay off debt and reduce the interest burden | |

| To fund business expansion and development, or acquisition of new assets | |

| To reduce the risk of negative shareholder equity, which could result in the revocation of the company's listing status | |

| To increase trading liquidity and the number of minority shareholders (free float) | |

| With a PP, funds can be raised quickly, and if the investors can provide synergistic benefits to the company, whether as a strategic partner or through an M&A deal via share swaps, it will also help adjust the investor base to an appropriate level | |

| With a PO, the company can raise a significant amount of money. The offering price will also be close to the market price because it is determined using the book building method, which ensures transparent pricing by taking institutional investors' demand into account |

Shareholders

| When a company can finance its planned investments or has an appropriate financial structure, shareholders will benefit from rising share prices or increased dividends | |

| Shareholders can also maintain their shareholding proportion through ROs |

An increase of listed company’s capital directly affects the shareholders’ rights as well as the company’s securities prices. Therefore, the listed company has to disclose information related to capital increase so that the shareholders and the investors can be equipped with useful information and timely in making investment decisions.

- Specified Objectives

Determine objectives for the use of capital (funding plan), plus clearly stating the number of additional and allocated shares. - General Mandate

- Shareholders approve allocation frameworks (i.e. types and number of shares), but not yet known the objective and other details.

- Shareholders give a mandate to the Board of Directors (BOD) considering capital increase and allocation. Every allocation must be disclosed in details.

- Right offering to all existing shareholders (Right Offering : RO)

- Right offering proportionately to all existing shareholders excluding shareholders whose holding of such share would cause the company to be under the obligations of any international laws. (Preferential Public Offering : PPO)

- Public offering (PO)

- Private placement* (PP)

*PP is an offering to no more than 50 persons, or not over 20 million Baht within 12 months, or offering to institutional investors.

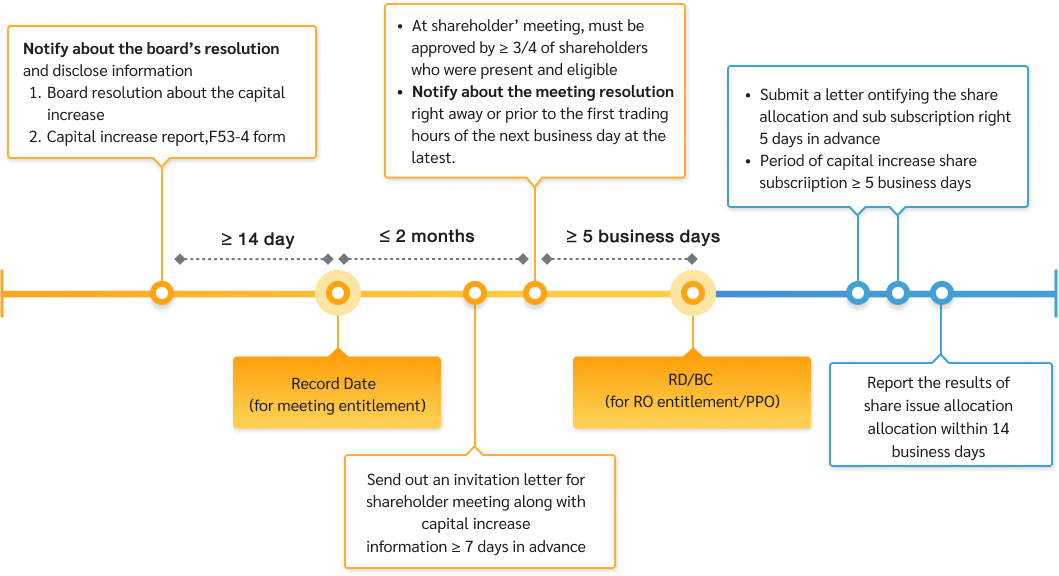

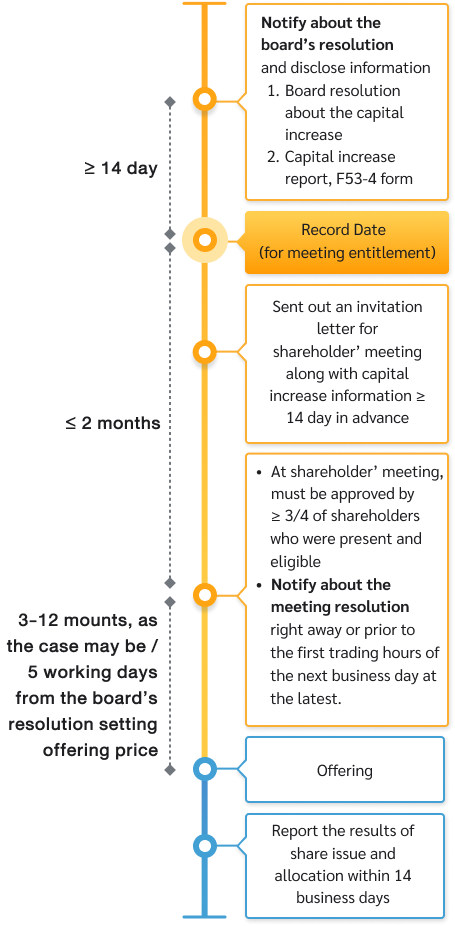

- The listed company must notify its BOD resolution on capital increase via SETLink system with related information as well as the Capital Increase Report Form (F53-4 form). The information must be submitted immediately on the day the board has made the resolution, or prior to the first trading hours of the next business day at the latest.

- Material information to be included in the BOD’s resolution as follows.

- Details of the allocation such as number of additional shares, types of investors, offering price and market price, and type of allocation.

- The objectives of share issuance and its timeframe.

- Separately specify in details of the objectives, budgets, and timeframes of each objective.

- In case the company raises the fund for its project, it has to briefly describe details of the project, expected return, impacts to the company if it fails to complete the project, risks, primary budgets and expected total budgets.

- Effects to company’s shareholders after capital increase including EPS dilution, control dilution, and worthiness of shareholders.

- Board of Directors’ opinions towards reasons and necessity of the capital increase, plan of the projects, sufficiency of the funds, impacts to company’s financial stability and its operation.

- Shareholder’s meeting date, Record Date (RD) or Book-closing Date (BC) for meeting entitlement

In case of RO and PPO,

- Specify the exercise ratio, record date (RD) or Book-closing Date (BC)

- The listed company must deliver the capital increase information and subscription right forms no less than five business days prior to the subscription date. And

- Allow no less than five business days for the subscription and payment.

