In the event of the delisting due to the failed to submit the financial statements before November 1, 2021, the listed company has the periods in each period as follows: Stage 1, the period of amend the grounds for delisting, has a period of 1 year, and stage 2, the period to resume trading, has a period of 1 year. The company can request for an extension of time in the stage 2 only 1 time, not more than 1 year. The revised summary of the revised guidelines is based on the information underlined. and the part of the criteria according to the information that is cross as follows;

| Reason for delisting | Conditions and period for improving the qualifications of listed companies | |

| Stage 1 Period for the elimination of the grounds for delisting | Stage 2 Period for the repossession of qualifications in order to resume trading | |

Failure to submit financial statements / late submission of financial statements / incorrect financial statements more than 6 months in each period, only the first period that is delayed more than 6 months | Submit financial statements for the period in which the reason for revocation occurs that is delayed more than 6 months can get all installments The auditor must not express an opinion that the financial statements are incorrect within 1 year within 2 years. | Submit all late financial statements and submit the financial statements within the specified time for 2 consecutive periods within 1 year (may request an extension of 1 year) The auditor's report must not be of any of the following characteristics: (1) There are conditions related to the case of defects in the internal control system. or accounting system incomplete or the financial statements do not conform to the financial reporting standards accepted by the SEC Office (2) Not expressing an opinion on the financial statements or expressing a conditional opinion in the event that the scope of the audit is restricted by the actions or non-actions of the Company or its directors or executives. (3) express an opinion that the financial statements are incorrect |

| Subject | Detail | |||||||||||

| Consideration criteria for possible delisting |

2. Considering from the submission of the financial statements that the auditor has expressed an adverse opinion, which means the financial statements are inaccurate, and the financial statements has not been revised for more than 6 months. | |||||||||||

| Procedures for action upon the possible delisting of ordinary shares of the listed company | In the case that the company does not submit financial statements / submit financial statements that the auditor has commented that the financial statements are inaccurate In the case of the SEC to amend the financial statements

| |||||||||||

| Action taken when the listed company faces possible delisting | In order for the company to have a clear solution and encourage it to expedite the action to resume trading as usual. The stock exchange will proceed as follows: 1) Period for the elimination of the grounds for delisting – There is a period of 2 years from the date the securities are announced as potentially subject to delisting.

| |||||||||||

| Consideration criteria for the repossession of qualifications in order to resume trading |

| |||||||||||

| Actions for listed companies to resume trading | 1. Submit an application to the Stock Exchange no less than 7 business days before the due date of the processing period in Phase 2. 2. Have a financial advisor co-create the request. The Stock Exchange may send the request along with various information. to the Office of the Securities and Exchange Commission (SEC) for consideration as well. The listed company must submit information for consideration as additionally requested by the Stock Exchange and/or the SEC Office. | |||||||||||

| Announcement of the resumption of trading | The SET shall disseminate information on the resumption of trading 7 business days on advance before the securities of the listed company commence trading. |

Remark * For details on how to post and remove the C sign, plwase see the section "C sign Posting"

Remark : The securities with SP sign posted for 3 months, the trading will be allowed for 1 month with NC sign posted and can be purchased with Cash Balance account only.

