In order to increase investors’ benefits protection measures, SET has issued the criteria for the posting of sign on securities of listed company, to inform investors of listed companies with risks in connection with financial position, operating result, financial liquidity or with qualification not being in compliance with the prescribed criteria. The investors shall only purchase such securities through Cash Balance account.

The criteria for posting of signs to warn investors shall comprise of “CB” (Business), “CS” (Financial Statements), “CC” (Non-compliance) and “CF” (Free Float) as follows;

| The criteria for posting of signs |

| 1.1. Criteria regarding Financial Position |

| Sign | Details | |

| The Posting of Signs | The Lifting of Signs | |

| CB (Business) |

|

|

|

| |

|

| |

|

| |

|

| |

| 1.2. Criteria regarding Financial Statements |

| Sign | Details | |

| The Posting of Signs | The Lifting of Signs | |

| CS (Financial Statements) |

|

|

|

| |

| 1.3. Criteria regarding Qualifications that not being in compliance with the prescribed criteria |

| Sign | Details | |

| The Posting of Signs | The Lifting of Signs | |

| CC (Non-Compliance) |

|

|

|

| |

|

| |

| CF (Free Float) |

|

|

Remarks

| /1 | The paid-up capital means the paid-up capital deducting the discounts on share capital and the discounts from business restructuring in accordance with the calculating method stipulated by the SET. In any case, the paid-up capital after those deductions shall be greater than zero. |

SET has specified the calculation guideline of the measure as follow

Step 1 Calculate shareholders’ equity to paid-up capital deducting the discounts on share capital ratio as follows

Equity*

Paid-up Capital - Discounts on Share Capital

| In case the result of the calculation in Step 1 > 50% : Not qualified as CB (Business) In case the result of the calculation in Step 1 < 50% : To calculate Step 2 |

In case the result of the calculation in Step 1 > 50% : Not qualified as CB (Business)

In case the result of the calculation in Step 1 < 50% : To calculate Step 2

In case the result of the calculation in Step 1 < 50% : To calculate Step 2

Step 2 In case the result of the calculation in Step 1 < 50%

| To deduct the discounts from business restructuring from the paid-up capital, such as the adjustment of equity interests under reverse takeover, the deficits arising from business combination under common control, among other items, as follows | ||||||

To deduct the discounts from business restructuring from the paid-up capital, such as the adjustment of equity interests under reverse takeover, the deficits arising from business combination under common control, among other items, as follows

Equity*

Paid-up Capital - Discounts on Share Capital - Discounts from Business Restructuring

| However, the deduction shall not be greater than the current paid-up capital. In case the result of the calculation in Step 2 > 50% : Not qualified as CB (Business) In case the result of the calculation in Step 2 < 50% : Qualified as CB (Business) |

However, the deduction shall not be greater than the current paid-up capital.

In case the result of the calculation in Step 2 > 50% : Not qualified as CB (Business)

In case the result of the calculation in Step 2 < 50%: Qualified as CB (Business)

In case the result of the calculation in Step 2 > 50% : Not qualified as CB (Business)

In case the result of the calculation in Step 2 < 50%: Qualified as CB (Business)

Remarks

| /2 | With respect to the default in payment or failure to comply with its obligation under transactions respecting issuance of bonds, the Exchange will refer to the posting of signs by the Thai Bond Market Association (ThaiBMA), such as, DP (Default Payment), DNP (Default not related to payment), FP (Failed to Pay), FPG (Failed to Pay with Guarantee), etc. |

| /3 | Please study the delisting in the cash company case regulation. |

| /4 | The definition of an Investment Company in accordance with the Notification of the Capital Market Supervisory Board, means investments in securities, derivatives or digital assets in one or more of the following manners at a collective total exceeding 40 percent of the total assets as per the most recent financial statements or the consolidated financial. |

| (1) Investments in shares in another company which is not, or will not become, a subsidiary or an associate, except for the investment in companies that cooperate or support businesses, or an affiliated company under the same parent company, or a network company that can demonstrate a policy or direction of cooperation or support for mutual operations. | |

| (2) Investments with the objective of generating returns from increases in capital gain or other returns exempted investment in government bonds, debt instruments issued by the Ministry of Finance with an unconditional, full guarantee of principal and interest and units in money market funds or units in general fixed income funds. | |

| The calculation of the proportion of such investments includes the investments in securities, derivatives or digital assets of subsidiary which is a non-financial institution and the investments in shares which are issued by an associate and engaged a non-financial institution. |

| Procedures to be taken by listed companies posted with CB, CS, CC and CF signs |

The listed company is required to set up a meeting in order to provide information to the investors and concerned persons (Public Presentation) within 15 days since the day that CB CS CC and CF sign are posted by providing of the plan to solve the problems and report on resolving progress to the company’s Board Of Directors (BOD) and Audit Committee to approve. Also, aforementioned plan and progress must be reported through the SET Disclosure System.

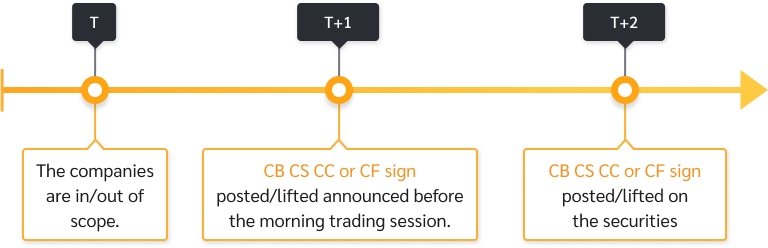

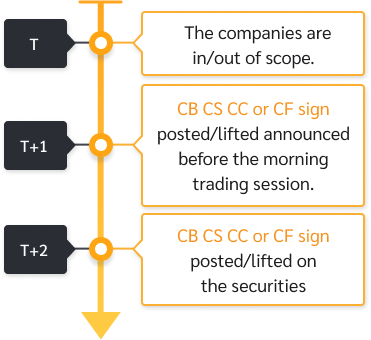

Whenever there is information that the listed company appeared to be in the scope of of CB CS CC and CF sign posting, SET will announce to post on the next business day before the morning trading session. As a result, investors have to purchase such securities with Cash Balance account on the next business day from the notified date onwards.

SET will lift the CB CS CC and CF sign by the announcement in advance for 1 business day when the company has completely resolved mentioned problems or the company’s securities has already been announced to be possible delisting.

SET will lift the CB CS CC and CF sign by the announcement in advance for 1 business day when the company has completely resolved mentioned problems or the company’s securities has already been announced to be possible delisting.

Related Regulations