In case of PP : must be in compliance with SEC’s rules

In case of PO: SEC approval is required. The listed company must submit of the prospectus to the SET in advance for ≥ 3 business days prior to the subscription and payment dates)

The listed company must disclose information via SETLink system as follows.

- Details of PP such as names and backgrounds.

- The BOD and audit committee’s opinions regarding its rationale of offering price, reasons and necessity of allocation to PP and the BOD’s statement of certification proving their consideration and verification on PP investors’ information.

- PP at a price below 90% of the market price (Discounted Price): a company must specify the shareholders’ right to protest such allocation with the BOD’s opinion on worthiness of investors comparing to the discounted price by considering the effects of expenses and company’s financial positions according to the accounting standard of share-based payments.

- Conditions/ other agreements of PP such as holding period, silent period, including the case that PP’s shares may be prohibited to sell in specified period (Silent Period) (Please see details of silent period for PP allocation at discounted price).

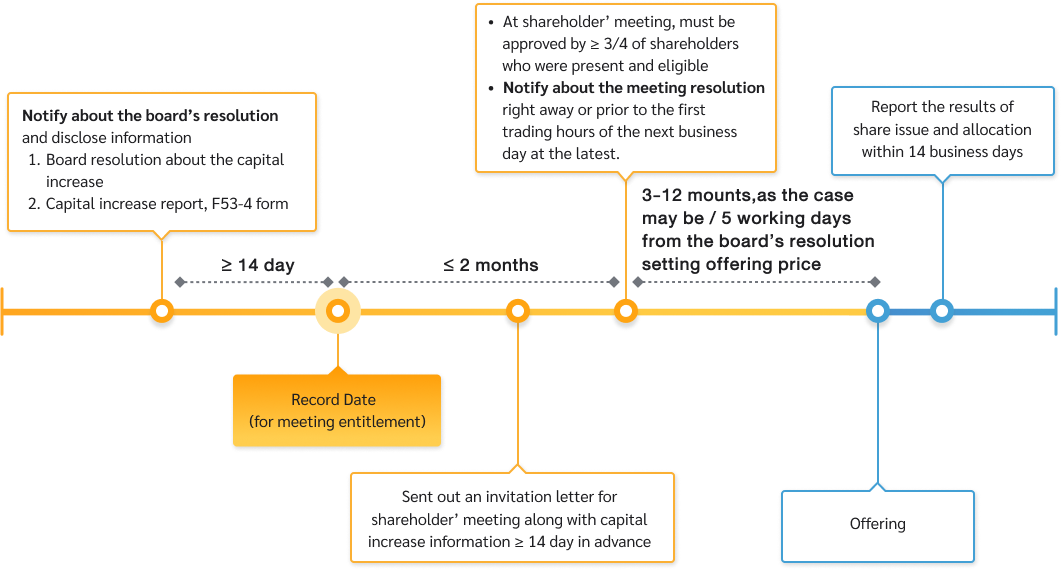

Permission criteria are divided into 3 cases depending on the setting of share price as per shareholders’ meeting resolutions. (The process of submission of applications for permission has been cancelled in all cases.)

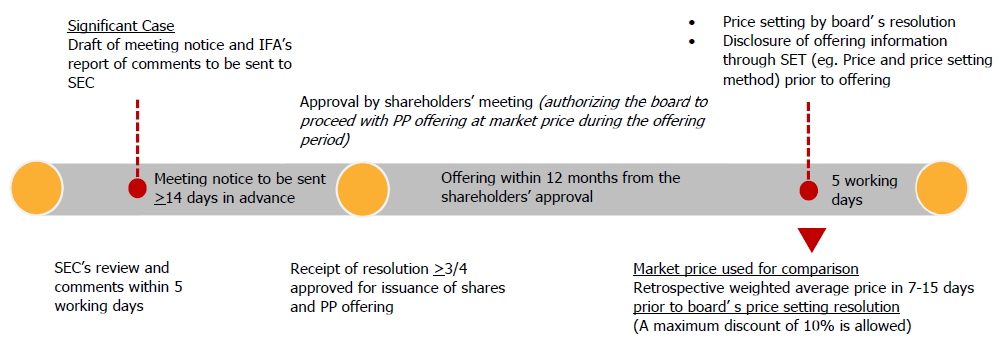

Case No. 1 Shareholders’ meeting assigns the company’s board to set share price according to market price*.

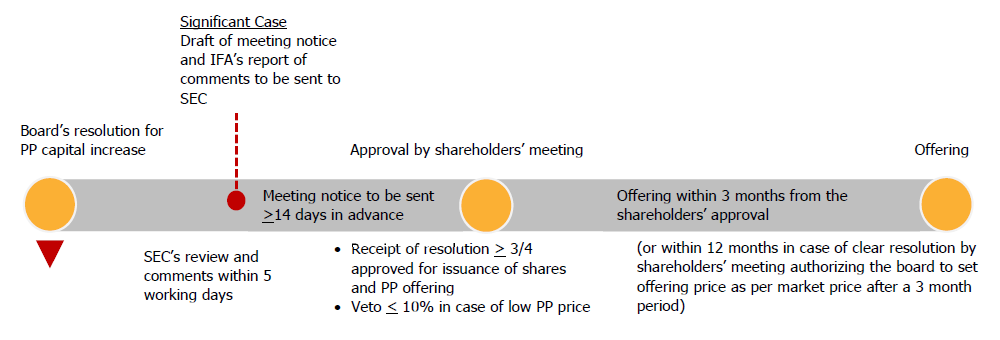

Case No. 2 Shareholders’ meeting clearly sets share price for offering.

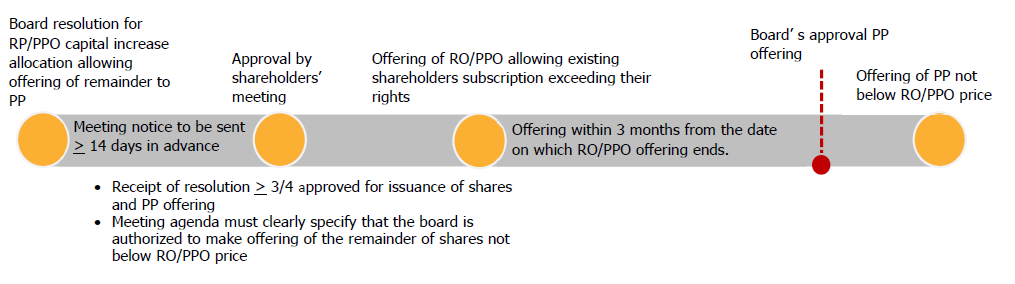

Case No. 3 Offering of remainder of shares after proportional allocation to the shareholders. (RO/PPO)

A listed company must deliver its meeting notice, containing information as specified in the criteria, to its shareholders not less than 14 days prior to the meeting date. In significant cases, a report of comments by independent financial advisor must be provided for shareholders’ consideration and approval.

