Consideration criteria for elimination of the delisting grounds

Consideration criteria for elimination of the delisting grounds

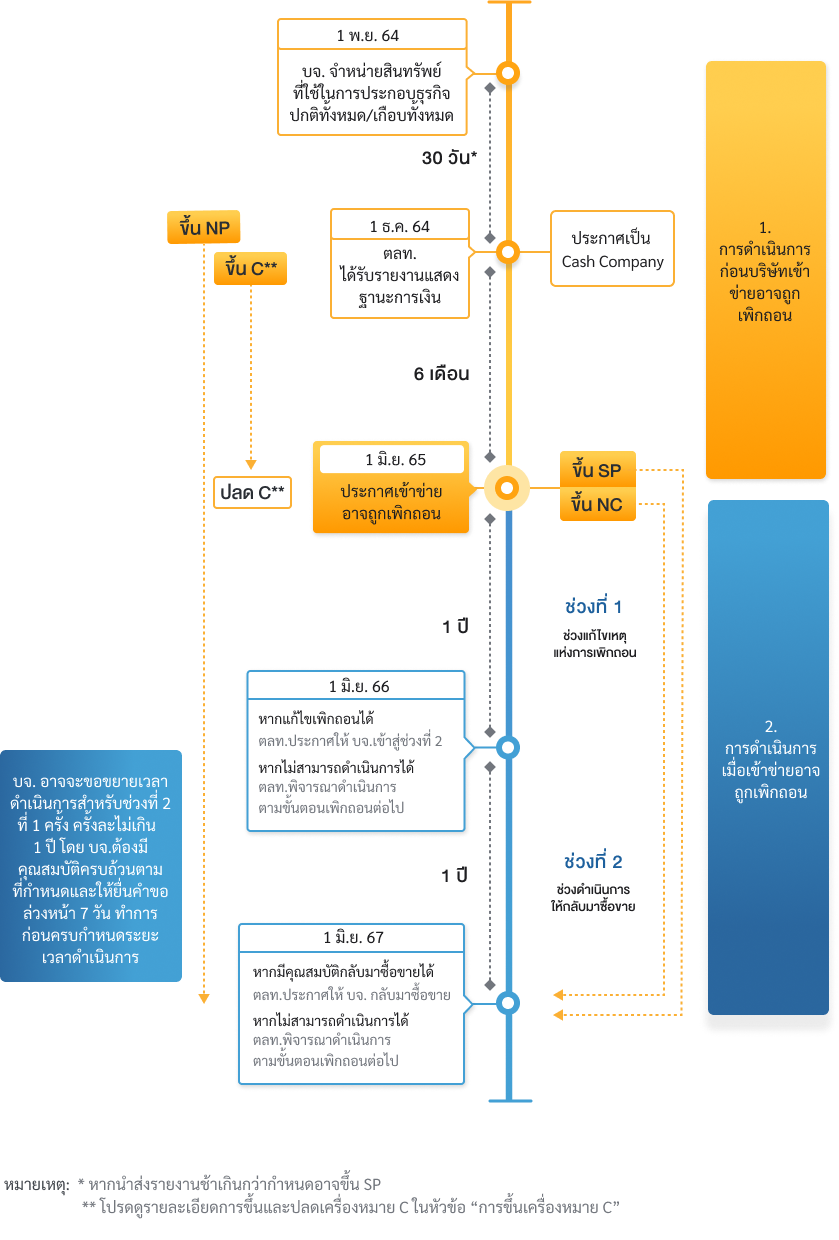

When the listed company and/or its subsidiary has disposed all or most of the assets used in the ordinary course of its business, thereby causing the listed company and/or its subsidiary to have all or most of assets in form of cash or short-term securities (Cash Company) for more than 6 months from the date the SET has received the audited statement of financial position after the disposition of all or most of the assets of listed company and/or subsidiary. (The statement of financial position*)

*The company have to submit a financial position report within 30 days from the date of asset disposal. during that, The SET may suspend trading of the company’s securities as post SP (Suspension) sign by SET Regulation: Rules, conditions and procedures for temporary suspension of securities trading until the company has reported complete and clear information as required by the SET.

Action steps before the company may be delisted

Action steps before the company may be delisted

The listed company have to cease the Cash Company status within 6 months from the date the Exchange has received the statement of financial position. Nevertheless, after the listed company submits the statement of financial position to the SET, the SET will announce that the company is a Cash Company and take measures against listed companies in accordance with the regulations of the Stock Exchange regarding measures to be taken in cases where listed companies have events that may affect their financial status and business operations. Along with posting the CC (Non-Compliance) sign on the registered securities.

Note :

- The CC sign will be maintained until the listed company is able to amend its status as a Cash Company or when the Stock Exchange announces that the listed company's common shares may be delisted from being listed securities.

- When the company has a business that is qualified for registration. Submit a request to the Stock Exchange to consider accepting new securities according to the securities acceptance criteria.

Actions step when the listed company facing possible delisting

Actions step when the listed company facing possible delisting

To provide the company with clear guidelines for the elimination of the grounds for the possible delisting and encourage business rehabilitation.

