A capital reduction can be accomplished through the following methods:

| Par value reduction |

| Share amount reduction |

Benefits

Company

| Promote capital-usage efficiency, which improves financial ratios (e.g., ROE, ROA, total asset turnover) and increases the company's attractiveness to investors |

| Support future dividend payments if the company has accumulated loss. Capital reduction will make up for a shortfall in retained earnings, allowing the company to pay dividends without having to wait for current operating results |

| Support capital increases by new investors |

Shareholders

| Have opportunities to earn a higher return on investment if it is a capital reduction for capital restructuring |

| Have opportunities to receive dividends sooner if it is a capital reduction to offset a deficit in retained earnings |

Tax duties

The capital reduction of retained earnings is considered assessable income and, as such, carries tax payment obligations for shareholders who receive it.

Capital decrease is an approach to manage the company’s fund appropriately. A company with huge accumulated losses may choose to reduce capital as to wipe out or decrease such losses, and attain a heathier fund structure. However, as capital decrease directly affects the shareholders’ benefits as well as company’s securities prices, the listed company is required to disclose information related to its capital reduction in order to provide shareholders and general investors with information essential to making investment decisions.

Type pf capital reduction |

- Par value reduction

- Share amount reduction

Objectives |

To wipe out accumulated losses, return the capital to shareholders, or to adjust the capital structure

Information disclosure |

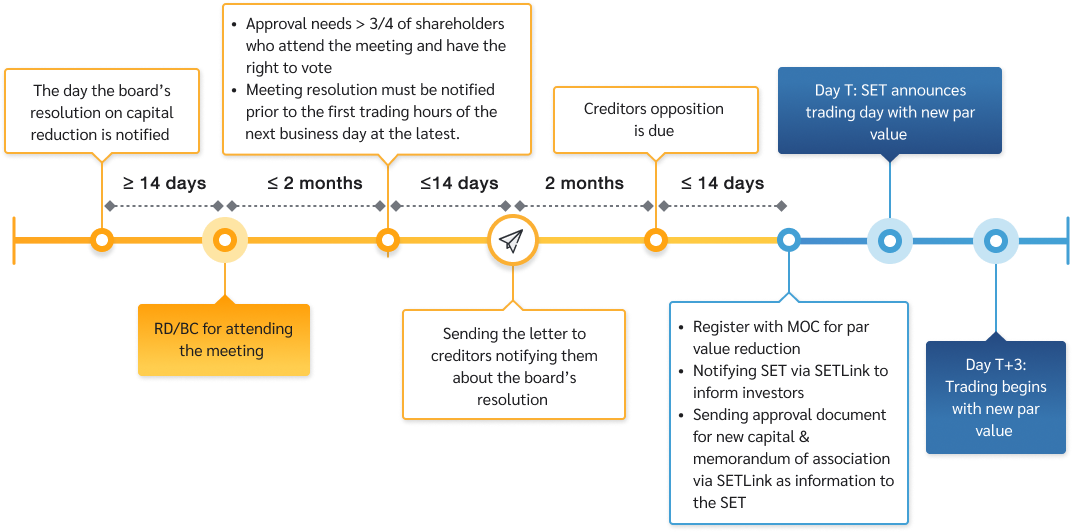

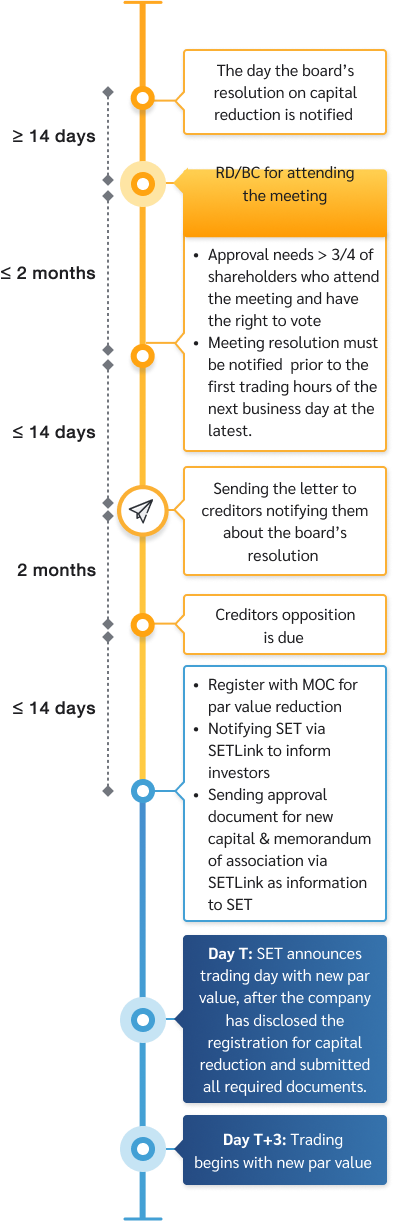

- The company has to notify investors via SETLink about the board’s resolution on capital reduction immediately, that is, within the date the board reached the resolution, or prior to the first trading hours of the next business day at the latest.