In this instance, a draft of meeting notice and a draft of IFA’s report of comments must be sent to the SEC for review and comments (if any) prior to their release to the shareholders.

Significant cases that require IFA’s report of comments:

- The offering of PP shares below market price.

- The offering of PP shares affecting shareholders’ profit-sharing or voting rights (EPS/Control dilution) in a proportion of 25% or higher.

- The offering of PP shares that may turn an allocated shareholder into the highest voter in a listed company (Persons under Securities and Exchange Act No. 258/ concert party/ Person No.258 of concert party)

The minimum coverage of contents in IFA’s report of comments is as follows.

- The suitability of price and conditions of PP share offering.

- The justification and benefit of PP share offering to investors, including spending plans, in comparison with impact on shareholders as a result of PP share offering.

- Advice to investors whether to vote for or against PP share offering.

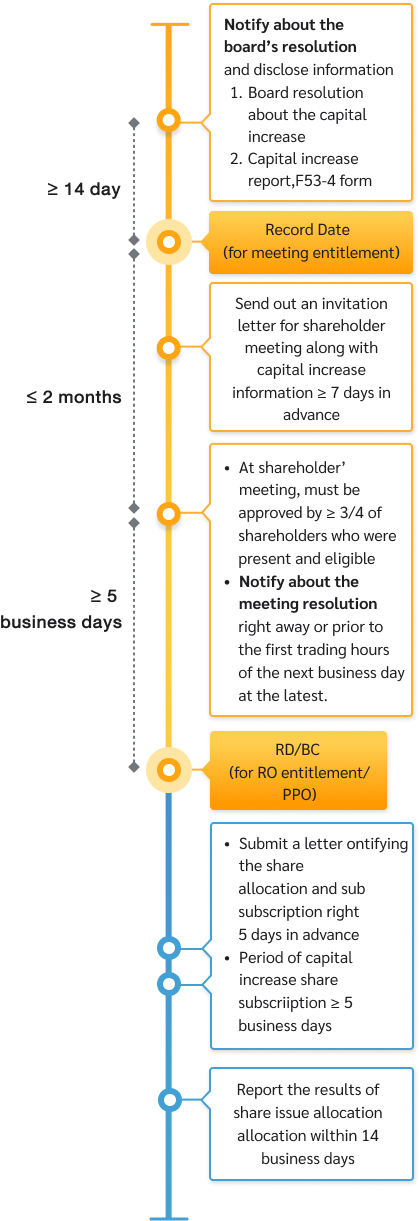

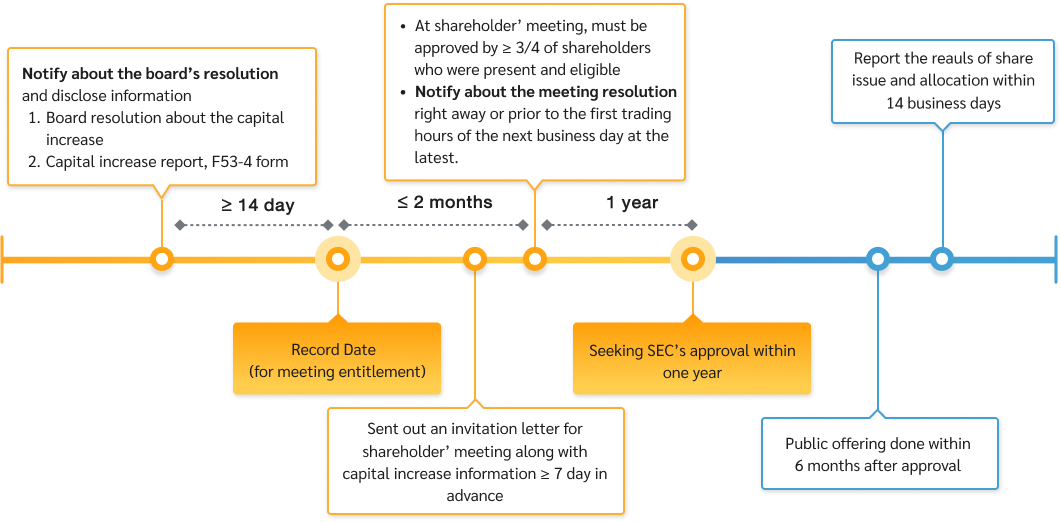

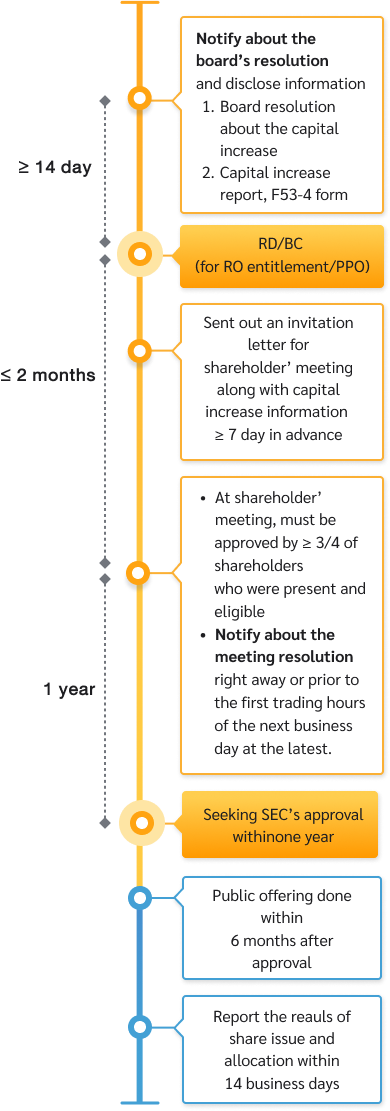

The process of each of the cases is summarized as per the following chart.

Case No.1 Shareholders’ meeting assigns the company’s board to set share price according to market price.

Case No.2 Shareholders’ meeting clearly sets share price for offering. (offering price might be either minimum price, price range, or calculation formula which the minimum price could be shown.)

Case No.3 Offering of remainder of shares after proportional allocation to the shareholders. (RO/PPO)

Note : IFA Report is not compulsory.

