Derivatives Clearing Services

Thailand Clearing House Company Limited

Thailand Clearing House Company Limited

Derivatives Clearing Services

| Licensed to undertake the business of a derivatives agent in accordance with the rules prescribed by the SEC or the Capital Market Supervisory Board | |

| Be a member of the TFEX More information | |

| Have a Risk Management Officer who is not the same person as the investor contact or Authorized trader | |

| Have an effective risk management policy |

| Have shareholders’ equity of not less than THB100 million | |

| Maintain the Net Capital Rule and/or the BIS Ratio or Capital Adequacy Ratio required by the SEC More information | |

| Have a system to check and control the derivatives position of the member’s account and the account of the member’s client | |

| Have a system to check and control the deposit of margins |

| Item | Fee |

| Admission fee |

|

| Annual fee | THB300,000 |

| Other fees and expenses in relation to TCH clearing services | Click here for more details |

Membership Admission Process

| An applicant files a membership application together with supporting documents and evidence | |

| TCH considers the application | |

| The applicant attends TCH work system training and test | |

| TCH notifies the applicant of the result of its consideration | |

| TCH notifies the applicant of the commencement date of its membership (once the applicant has fully complied with the criteria and has all qualifications required) | |

| The applicant who is granted approval to become a member shall submit the documents and evidence in accordance with the criteria prescribed by TCH, pay an admission fee, place the Securities Deposit and contribute to the Clearing Fund as specified by TCH | |

| The applicant commences operation as a member |

TCH Derivatives Members

Related rules and regulations

Clearing and Settlement Procedure

Derivatives Market

TCH will become a counterparty (Central Counterparty: CCP) as soon as trading orders on TFEX are matched in the trading system, and will guarantee the clearing and settlement of all transactions on the Exchange.

The novation process with the TCH member will be terminated when the member closes out the contract, the contract expires, the final cash settlement is completed, or TCH matches Derivatives for Delivery (Physical delivery)

Account Opening

TCH requires a clearing member to keep its position account and the margin account separate from its clients.

A member must open a position account according to the type of clients and use collateral calculation methods prescribed by TCH.

| If a client is an end beneficial owner, the member must open a Net Position Account for the client and use Net Margining as a method of margin calculation. |

| If a client is not an end beneficial owner or has an Omnibus Account, the member must open a Gross Position Account for the client and use Gross Margining as a method of margin calculation. |

If the member is unable to verify that the client is the end-beneficial owner, it shall be deemed that the client is the owner of an Omnibus Account.

Assets for Derivatives Settlement

TCH will record transactions from the TFEX trading system as soon as they are matched, process all derivatives contract obligations, both for cash settlements and physical deliveries, and require the members to make the payment using the assets listed below :

| Types of Margins or Obligations | Types of Assets |

| Maintenance margin or Additional Margin | Cash or other types of collateral as specified by TCH such as securities, government bonds or Bank of Thailand bonds |

| Mark-to-Market | Cash only |

| Option Premium Amount | Cash only |

| Exercise / Assign Amount | Cash only |

Margin Calculation

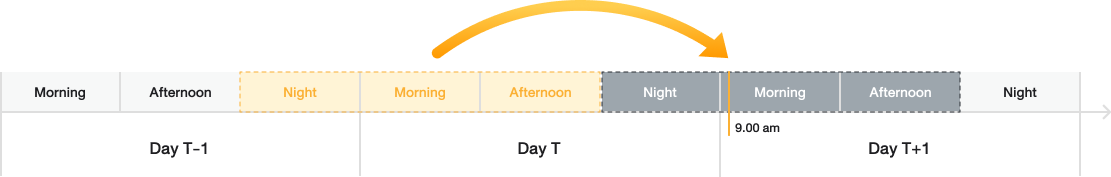

TCH will calculate the margin requirement and obligations for the outstanding positions on a daily basis in accordance with the TCH’s prescribe. That is, at the end of the day, TCH will process the previous business day's outstanding positions, the previous day's night trading transactions (Night session of T - 1), and the current business day's trading transactions (day sessions i.e. morning and afternoon sessions of Day T).

After receiving the TCH reports on the margin value and obligations, TCH members must clear and settle all traded contracts on the next business day (T+1).

When market conditions or derivative prices are unusually volatile, TCH may require clearing members to deposit intra-day margin, which is currently calculated on an hourly basis. Members must place their intra-day margins within two hours of being notified by TCH. However, the intra-day margin settlement time is according to the operating schedule of TCH.