- Material information required for disclosure when the company reduces capital

- The date the company’s board has made a resolution to reduce capital

- Agenda of the shareholders’ meeting, list of eligible shareholders to attend the meeting (by the record date or the book closing date), and details on whether the memorandum of association will be adjusted by par value or by the decrease share amount

- Types of capital decrease

| Par value reduction | Share amount reduction |

| - Par value before and after capital reduction - Total amount of reduced capital - Objectives of capital reduction | - Shareholders whose capital will be reduced (In case certain shareholders are affected, details of those shareholders should be specified) - Amount of shares reduced - Objectives of capital reduction - The record date for the shareholders whose shares are to reduced - Ratio of capital reduction (Existing share: Share after reduction)* |

| Additional information is required if it is the case of capital reduction to return capital to shareholders - Amount of fund to be returned to the shareholders - The record date for the shareholders whose shares are to reduced and eligible for refund - Date for the refund payment | |

Remarks

* The procedure must be specified in details when the capital reduction ratio leads to odd lots, for example “...when the calculation for each shareholder’s capital reduction is completed and the shareholder has remaining odd lots in digits, it must either be rounded up or down proportionately i.e. more than 0.5 shares will be rounded up to one, while lower than 0.5 shares will be cut off. After the whole calculation process is complete and there are ……. shares in excess or in need, the executive directors’ shareholding will be considered to add or reduce further.”

Announcement of the shareholders’ resolution |

- Must be approved at the shareholders’ meeting with no less than three-fourths of total votes from shareholders who attend the meeting and have the right to vote.

- Within the shareholders’ meeting date or prior to the first trading hours of the next business day at the latest, via SETLink to inform investors.

Result of the creditor opposition |

- The company must send a letter notifying about the resolution to its creditors within 14 days from the day the shareholders has made the resolution. The creditors will be given two months, from the day they have received the letter, to send their opposition. The company shall also advertise the resolution in the newspapers during those 14 days.

- Once reaching the 2-month period, the company shall notify via SETLink to inform investors about the result of the creditor opposition.

Registering the capital reduction |

- After the company has notified its capital amendment registration to the Ministry of Commerce (MOC), it shall submit a copy of documents related to capital registration via SETLink as information to the SET.

- Once the company has finished the registration for capital reduction, it shall send a notification letter to shareholders and advertise in at least one newspaper, within 14 days from the day it made the registration.