- Features of the offerings

1) Amount of share offering

2) Allocation

3) Offering Price and the Market Price calculations

4) Offering and Allocation methods - Objectives on PP Allocation

1) Clear objectives on the offerings

2) Funding plan

3) Details of projects - Impacts on shareholders

1) price dilution

2) earnings per share dilution หรือ control dilution

3) Worthiness of investors considering the dilutions. - Board of Directors’ opinions

1) Reasons and necessity of the capital increase

2) Possibility of funding plan

3) Rationale of capital increase, funding plan, and the project, and the fund sufficiency if the capital increase does not meet expectation.

4) Impacts on company’s business, financial stability and its operation from the capital increase and funding plan.

5) Other information (if any) - Statements specify shareholders’ right to demand compensation if BOD fails to do its duty with sincere and protect company’s benefits.

- In case specified price is voted by shareholders, additional information (besides 1-5) is required accordingly;

1. Names of subscribers

2. Board of Director’s opinion on

• Pricing of issued shares

• Offering Price calculation

• Reasons and necessities of the offering

3) The commitment of BOD showing it carefully considers and audits the subscribers to ensure their potential on investment. - In case specified price is voted by shareholders at the Discounted Price or PP allocation after RO at the price below fully diluted, must follow additional requirements accordingly;

1. Must not have ≥10% veto of shareholder votes

2. BOD’s opinion on

• The subscriber’s business or expertise that whether it be synergized to the company

• The worthiness of investors considering share-based payments - In significance case, an IFA Report is compulsory. Updated information is required by SEC’ observation (if any).

| Information | RO | PPO | PO | PP | |

| Size Limit (% of paid-up capital as of the date the BOD has resolved an increase capital by general mandate) | Not over 30% | Not over 20% | Not over 20% | Not over 10% | |

| Call for capital paid-up not more than 30% of total PO and PP no more than 20% | |||||

| Offering price | Not specified | Not subjected to the Discounted Price* as per SEC PO or PP approval rules (Discount not over 10%) | |||

| Allocation period | By the next Annual General Meeting (AGM) or the date required by law for the next AGM, whichever comes first | ||||

| Type of securities | - Common shares - Preferred shares - TSR | - Common shares - Preferred shares | |||

*Market Price as PO approval rules

Weighted Average Price must be given priority in setting market price. In case the foregoing is not compliable, one of the following must be used respectively namely Book building price or Fair price.

Weighted average price means retrospective weighted average price of shares covering a period of 7-15 consecutive days prior to the board’s resolution. The date for price setting will be according to the board’s resolution, which could be one of the followings:

- The day that BOD resolved

- The first share offering day for investors

- The day the shareholders can exercise their rights to convert its debentures, or to subscribe shares as per their warrants

Weighted average price must be given priority in setting market price. In case the foregoing is not compliable, one of the following must be used respectively namely Book building price or Fair price Weighted average price means retrospective weighted average price of shares covering a period of 7-15 consecutive days prior to the board’s resolution.

| Information disclose in Capital Increase Form | Objective Specification | General Mandate | ||

| Shareholders' approval | Once allocated | Shareholders' approval on framework | Board Resolves an allocation | |

| ||||

| X | |||

| X | |||

| X | |||

| X | |||

| X | |||

| X | |||

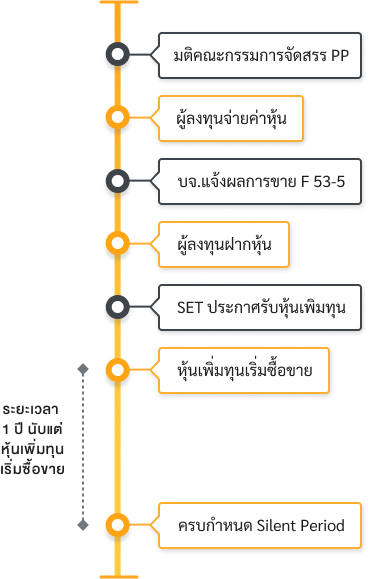

On the Meeting day,or prior to the first trading hours of the next business day at the latest via SETLink

Within 14 days from the last subscription date in line with Form 53-5 via SETLink

The listed company is responsible for reporting the utilization of the capital increase fund every six calendar months, within 30 days, via SETLink:

| Period of using capital increase fund | Reporting due date |

| January – June July – December | 30 July 30 January of the following year |

- After reporting the results of share allocation, the company must registered additional shares with the Department of Business Development, Ministry of Commerce (MOC). The company then receives an affidavit with respect to the Company's registered capital and the receipt for payment of fee.

- Submit a copy of an affidavit with respect to the Company's registered capital to the registrar (Thailand Securities Depository: TSD), so that TSD will either add shares by crediting additional shares into shareholder’s accounts, or issuing share certificates.

- In case the company allocate to PP at the Discounted Price, those PP’s shares must be locked up with TSD (Silent Period) (See more detail on Silent Period for PP Allocation rule).

- Submit the Application for Listing of Securities (F53-6) via Smart Listing, SETLink within 30 days after the subscription or the conversion has ended.

- After the SET has received F53-6 form together with other required documents, and TSD has issued new shares or share certificates to subscribers, SET will announce the new shares are approved as listed securities. The effective date and first trading date for those shares starts from the day after the announcement date (only for the case that the company’s common shares are not during suspension period).

- None

- PP that are subjected to Silent Period: The investors that subscribe additional shares or convert securities at the price ≥ 90% below the Market Price.

- The price below 90% of the Market price: Calculate in accordance to SEC regulation;

- Shares from additional shares subscription: use offering price

- Shares from debenture conversion: use CD offering price divided by conversion ratio

- Share from warrant exercise: use warrant offering price adds exercise price

- Share from additional shares issued along with warrant calculated by

((Ps) (Qs)) + ((Pw)(Qw))+ ((Ep)(Qx))

Qs + QxWhere;

Ps = Offering Price

Qs = Quantity of shares offering with additional warrants

Pw = Warrants offering price

Qw = Quantity of warrants offering with additional shares

Ep = Warrants exercise price

Qx = Quantity of shares after exercise Qw

- Quantity of locked up shares: All shares allocated to PP at the Discounted Price. Also, the additional shares from securities conversion.

- Silent Period: 1 year from additional shares’ first trading date. After 6 months, the shareholders can sell up to 25% of the locked up stocks.