The SET has set the process in 2 periods as the following actions:

1) Period for the elimination of the grounds for delisting – one year since the SET announce that its securities may potentially be delisted

The SET shall post NC (Non-Compliance) sign to inform investors that the securities may potentially be delisted, and SP (Suspension) sign to prohibit trading of securities until the company can eliminate the grounds for delisting and repossess the qualifications in order to resume normal trading:

- If the company is able to have a main business that will continue to operate the business clearly within one year from the date of announcement that its securities may potentially be delisted, the company shall submit written notice to the SET to clarify that it has eliminated the grounds for delisting. On this basis, the SET shall announce that its securities have entered the period for the repossession of qualifications in order to resume trading.

As apparently there is a main business to be operated on a continuous basis taking into account which the SET will consider the following factors: commercial revenue, assets used in the operation of the main business, license/concessions required to operate such business, etc. or any other factors indicating that the listed company clarify has a core business that will continue to operate the business

- If the listed company is unable to eliminate the grounds for delisting within one year from the date of NC sign posting, the SET shall consider an order to delist the securities, and may allow 7 days for trading before the delisting date, with NC sign remain posted and purchased via cash balance account.

2) Period for the repossession of qualifications in order to resume trading one year since the SET announces that the company has entered into the 2nd period.

The SET shall give the listed company time to take actions to repossess qualifications in order to resume trading within one year from the end of the elimination of grounds for delisting period, or from date the SET has received correct and complete written notice from the listed indicating that it has taken actions to eliminate the delisting grounds, whichever is the earlier:

- If the listed company is able to repossess the qualifications in order to resume trading within one year as per the schedule, the listed company can submit request to have its securities re-listed with the SET pursuant to the SET regulations

- If the listed company is unable to repossess the qualifications in order to resume trading within one year as per the schedule, the SET shall consider an order to delist the securities, and may allow 7 days for trading before the delisting date, with NC sign remain posted.

Request for the extension to rehabilitation

Request for the extension to rehabilitation

The listed company can submit the request for the extension to resume trading once, and not exceed one year. The listed company shall submit the request for extension 7 business days in advance prior to the due date, together with the notice clarifying and providing supporting reasons or information, which shows that the listed company possess all of the following qualifications:

- There is shareholder equity. (after adjusting the auditor's opinion) or having net profit from operations from the main business for 1 year. It will consider the annual financial statements or the most recent 4 quarter financial statements that have been audited or reviewed. (as the case may be) as specified in the securities acceptance criteria, effective January 1, 2025. As required to have shareholder equity of not less than 100 million baht or net profit of not less than 25 million baht.

- There is a procedure to eliminate the grounds for delisting, clear progress, and clear adherence to such plan; and

- Other qualifications i.e. management and controlling parties do not possess the prohibited characteristics pursuant to the SEC notification and compliance with SET’s disclosure rules e.g. submitting complete financial statements within the due date.

Consideration criteria for the repossession of qualifications in order to resume trading

Consideration criteria for the repossession of qualifications in order to resume trading

The listed company can submit the request for the SET to consider allowing the listed company to resume trading as normal provided that the listed company possess all the qualifications pursuant to the SET Regulation on Listing of Ordinary Shares or Preferred Shares as Listed Securities on SET or the mai (whichever the case). In regards to the minority shareholder distribution, the listed company shall comply with the regulation on maintain the listing company status. A listed company must have no less than 150 minority shareholders, who collectively hold no less than 15% of the company’s paid-up capital.

Actions for listed companies to resume trading

Actions for listed companies to resume trading

Submit an application to the Stock Exchange not less than 7 business days before the due date of the processing period in period 2.

The Stock Exchange may send the request along with various information. to the Office of the Securities and Exchange Commission (SEC) for consideration as well. The listed company must submit information for consideration as additionally requested by the Stock Exchange and/or the SEC Office.

Announcement of the trading resumption

Announcement of the trading resumption

The SET shall disseminate information on the resumption of trading 7 business days in advance before the securities of the listed company commence trading. In this regard, listed companies must organize meetings to present and explain information about the business and operating results of the listed company to shareholders, investors, and related persons. According to the guidelines set by the Stock Exchange, at least 1 time within 1 year from the date of the announcement that common shares of listed companies will resume trading on the Stock Exchange.

Delist

Delist

Delist: If the company is unable to resolve all the reasons for delisting or are not qualified to return to trading within the specified period The Stock Exchange will consider ordering the delisting and will allow trading of securities 7 business days before delisting while maintaining the NC symbol and allowing purchases with a Cash Balance account.

For the company which is subject to possible delisting since November 1, 2021

For the company which is subject to possible delisting before November 1, 2021

Related Regulations

|

|

If the listed company is unable to solve the Cash Company status with 6 months from the date the SET receives the financial position report, which has been reviewed by the auditor, after the disposition of all or most of the assets of listed company and/or subsidiary, the SET shall announce its securities may potentially be delisted and post NC (Non-Compliance) and SP (Suspension) sign to suspend trading of securities until the listed company can eliminate the grounds for delisting, and repossess qualifications in order to resume normal trading.

The listed company can submit the request to be considered re-listing its securities pursuant to the SET’s Regulation on Listing of Ordinary Shares or Preferred Shares as Listed Securities on mai. After the SET has approved the company’s qualifications, its securities will resume trading on mai.