|

|

|

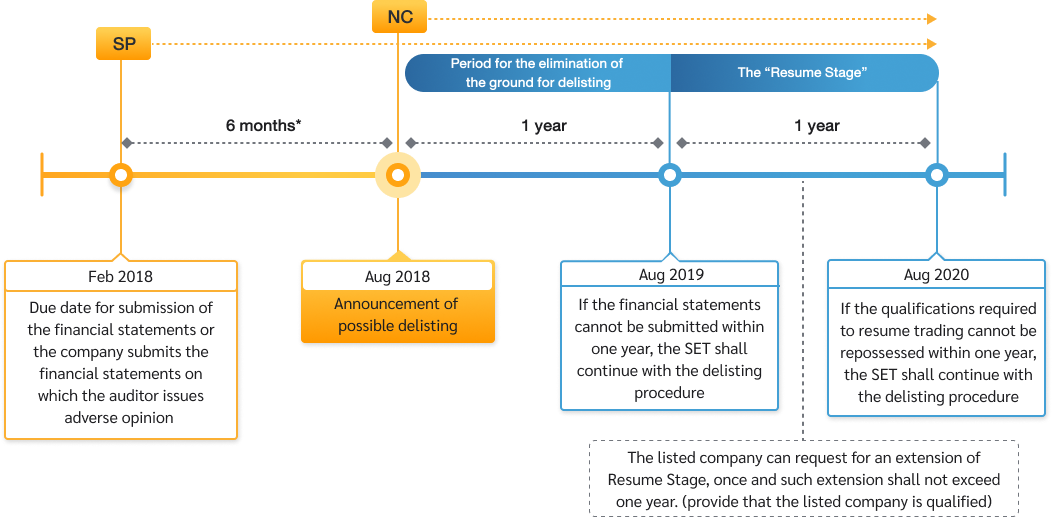

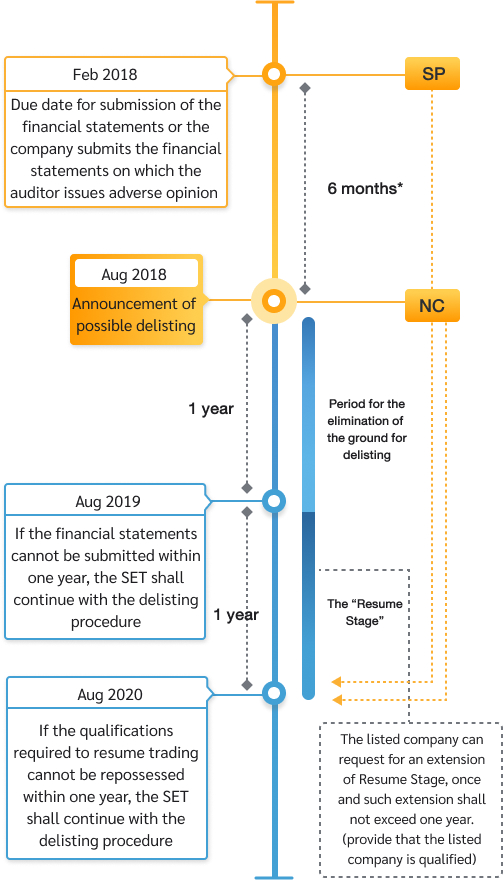

The SET will announce that the securities of listed company may potentially be delisted, and post NC (Non-Compliance) sign, from the date the financial statements submission has been overdue for 6 months until the listed company can submit the financial statements and take actions to repossess the qualifications in order to resume trading. In addition, SET will post an SP (suspension) sign in order to suspend trading. The securities with SP sign posted for 3 months, the trading will be allowed for 1 month with NC sign posted and can be purchased with Cash Balance account only.

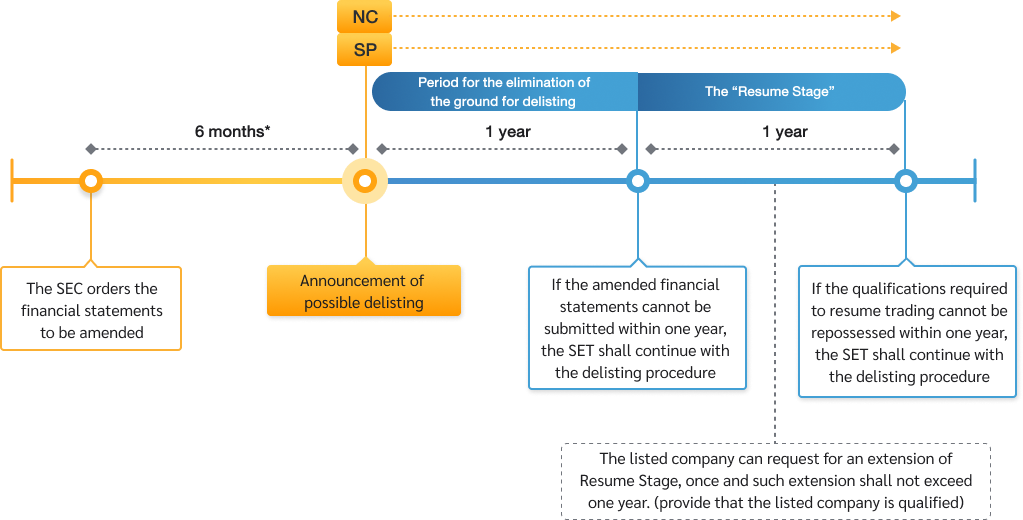

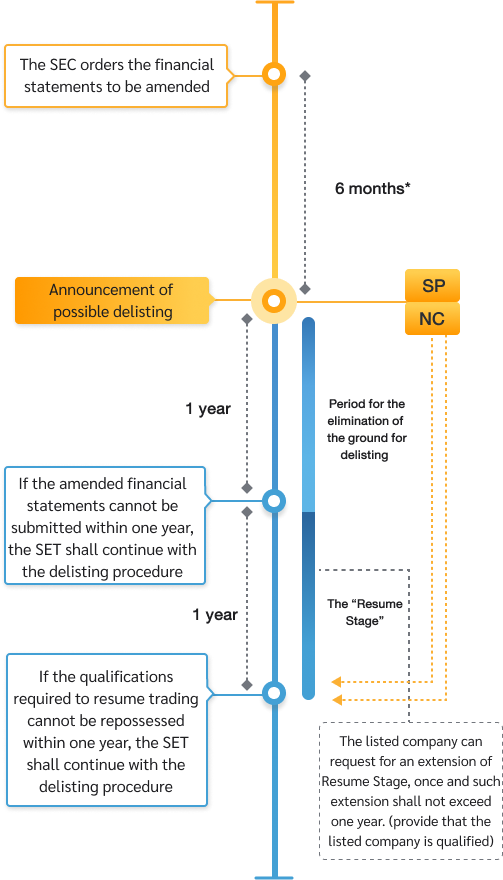

The SET will announce that the securities of listed company may potentially be delisted, and post NC (Non-Compliance) and SP (Suspension) signs to suspend trading, from the due date after the SEC had ordered the amendment of the financial statements for six months. NC sign remains posted until the listed company can submit the revised financial statements and take actions to repossess the qualifications in order to resume trading.