- For convertible security offerings, silent period will be 1 year from the day that investors own those securities. - Exemption: PP allocated after RO/PPO at the price above not below the RO/PPO Price (only when the company allows RO/PPO to oversubscribe)

- Allowance: SET may soften the criteria for certain investors of the certain categories such as

- Creditors who are allocated shares or convertible securities as a result of business rehabilitation plan approved by the bankruptcy court by means of mewly issued shares for debt settlement

RO / PPO

- At shareholders' meeting must be approved by ≥3/4 of shareholders who were present and eligible to vote, with objection not ≥10% of shareholders who were present and eligible to vote

|

|

|

|

|

| Example of Capital Increase Information Disclosure (XY Plc.) |

| Increasing Capital | |

| Subject | Specifying the purpose of utilizing proceeds |

| Date of Board’s resolution | ... |

| Details of allotment | |

| Allocated to | Existing common shares' shareholders |

| Type of allocated securities | Common shares |

| Number of allotted shares (shares) | 1,600,000,000 |

| Ratio (Old: New) | 1 : 1 |

| Subscription price (baht per share) | ... |

| Subscription period | From …. To …. |

| Record date for the right subscribe additional shares | ... |

| Ex-Rights Date (XR) | ... |

| Allocated to | Private Placement |

| Type of allocated securities | Common shares |

| Person(s) receiving allotment(s) | - |

| Number of allotted shares (shares) | 800,000,000 |

| Number of additional common share(shares) | 2,400,000,000 |

| Total of additional shares (shares) | 2,400,000,000 |

| Par value (baht per share) | 1.00 |

| Schedule of Shareholders' meeting | |

| Subject | Schedule of Extra-General Meeting of Shareholders |

| Date of Board’s resolution | ... |

| Shareholders’ meeting date | ... |

| Beginning time of meeting (h:mm) | ... |

| Record date for the right to attend the meeting | ... |

| Ex-meeting date | ... |

| Significant agenda item | Capital increas |

| Venue of the meeting | ... |

| (F 53-4) |

Increase of the registered capital of the Company for Baht 2,400,000,000 from Baht … to Baht … by mean of 2,400,000,000 newly issued ordinary shares with the par value of 1 baht each. The details of the type of capital increase are as follows:

| Capital Increase | Type of Share | No. of shares | Par Value (Baht/ Share) | Total Value (Baht) |

| newly issued ordinary shares Preferred Stocks | 2,400,000,000 - | 1.00 - | 2,400,000,000 - | |

| newly issued ordinary shares Preferred Stocks | - - | - - | - - |

- Under specify the purpose of utilizing proceeds

| Allotted to | No. of shares (not exceeding) | Sale Price and Ratio | Subscription and payment period | Remark |

| 2.1 For Private Placement | 800,000,000 | Please see remark (1) | Please see remark (2) | - |

| 2.2 For Right Offering | 1,600,000,000 | Baht … per shares at Ratio 1:1 Please see remark (3) | Subscription date… Please see remark (2) | - |

(1) The offering price to the specific investors (Private Placement) will be determined by the Board of Directors, whereby the offering price will be in accordance with the market price at the best price for the offering period to the investors pursuant to the Notification of the Capital Market Supervisory Board No. Tor Chor.28/2565 re: approval for the listed companies to issue the newly-issued shares to the specific investors.

(3) The allotment of newly issued shares proportionately (Rights Offering) as table 2.2 specified the offering price at Baht … per share, which is the discounted price from the closing price of the company’s securities on ……equal to Baht …. , which is the date of BOD’s resolution (the closing price of company’s securities as of ….. equaling to Baht …. Therefore, the offering price at Baht … per share is discounted by …% of the mentioned closing price) The ratio of newly issued shares equals to 1 old share: 1 newly issued shares (the number of shares to be subscribed for at the first subscription is … shares). The Company has scheduled the date to determine the names of the shareholders entitled to subscription and allocation of the newly issued shares of the Company in proportion to their shareholding (Record Date) according to 2.2 on …… (Record Date). However, the determination of rights to subscribe for and receive the allocation of the newly issued ordinary shares, and the subscription period are still uncertain and subject to an approval of the meeting of shareholders.

- The Company’s plan in case there are fractional shares remaining: Round off.

5.2 In case the additional share left from subscription, the company may consider …

The Company pays dividends at no less than …% of consolidated net profit after tax and other legal reserves (if any). The Company also takes into consideration cash flows and/or any new investment or expansion of both existing businesses and potential new businesses.

7.2 Subscribers of new shares issued for this capital increase and warrant holders who subscribed for warrants will be entitled to receive dividends from the Company's business operations starting from when the subscribers are registered as the shareholders of the Company.

7.3 Others

-None-

| No. | Procedure of the Capital Increase | Date/Month/Year |

| 1 | Board of Directors Meeting No. … | ... |

| 2 | Record Date to determine the name of shareholders who are eligible to attend the extraordinary general shareholders meeting No. … | ... |

| 3 | Book Closing Date to compile the names who are eligible to attend the extraordinary general shareholders meeting No. … | ... |

| 4 | The extraordinary general shareholders meeting No. … | ... |

| 5 | Registration of the increase of registered capital and amendment to the Memorandum of Association with the Ministry of Commerce. | Within 14 days from the date of approval by Shareholders |

| 6 | Record Date to determine the name of shareholders who are eligible to subscribe additional shares No. … | ... |

| 7 | Book Closing Date to compile the names who are eligible to subscribe additional shares No. … | ... |

| 8 | Subscription Period | ... |

| 9 | New capital registered at the MOC | Within 14 days from the date of subscription period |

| 10 | Additional shares to be listed in SET | Announce afterwards |

| Information Memorandum regarding the allocation of the newly issued shares to the Specific Investors (Private Placement) |

The allocation of the newly issued shares to the specific investors (Private Placement) is significant matter; the Company then prepares this substantial information memorandum for the shareholders’ consideration according to the Capital Market Supervisory Board No. TorChor. 73/2558, Re: List of Information in Notice of Shareholders’ Meeting of Listed Company for seeking approval of the issuance and offering of securities, with the details as follows:

The Board of Directors’ meeting resolved to approve the allocation of not exceeding 800,000,000 newly-issued ordinary shares to specific investors (Private Placement) who are not connected persons of the Company. The Board of Directors is authorized to determine the offering price in accordance with the following conditions:

(1) The offering price shall be the best market price according to the market condition during the offering period, i.e. the price shall not be lower than the weighted average of the shares trading on the Stock Exchange of Thailand (the “Stock Exchange”) for 7 but not more than 15 consecutive trading days (Market Price). In this regard, the Company may determine the discount on the offering price but shall not be more than 10.0 percent of such Market Price, or not lower than price which is determined by the book building method surveyed by the securities company in accordance with the Notification of the Capital Market Supervisory Board No. TorChor. 28/2565, Re: Approval for the Listed Companies to Issue the Newly-issued Shares to the Specific Investors; and

