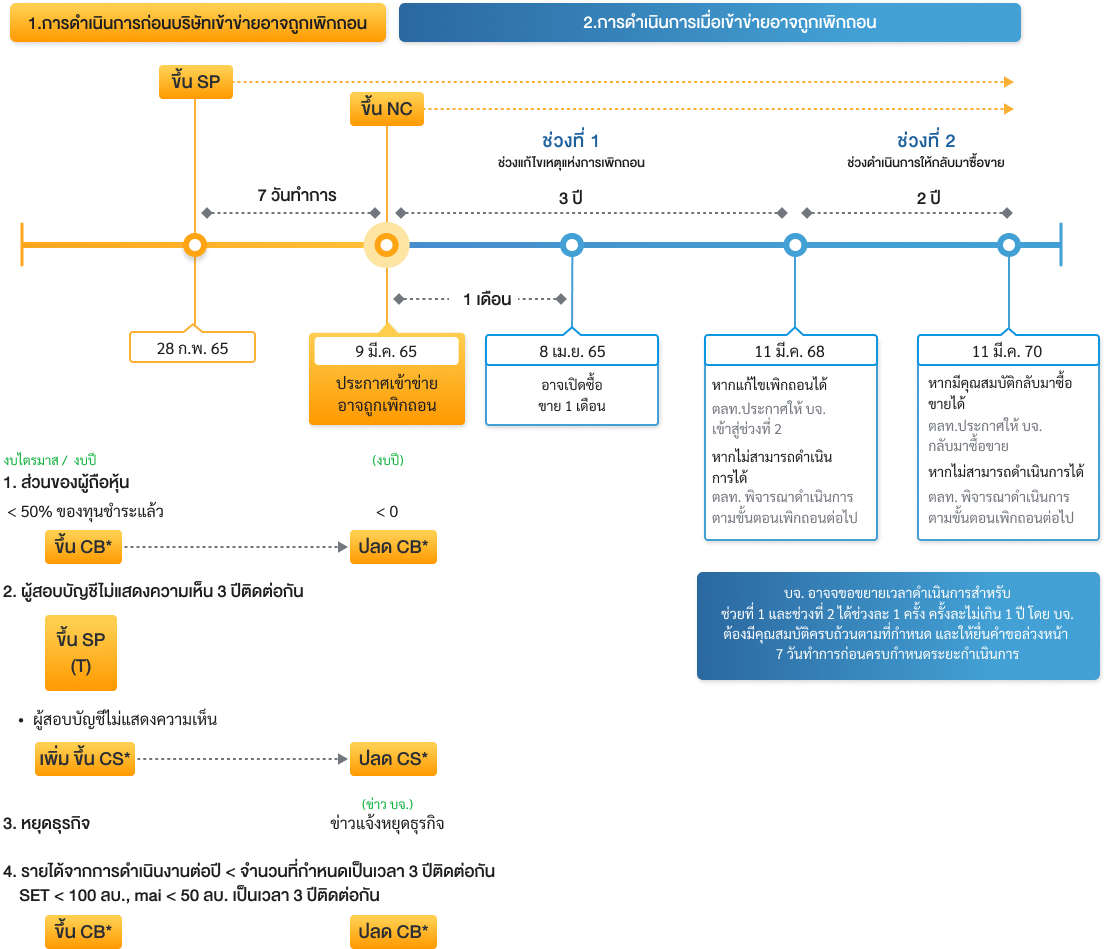

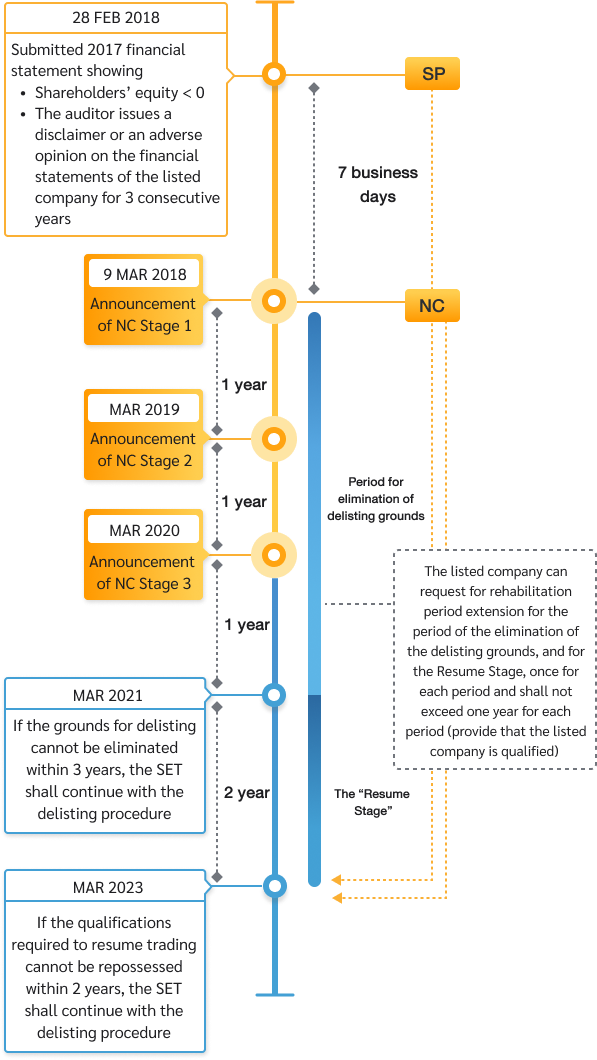

In the case that the listed company has operations or financial status that may be subject to delisting. Before November 1, 2021, The SET will announce that it may be delisted in stage 1 with a sign Non-compliance (NC) in 3 stages. Each term has a period of 1 year: NC stage 1, NC stage 2, and NC stage 3. The revised guidelines are summarized in accordance with the information underlined and part of the previousl criteria according to the information that is ticked out as follows.

| Ground for Delisting | Conditions and period for improving the qualifications of listed companies | |

| Stage 1 Period for the elimination of the grounds for delisting | Stage 2 Period for the repossession of qualifications in order to resume trading | |

Financial position

| Resolve the grounds for possible delisting within 3 years (may request an extension of 1 year) For example, in the case of Equity < 0, actions have been taken so that Equity is not less than 0, etc. pursuant to each of the grounds for delisting announced as follows:

During the Company is in stage 1 the SET will announce the list of listed companies in 3 periods of 1 year each, namely NC stage 1, NC stage 2 and NC stage 3. (*Considered from annual financial statements or annual consolidated financial statements audited by auditors) | Qualifications are as follows within 2 years (may request an extension of 1 year)

|

Qualifications for requesting an extension of time It must have all of the following :

There are directors, executives, and controlling persons who do not have any prohibited characteristics under the SEC criteria and complete information disclosure. *Consider the annual budget or the latest 4 quarter budget that has been audited or reviewed by an auditor. (depending on the case) | ||

| Subject | Details |

| Consideration criteria for the grounds of delisting | Operation performance or financial conditions of the listed company falls within any of these following cases:

Consideration criteria in the event that the shareholders’ equity is lower than zero:

|

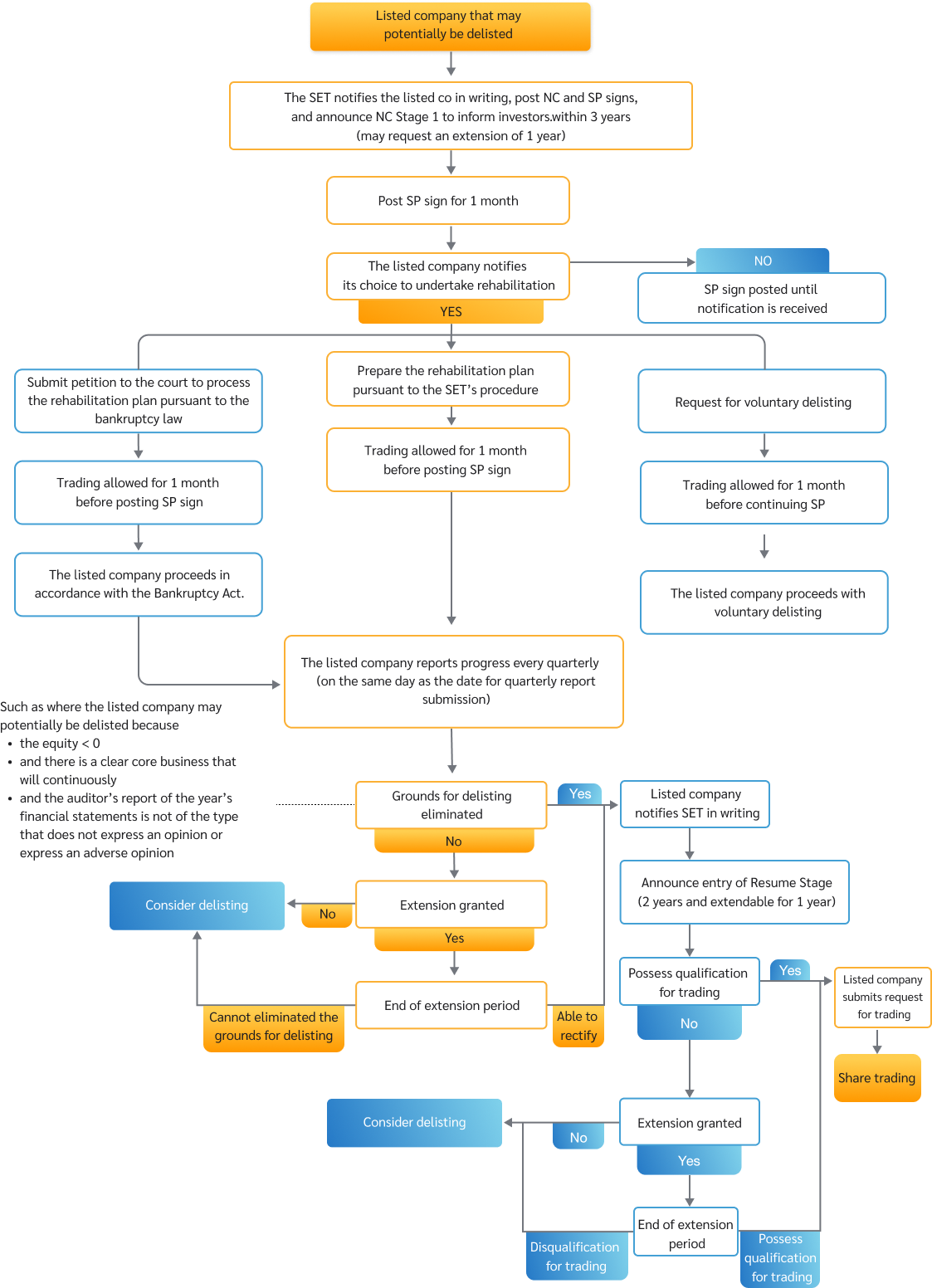

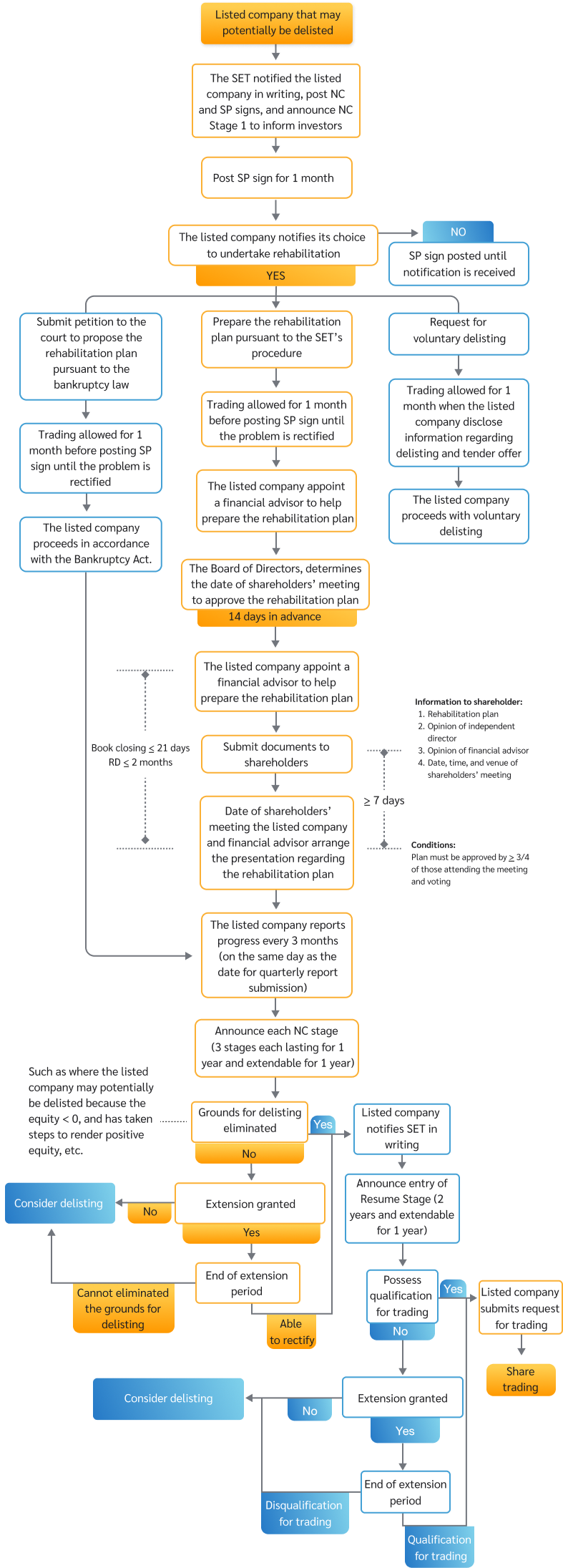

| Procedures for action upon the possible delisting of ordinary shares of the listed company | To warn investors to be cautious in their investment, SET will consider information from financial statements that have been audited or reviewed by auditors and proceed as follows;

|

| Posting a sign when the company may be possible delisting | To encourage the listed company to have a clear plan and urgently process a rehabilitation, SET shall take the following actions:

If the company is qualified to resume trading within the specified period, the company can submit a written notice to the SET to consider removing NC and SP signs in order to resume trading. Rehabilitation period is divided into two parts as the following: 1) Period for the elimination of the grounds for delisting

2) Period for the repossession of qualifications in order to resume trading (Stage 2) is within 2 years from the date that the SET announced the securities move to stage 2 .

|

| Rehabilitation period extension | The listed company can request for rehabilitation period extension for Stage 1 - Period for the elimination of the grounds for delisting; and Stage 2 - once for each period and such extension shall not exceed 1 year. The request shall be submitted 7 business days in advance before the end of NC period, with explanations and supporting information to show that the listed company possess all qualifications as follows.

|

| Consideration on the repossession of qualifications in order to resume trading | The listed company shall possess all qualifications. and must continue to exist until the date the Stock Exchange allows listed securities of listed companies to resume trading on the Stock Exchange as follows

The SET may also prescribe conditions for the listed company to take additional actions as follows:

|

| Silent Period in case the Company is Qualified Resume Trading | The listed company’s strategic shareholders are prohibited to sell their shares amounting to 55% of the paid-up capital:

Every six months after the date of trading commencement, the shareholders under the silent period can sell 25% of all the securities prohibited from being traded. |

| Actions for listed companies to resume trading |

|

| Announcement of Trading Resumption | The SET shall disseminate information about the resumption of trading 7 business days in advance before the listed company’s securities commence trading. In this regard, listed companies must organize meetings to present and explain information about the business and operating results of the listed company to shareholders, investors, and related persons. According to the guidelines set by the Stock Exchange, at least 1 time within 1 year from the date of the announcement that common shares of listed companies will resume trading on the Stock Exchange. |

| Delisting | If the company is unable to resolve all the grounds for delisting or does not have the qualifications to return to trading within the specified time. SET will consider delisting which will be open for trading 7 business days before the delisting and still post the NC sign and trading with a Cash Balance account. |

Note : *For details on how to post and remove the C sign, please see the section “C Sign Posting”

(For the company which is subject to possible delisting since November 1, 2021)

used in the operation has significantly decreased:

Remarks:

When the SET announces the listed company is under NC stage 1, the listed company will have 1 month to consider its choice to undertake rehabilitation. After the company has informed the SET of the rehabilitation plan, its securities will be allowed to trade for 1 month by purchasing with Cash Balance account only (with NC sign posted). After that, SP sign will be posted until the company can make improvement and repossess qualifications to resume trading. The listed company will be required to report about the progress of rehabilitation every 3 months or on the date the quarterly financial statement is due for submission.

(For the company which is subject to possible delisting before November 1, 2021)

|

|

|

Only the shareholders’ equity of the listed company will be considered, not including the non-controlling interests’ equity in the subsidiary.

The shareholders’ equity in the consolidated financial statements will be considered. If it shows a negative equity, the company may face possible delisting.

This will not be the case where the auditor issues a disclaimer opinion on the financial statements for 3 consecutive years.

However, if the SEC orders the listed company to amend its financial statements afterwards and the auditor switches from issuing a qualified opinion to a disclaimer opinion, then it will be the case where the auditor issues a disclaimer opinion on the financial statements for 3 consecutive years, resulting in possible delisting.

- Submit the financial report for the first six months of an accounting year (reviewed version by the auditor is not required), along with the Interim Management Discussion and Analysis, instead of the quarterly financial statements. These shall be submitted within 45 days from the last day of the first 6-month period of that accounting year; or

- Submit the audited annual financial statements within 3 months from the last day of that accounting period.

When the listed company does not submit quarterly financial statements, the company still has to report the progress of rehabilitation every 3 months.

When the listed company submits a request to resume trading during the period of quarterly financial statements submission, the company has to submit financial statements for that quarter as well. For example, if the company’s accounting period ends on 31 December and the request is submitted in September, the company will have to submit the 6-month financial report which shows net profit from operation.

In case the listed company’s performance or financial conditions fall within any criteria for possible delisting (negative equity / the auditor issues a disclaimer opinion on the financial statement for 3 consecutive years / assets used in operation have significantly lessened / the business ceases all or most of its operations/ Operating income in the cumulative period or latest year SET > 100 million baht mai > 50 million baht), the consideration for repossession of qualifications to resume trading will not be different.

In case the listed company’s performance or financial conditions fall within any criteria for possible delisting (negative equity / the auditor issues a disclaimer opinion on the financial statement for 3 consecutive years / assets used in operation have significantly decreased / business operation is halted entirely or almost entirely), the consideration criteria for resume trading will not be different.

1. The shareholders’ equity that appears on the financial statements is negative; or

2. The shareholders’ equity that appears on the financial statements is positive, but the auditor has issued a qualified opinion, or a disclaimer opinion on the financial statements. If the financial statements are to be adjusted in accordance with the auditor’s opinion, the shareholders’ equity will be reduced to negative.