When a listed company would like to delist its common shares from being listed on the Stock Exchange of Thailand (SET) or Market for Alternative Investment (mai), the company has to disclose related information and procedures such as the Board of Director’s resolution, shareholders’ approval, and tender offer. This is to protect the benefits of minority shareholders whose shares will finally become illiquid once the company’s common shares have been delisted.

Information disclosure

Information disclosure

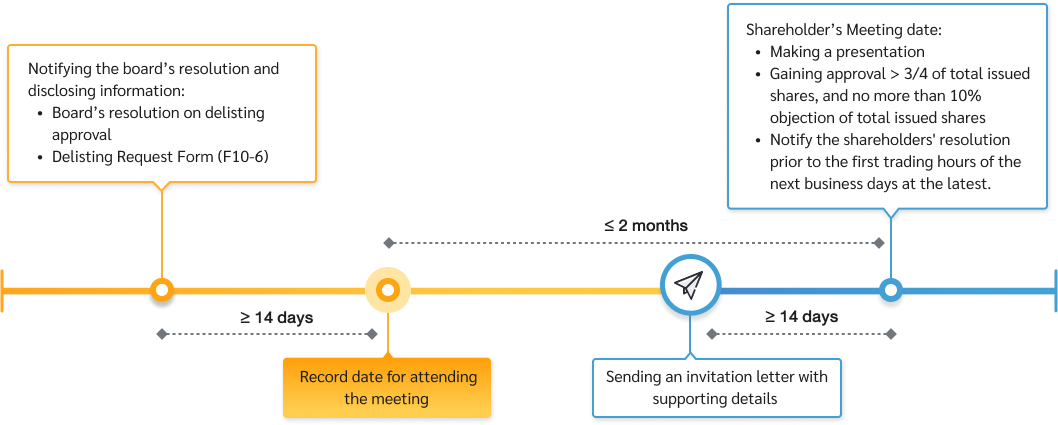

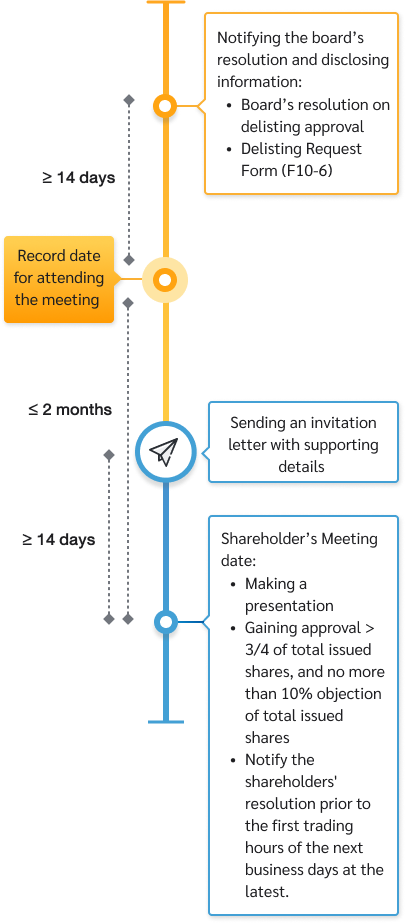

The listed company has to notify SET, via SETLink, about the Board of Director’s resolution regarding the delisting within the day the board has made the resolution, or prior to the first trading hours of the following business day at the latest. The following are required content:

- Delisting Request Form (F10-6):

- Type of securities

- Hosting of the shareholders’ meeting to seek approval on delisting, with the record date mentioned for attending the meeting

- Reasons and facts about the delisting of securities

- Names of the buyers or buyer group(s), as well as their relationships with the company

- Tender offer prices (by each type of securities)

- Name of the independent financial advisor who will provide consulting service and give advice to the shareholders

- Highest price that the purchaser has purchased in 90 days prior to the tender offer.

- Five-day weighted average market price prior to the day the board has reached the resolution to delist the securities, or the day the shareholders reached the resolution, whichever happens first.

- Net asset value of the company, calculated from its adjusted book value to reflected latest market prices of the company’s assets and liabilities, and

- Fair value of the company’s shares assessed by the financial advisor.

- Highest price that the purchaser has purchased in 90 days prior to the tender offer.

Sending the meeting notice to shareholders

Sending the meeting notice to shareholders

- Sending an invitation letter to the shareholders 14 days in advance before the meeting date, containing the following minimum information:

- Facts and reasons concerning the request for delisting shares

- Opinion of the independent directors

- Opinion of the independent financial advisor

- The offered price to purchase shares and convertible securities (if any)

- Updated company’s information in the Form of 56-1 One Report

- Facts and reasons concerning the request for delisting shares

- Disclosing opinions of the independent financial advisor and independent directors via SETLink

Shareholders’ meeting

Shareholders’ meeting

- The independent financial advisor has to make a presentation at the shareholders’ meeting to share their suggestions toward the delisting and tender offer.

- Approval must be given at the shareholders’ meeting with no less than three-fourths of the total issued shares of the listed company, and also no more than 10% objection of the total issued shares.

- In the case of the shareholding restructure of listed company by establishing a new company which is a holding company and issues new shares to swap with the existing shares of the listed company’s shares at the ratio of 1:1 ,and the holding company will be listed in the Exchange instead of the existing listed company. For this case, the resolution of shareholder’s meeting shall be approved by not less than three-fourths of total votes of the shareholders who are present at the meeting and have the rights to vote.

Notification of the meeting’s resolution and filing the delisting request

Notification of the meeting’s resolution and filing the delisting request

- Within the same day as the shareholders’ meeting, or prior to the first trading hours of the following business day at the latest, via SETLink

- The company submits its delisting request form (F10-7) to SET after gaining shareholders’ approval via SETLink

- SET will consider its delisting request and will notify the result within 30 days upon receiving complete and correct information

Launching the tender offer

Launching the tender offer

- The company arranges a complete tender offer as required by the Securities and Exchange Commission (SEC) with the following details:

- Giving a maximum tender period of 45 business days

- Providing opinion from the independent financial advisor who is also acting as the shareholders’ advisor concerning the tender offer prescribed in the Form 250-2, then sending documents to shareholders within 15 days from the tender offering date.

- Submitting primary tender offer report form 247-6-Khor within 21 business days from the tender offering date.

- Giving a maximum tender period of 45 business days

- The company shall disclose its tender offer information (Form 247-4, Form 250-2, Form 247-6-Khor) via SETLink at the latest on the date it receives information from the purchaser.

Delisting of securities

Delisting of securities

After tender offer has been completed:- Submit the Tender Offer Report Form (Form 256-2), via SETLink, within five business days from when the tender offer finished.

- SET will order and determine an effective date for delisting.

Related Regulations

|

|

Forms

This is not yet the shareholders’ approval as per SET rules. For voluntary delisting, both the company and shareholders must have their voluntary agreement about the decision. Thus, the company must gain votes to delist, no less than three-fourths of paid-up capital, and no more than 10% of paid-up capital in objection. Then, the company will be eligible to delist.

For this case, the resolution of shareholder’s meeting shall be approved by not less than three-fourths of total votes of the shareholders who are present at the meeting and have the rights to vote.