(2) Such price shall be the offering price not lower than the price which is offered to the existing shareholders proportionate to their respective shareholdings (Rights Offering) on the first offering (Baht … per share) and shall be a reasonable price when considering to benefits, interest and any impact to the existing shareholders of the Company. The issuance and offering of the newly issued shares to the specific investors is subject to the approval from the Securities and Exchange Commission (“SEC”). In addition, it is proposed to the Extraordinary General Meeting of the Shareholders No … on … that that the Board of Directors or …, Chief Executive Officer and President, as a person designed by the Board of Directors has the authority to determine and/or make changes to other details relating to the allocation of the newly-issued shares to the specific investors, subject to the relevant rules and laws, which shall include but not be limited to the following: (1) to consider and determine whether the newly-issued ordinary shares shall be one or from time to time allocation (within 6 months), the offering period, the share allocation, offering price, payment for shares, and other details and conditions relating to the allocation; (2) to appoint the financial advisors, enter into negotiations, agreements, and execute relevant documentation and agreements relating to the allocation, and to undertake any act in connection with the allocation; and (3) to sign application forms for permission, relaxation, and evidence necessary for and relevant to the allocation, as well as to coordinate with and apply for permission for approval, relaxation, and necessary and relevant evidence from the relevant government agencies or relevant agencies, and to list the newly-issued ordinary shares on the Stock Exchange, and any take other action as it deems necessary and appropriate for the purpose of the allocation.

2. Criteria for the allocation of the newly issued shares to the specific investor

With respect to this issuance and offering of the newly-issued ordinary shares to specific investors (Private Placement), the Company will choose a variety of types of investors such as institutional investors, private equities, hedge funds, strategic investors, as well as institutional investors that have previously invested in …. This is for the reason that the aforementioned groups of investors have extensive investment experience … Their investment policy also includes the holding of shares in the Company in the long term and such investors shall have investment potential and capable to the investment. In this regard such investors will not be connected persons as prescribed by the Notification of the Capital Market Supervisory Board on Connected Transactions.

3. Objectives of the allocation of the newly issued shares to the specific investor and plans for utilizing proceeds received from the capital increase

The Company will utilize all proceeds received from the issuance of the newly issued shares to the specific investors (Private Placement) to the restructure of the capital and repayment of the loan from financial institution received by the Group of Company to acquire the business … at the amount of …% of total issued and paid-up shares of …, which the Company was granted the bridge loan from the financial institution at the amount of Baht … million.

4. Effect to the existing shareholders from the allocation of newly issued shares to the specific investors

The potential effects resulting from the allocation of shares to the Private Placement on the existing shareholders are price dilution, control dilution, and earnings per share (EPS) dilution.

...............

5. Opinion of the Board of Directors on the capital increase or allocation of the newly issued shares to specific investors (Private Placement)

(1) Rationale and necessity for the capital increase

The Board of Directors was of the opinion that, it is necessary for the Company to increase its registered capital and issue newly-issued ordinary shares to the specific investors (Private Placement) who are not connected persons of the Company in order to use the proceeds derived from the Private Placement (as well as from the proceeds received from the allocation of the newly-issued ordinary shares to the existing shareholders of the Company proportionate to their respective shareholdings (Rights Offering)) for restructuring the investment capital of the Company. This will be done by means of using the proceeds derived from the capital increase as funds for repaying the short-term loans with the financial institutions from which the group of the Company had obtained a bridge loan for the acquisition of the business … as mentioned above. In this regard, the Board of Directors has determined that the specific investors to be allocated the newly issued shares, shall be in accordance with the Criteria for the allocation of the newly issued shares to the specific investor as specified in Clause 2 above.

(2) Feasibility of the proceeds utilization plan

The Company expects that the issuance and offering of the shares to specific investors (Private Placement) and the obtaining of proceeds from the offering of such newly-issued ordinary shares will occur within … (this will be around the same time as the allocation of the newly-issued ordinary shares to the existing shareholders proportionate to their respective shareholdings (Rights Offering). The Company will use all of the proceeds derived from the issuance and offering of the newly issued shares to the Private Placement for repaying the short-term loan to the financial institution as soon as possible in order to reduce its interest obligations.

(3) Reasonableness of the capital increase, plan to utilize the proceeds derived from the offering for sale, and projects to be operated, including the sufficiency of the sources of funds

The Board of Director was of the opinion that the issuance and offering of the newly issued ordinary shares to the specific investors (Private Placement) and to the existing shareholders proportionate to their respective shareholdings are part of the capital restructuring plan in accordance with the capital restructuring plan of the Company for the repayment of loans secured from the financial institutions which the group of the Company used to acquire the business of ... When combining the transactions of the issuance of debentures, Bill of Exchange and/or lending from the financial institution which the Company will proceed with such transaction concurrently with the refinancing in the total amount of not exceeding Baht … million (excluding the existing debentures and credit facilities granted to the Company Group that are the part not relevant to the loan which the Company used in the investment in the shares of …), therefore it will be sufficient for the capital restructuring of the Company.

(4) The potential impact which may occur to the business operation of the Company, as well as its financial positions, and operational results, due to the capital increase and the proceeds utilization plan or projects:

The Board of Director was of the opinion that the proceeds derived from the capital increase will strengthen the financial position and capital structure of the Company and to reduce the interest obligations in the future after the completion of the capital increase.

(5) Expected effects to the Company in the case that the newly issued shares to the

Private Placement are not fully subscribed

The Board of Director has considered such effect, then resolved to approve the allocation of the remaining shares from the share subscription by the Private Placement to the existing shareholders.

(6) Appropriateness of the offering price of the Private Placement, rationale on determination of offering price, rationale and necessity for the Private Placement:

After due consideration, the Board of Directors was of the opinion that, the offering price of the Private Placement is appropriate and reliable, because such offering price shall be determined in accordance with the best market price, according to the market condition during the offering period, i.e. the price not lower than the weighted average of the shares trading on the Stock Exchange for 7 but not more than 15 consecutive trading days prior to such period (Market Price). In this regard, the Board of Directors may determine the discount on the offering price but shall not be more than 10 percent of such Market Price, or not lower than the price which is determined by the book building method surveyed by the securities company subject to the Notification of the Capital Market Supervisory Board No. TorChor. 28/2565, Re: Approval for the Listed Companies to Issue the Newly-issued Shares to the Specific Investors; and such offering price is not lower than the price which is offered to the existing shareholders proportionate to their respective shareholdings (Rights Offering) on the first offering. In this regard, the Board of Directors hereby certifies that, it shall consider and verify information and the potential of the investors by taking into account the best interests of the Company and its shareholders.