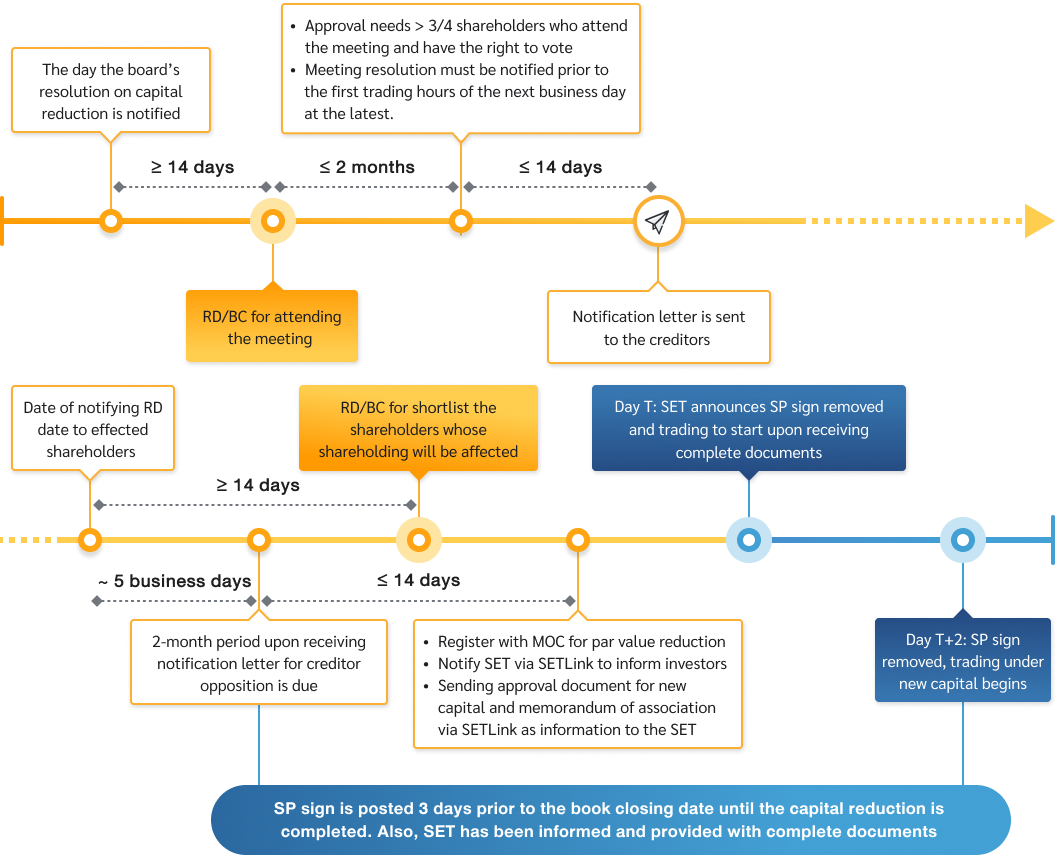

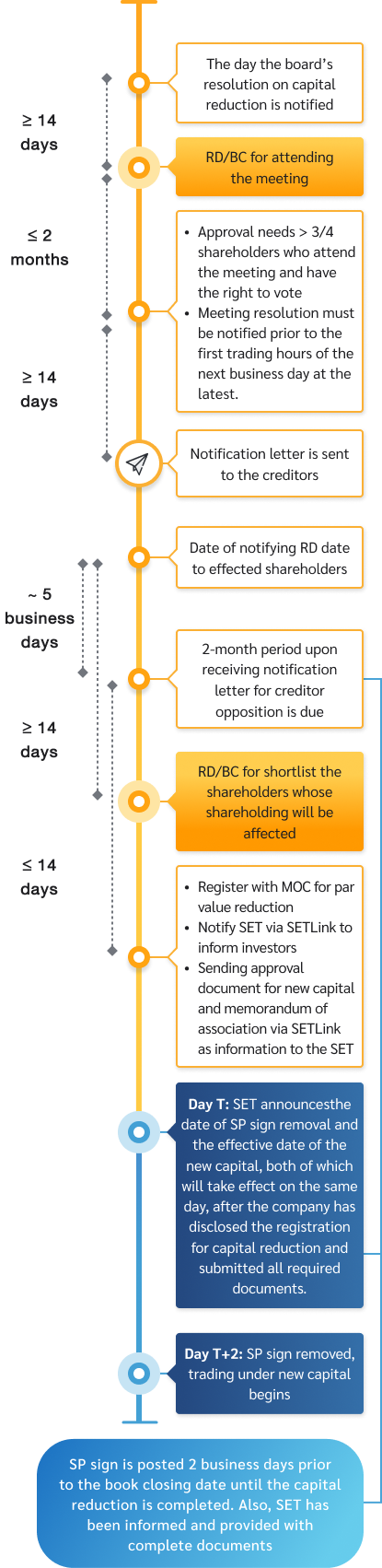

Additional process when capital is reduced by decreasing number of shares |

- Announce the book closing date (BC) or the record date (RD) to shortlist the shareholders whose shareholding will be affected at least 14 days in advance.

Remarks To foster a speedy capital reduction, the company may announce the record date five days before the date for creditor opposition is due (This is possible only if the listed company is certain that there would be no creditor opposition. The company should also notify that how many creditors have not yet responded so far until that day, and how many percent they are off all the creditors. Consequently, how the company will handle it if the mentioned creditors become opposing to its decision. It may, for example, be able to repay debts as it has sufficient cash flows). - To let the shareholders know of their post-reduction shareholding, and to avoid confusion when trading during the registration process is not completed yet, the listed company must ask SET to suspend trading (SP) on their securities while the company is in the process of capital reduction. The SP sign will be posted three days prior to the book closing date to determine the list of shareholders whose capital will be reduced. The sign will remain until the capital reduction process is completed, so that shareholders are aware of the number of shares held after the capital reduction.

Remarks To avoid having SP sign posted on for a long period, hence affecting the shareholders’ rights and trading liquidity, the company should plan ahead about capital registration process with the MOC and about reducing share amount by the registrar, so as to minimize the time used (the company can actually complete these processes within 7 – 8 business days).

Tips

When the company is to reduce its capital, there will be changes made to the capital (reduction), it therefore needs to propose an agenda to amend memorandum of association, for further shareholder approval.

Tips

When the company is to reduce its capital, there will be changes made to the capital (reduction), it therefore needs to propose an agenda to amend memorandum of association, for further shareholder approval.

Capital reduced by par value reduction

Capital reduced by reducing number of shares

Related Regulations

|

Issues for consideration

|

|

|

|

|

Q&As

In case the capital reduction is by par value, the listed company is not required to ask SET to suspend trading of its securities. The practice will be similar to par splitting.

In the event there is creditor opposition, the listed company will not be able to reduce capital until the debts have all been repaid, or fully guaranteed.