6. Certification of the Board of Directors regarding the capital increase

According to the Section 85 of the Public Company Limited Act B.E. 2535 (including any amendment thereto), in the case that the directors of the Company do not comply with the laws, the objectives, the articles of association of the Company, and the resolution of the meeting of shareholders in good faith and with care to preserve the interest of the Company on matters relating to the increase of registered capital, resulting that the performance of any act or non-performance of any act which fails to comply with the aforementioned duties and causes damages to the Company, the Company may claim compensation from the directors. In the case where the Company fails to make such claim, any one or more shareholders holding shares amounting to not less than 5% of the total number of issued shares of the Company may issue a written notice requesting the Company to make such a claim. If the Company fails to take action as directed by the said shareholders, such shareholders may bring a suit to the court to claim compensation on behalf of the Company. In addition, according to Section 89/18 of the Securities and Exchange Act B.E.2535 (including any amendment thereto), in the case where the director acts or omits to act in such a way that not comply with the laws, the objectives, the articles of association and the resolution of the meeting of shareholders with due care and loyalty to preserve the interest of the Company on the matters relating to the increase of registered capital, resulting that the director, the executive or the related person to obtain undue benefits, the Company may bring an action against the director for disgorgement of such benefits to the Company. In this regard, a shareholder or shareholders who hold shares and have the right to vote amounting to not less than 5% of the total number of voting rights of the Company may issue a written notice requesting the Company to bring the aforementioned action and the Company fails to proceed as requested within one month from the date of the notice, such shareholder or shareholders may bring an action for disgorgement of benefits on behalf of the Company.

………………………..…………….(The company)

| ............................. (Director) | ............................. (Director) |

| Examples: the calculation of 7-15 business days weighted average prices when offering to Private Placement |

To The President

The Stock Exchange of Thailand

Refer to the letter of the Stock Exchange of Thailand No. … Dated … Re: Notification of the details of issuing and offering of the newly-issued ordinary shares to person under the Private Placement Scheme according to the resolution of the Extraordinary General Meeting of Shareholders No. … By rhe resolution of the Extraordinary General Meeting of Shareholder No. … of …. (the “company”) held on … , which has approved the increase in the registered capital and allocation of … newly-issued ordinary shares, at the par value of Baht … per share to offer for sale to …, at offering price of baht … per share which arrived from the negotiation between the company and … , where the Company referred to the valuation of the price by Adjusted Book Value Approach and Discounted Cash Flow Approach prepared by the management of the Company. Moreover, the company also took into consideration the weighted average market price during 30 business day prior to resolution to approve such transaction from the Board of Directors’ meeting which equal to … per share.

Furthermore, in order to be consistent with the Notification of the Stock Exchange of Thailand Re: Rules, Condition and Procedures Governing the Listing of Ordinary or Preference Shares Issued for Capital Increase, 2015, the Company would like to announce the weighted average market price of the Company’s shares on the Stock Exchange of Thailand (“the SET”) over 7-15 consecutive trading days prior the first day of payment.

… has already paid-up the Company’s newly issued shares on … So the Company will determine the period for calculated market price between … to … in order consider the Silent Period in case of the offering of securities to person under private placement scheme at the offering piece of lower than 90% of the market price. Calculate details are as follows:

| No. | Date | Quantity of purchase and sale (Shares) | Value of purchase and sale (Shares) |

| 1 | December 22, 2015 | ... | ... |

| 2 | December 23, 2015 | ... | ... |

| 3 | December 24, 2015 | ... | ... |

| 4 | December 25, 2015 | ... | ... |

| 5 | December 26, 2015 | ... | ... |

| 6 | December 27, 2015 | ... | ... |

| 7 | December 28, 2015 | ... | ... |

| 8 | December 29, 2015 | ... | ... |

| 9 | December 30, 2015 | ... | ... |

| 10 | December 31, 2015 | ... | ... |

| 11 | January 12, 2017 | ... | ... |

| 12 | January 13, 2017 | ... | ... |

| 13 | January 14, 2017 | ... | ... |

| 14 | January 15, 2017 | ... | ... |

| 15 | January 16, 2017 | ... | ... |

| The weighted average market price for 15 trading day | |||

| 90% of the weighted average market price for 15 trading days | |||

| Sincerely yours |

| ...................................................... |

| (Authorized Person the Disclose Information) |

To President

The Stock Exchange of Thailand

… (the “Company”) would like to inform about the allotment of newly issued ordinary shares via private placement in the amount of … shares at the par value of … Baht per share to Mr. ... The purpose of the offering of newly issued ordinary shares via private placement was to complete the payment for the transaction of assets which refers to .... The offering price of newly issued ordinary shares was … Baht per share, which was not lower than 90 percent of the Market Price (The weighted average price is during the date of … - …). This price was acceptable by the Buyer, or the Company, and the Seller, Mr. …, who was …. The offering price was as pursuant to the Notification of the Capital Market Advisory no. TorJor. 72/2558 (2015) Re: Private Placement Offering Category 2 concerning offering to shareholders with specified offering price. The “Market Price” derived from 9-consecutive-business-day weighted average closing price of … prior to the date on which the Company’s Board of Directors passed a resolution to propose the issue to the 2016 Annual General Meeting of Shareholders for approval of the issuance of new shares via private placement at the price of … Baht per share, calculated between February 19, 2016 and March 3, 2016. In this regard, the authorized director has appointed the date for the offering, the subscription and the payment of the newly issued ordinary shares on June 3, 2016.

Furthermore, in order to be consistent with the Notification of the Stock Exchange of Thailand Re: Rules, Conditions and Procedures Governing the Listing of Ordinary or Preference Shares Issued for Capital Increase, 2015, the Company must inform market price over 7 to 15 consecutive trading days prior the first day of payment. The Company calculated market price during the period from May 12, 2016 to June 2, 2016 (The weighted average price of the Company’s shares on the Stock Exchange of Thailand over 7 to 15 consecutive trading days prior the first day of payment). Details are as follows:

| No. | Date | Volume (Shares) | Value (Shares) |

| 1 | May 12, 2016 | ... | ... |

| 2 | May 13, 2016 | ... | ... |

| 3 | May 16, 2016 | ... | ... |

| 4 | May 17, 2016 | ... | ... |

| 5 | May 18, 2016 | ... | ... |

| 6 | May 19, 2016 | ... | ... |

| 7 | May 23, 2016 | ... | ... |

| 8 | May 24, 2016 | ... | ... |

| 9 | May 25, 2016 | ... | ... |

| 10 | May 26, 2016 | ... | ... |

| 11 | May 27, 2016 | ... | ... |

| 12 | May 30, 2016 | ... | ... |

| 13 | May 31, 2016 | ... | ... |

| 14 | June 1, 2016 | ... | ... |

| 15 | June 2, 2016 | ... | ... |

| The weighted average market price for 15 trading days (Baht/ Share) | |||

| 90% of the weighted average market price for 15 trading days (Baht/ Share) | |||

| Sincerely yours |

| ...................................................... |

| Chief Executive Officer |

| Example of Report on the Result of Sale of Common Shares offered to Private Placement (F53-5) (WZ Plc.) |

| Objectives | Utilization Plan (Approx.) | Proceeds Used as of 30 Jun 2014 | Ending Bal as of 30 Jun 2014 | Proceeds Used between 1/7/14-31/12/14 | Ending Bal as of 31/12/14 |

| 1. For investment in plants, power and equipment | ... | ... | ... | ... | ... |

| 2. New office building construction and renovation project | ... | ... | ... | ... | ... |

| 3. Investment in land | ... | ... | ... | ... | ... |

| 4. For working Capital or adjust capital structure | ... | ... | ... | ... | ... |

| Total | 2,000 | 1,600 | 400 | 100 | 300 |

| Example of Report on the results of sale of common shares offered to private placement (F53-5) Date/Time: 05/02/2018 17:05:00 Headline: Report on the results of sale of common shares (F53-5) Symbol: ... | ||||

| Details of additional shares allocation shown as follows: | ||||

| Offered to | Number of allotted shares (shares) | Subscription price (baht per share) | Subscription and payment period | Number of subscribed shares (shares) |

| Private Placement allocation based on shareholders’ resolution totally 183,000,000 shares. The number of allotted and subscribed shares equal to 2,000,000 shares and remaining shares equal to 181,000,000 shares. Detail as following | ||||

| Mr. …………… | …. | …. | 3 Jun, 2016 | …. |

| Summary | …. | |||

| Total amount (baht) | …. |

| Total expense (baht) | …. |

| Expense details | …. |

| Net amount received (baht) | …. |

| Remark | Since the offering price of 2.03 Baht per share was lower than 90 percent of the weighted average market price, the transaction was the offering price of lower than 90 percent of the market price according to the regulation of the Stock Exchange of Thailand. Thus, silent period is specified to one year. Nevertheless, the Company specified two years of silent period and sell was permitted by 50 percent of shares under sell prohibition after the first year from the day when shares for capital increase was traded on the Stock Exchange of Thailand. This condition is above regulatory requirement of the Stock Exchange of Thailand. | ||

| Signature (MR. …………...................................……) Director | Signature (MR. …………...................................……) Director Authorized to sign on behalf of the company | ||

Until fund has been used up.

The company must report, via SETLink, the BOD’s resolution regarding the entitlement and subscription date for capital increase, as well as other related information at least 14 days in advance.

Calculation is categorized into 2 cases

(1) Offering share price

(2) Sum of the offering share price and warrants price

Whichever price falls below 90% of the market price, the shares and convertible securities must be locked up by silent period rules for discounted PP.

Therefore, the shares and shares converted from exercising warrants must be locked up in this case since the offering price of shares and warrants is less than 90% of market price.

If the offering price is at least 90% of market price, the shares must not be locked up due to the silent period rules. The calculation of the Market Price is weighted average price of 7-15 consecutive business days prior to board’s price setting resolution. (Please study market share price under subject of “Silent Period for PP below market price”.)

Note In case of shareholders’ approval ordinary shares/ warrants to PP offering prior to effective date from 1 July 2023. If the offering price is less than 90% of market price, the shares must be locked up due to the silent period rules. The calculation of the Market Price is weighted average price of 7-15 consecutive business days prior to the first offering date.

The Market Price is calculated from 7-15 consecutive business days prior to board’s price setting resolution. (Please study market share price under subject of “Silent Period for PP below market price”.)

Note In case of shareholders’ approval ordinary shares/ warrants to PP offering prior to effective date from 1 July 2023.

- The Market Price of Mr. A is calculated from 7-15 consecutive days prior to July 1.

- The Market Price of Mr. A is calculated from 7-15 consecutive days prior to August 22.

PP Share Allocation + Warrant

Convertible Security Conversion

Until fund has been used up.

The company must report, via SETLink, the BOD’s resolution regarding the entitlement and subscription date for capital increase, as well as other related information at least 14 days in advance.

Calculation is categorized into 2 cases

(1) Offering share price

(2) Sum of the offering share price and warrants price

Whichever price falls below 90% of the market price, the shares and convertible securities must be locked up by silent period rules for discounted PP.

Therefore, the shares and shares converted from exercising warrants must be locked up in this case since the offering price of shares and warrants is less than 90% of market price.

If the offering price is at least 90% of market price, the shares must not be locked up due to the silent period rules. The calculation of the Market Price is weighted average price of 7-15 consecutive business days prior to board’s price setting resolution. (Please study market share price under subject of “Silent Period for PP below market price”.)

Note In case of shareholders’ approval ordinary shares/ warrants to PP offering prior to effective date from 1 July 2023. If the offering price is less than 90% of market price, the shares must be locked up due to the silent period rules. The calculation of the Market Price is weighted average price of 7-15 consecutive business days prior to the first offering date.

The Market Price is calculated from 7-15 consecutive business days prior to board’s price setting resolution. (Please study market share price under subject of “Silent Period for PP below market price”.)

Note In case of shareholders’ approval ordinary shares/ warrants to PP offering prior to effective date from 1 July 2023.

The Market Price is calculated separately for each subscription

- The Market Price of Mr. A is calculated from 7-15 consecutive days prior to July 1.

- The Market Price of Mr. A is calculated from 7-15 consecutive days prior to August 22.

PP Share Allocation

PP Share Allocation + Warrant

Convertible Security Conversion

* Immediately: information to be disclosed by 9 a.m. on the next working day or on the event date (The date of the board of directors or shareholders meeting's have resolution)

3 working days: Information to be disclosed within 3 working days after the event date

.svg)

.svg)

.png?ver=20220129025126)

.png?ver=20220129025147)