Settlement Methods

Derivative settlements can be done through cash settlement and physical delivery.

| Cash Settlement |

For the purpose of carrying out a clearing, the member shall maintain a full and correct amount of funds in its deposit account with a commercial bank acting as a clearing agent as designated by TCH (Settlement Bank) in accordance with the clearing report of TCH and within the time prescribed by TCH.

| Physical Delivery |

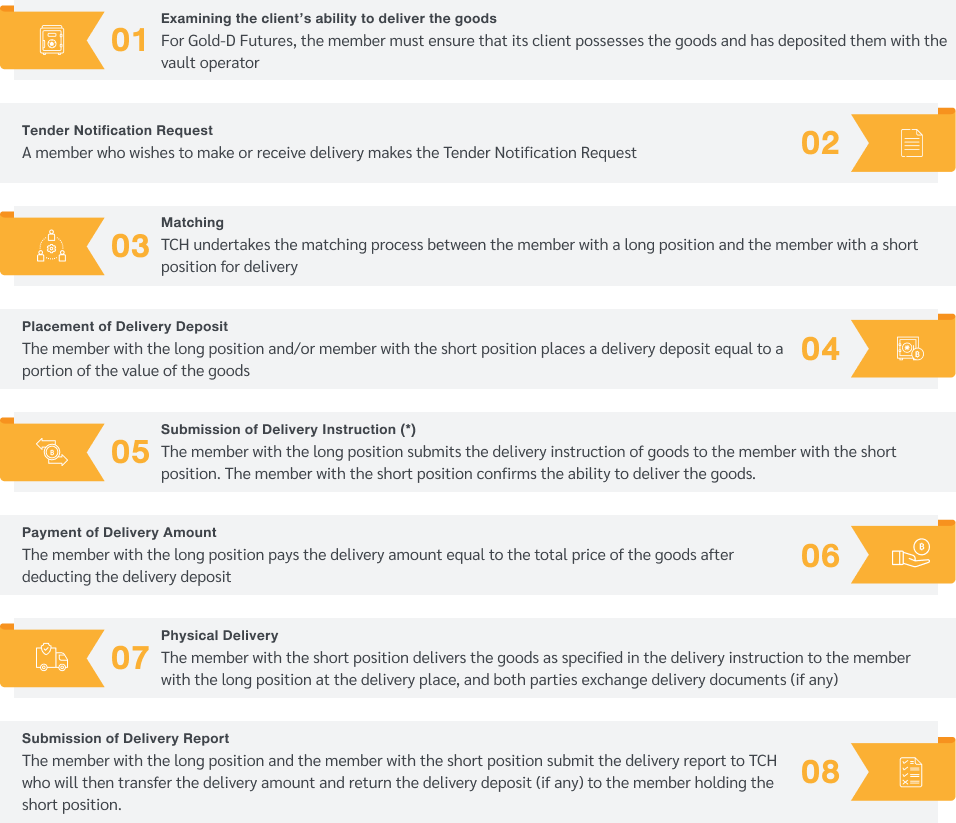

Delivery Process

Note: * The matched counterparty members can choose to use Alternative Delivery Procedures (ADP).

Inspection of Quality of Goods

If the receiving party wishes to inspect the quality of the goods, the party may contact a surveyor on the TCH name list to inspect the quality and weight of the goods. The delivery party is responsible for the payment of quality inspection fees, as well as compensation and other expenses if the quality does not conform to what is specified in the Contract Specification.

Default of Delivery

Members are deemed to be in delivery default when they fail to submit delivery instructions, place the delivery deposit in whole or in part, make delivery in whole or in part, or when the quality of the goods does not conform to the prescription in the contract specification. The non-defaulting member is required to notify TCH within the next business day following the date of default, after which TCH will coordinate with the counterparty member to reach a mutual settlement.

Related rules and regulations

| The operating schedule of TCH | |

| Activity | Timeframe |

| 1. Download Risk Parameter File, Position Ledger / Trade Listing and Others | |

| 1.1 Download Risk Parameter File from SET CLEAR System and SET Portal | |

| 7:00 , 8:10 , 9:10 respectively |

| 10:10 , 11:10 , 12:10 , 13:10 respectively |

| 14:10 , 15:10 , 16:10 , 17:10 respectively |

| 18:05 |

| 18:15 |

| 1.2 Download Position Ledger / Trade Listing File on SET Portal | |

| 12:40 , 17:10 , 17:55 , 19:25 , 03:15 respectively |

| 1.3 Download Margin Requirement และ Fee File on SET Portal | |

| 21:00 |

| 1.4 Inquire Settlement Price on SET CLEAR System | |

| 17:45 (Final Settlment Price of Silver Online Futures at 19:45) |

| 1.5 Inquire Exchange Rate of Foreign Currency | |

| 15:40 |

| 18:15 |

| 2. Margin Requirement Calculation, Settlement and Collateral Placement | |

| 2.1 Margin Requirement Calculation | |

| 19:00 |

| 9:55 , 10:55 , 11:55 , 12:55 respectively |

| 2.2 Settlement | |

| 9:00 |

| 12:00 , 13:00 , 14:00 , 15:00 respectively |

| 2.3 Margin Requirement and Fee on SET CLEAR System | |

| Within 20:00 |

| 3. Collateral Deposit / Withdrawal via SET CLEAR System | |

| 3.1 Cash / Collateral Deposit | |

| 3.1.1 Foreign currency | |

| Within 8:30 |

| Within 11:30 , Within 12:30 , Within น 13:30 , Within 14:30 respectively |

| 3.1.2 Securities and Bond | |

| 7:00 - 19:00 (Transaction cannot be conducted between 13.25 – 14.15 and between 15.10 – 16.15, additionally, member shall conduct the transaction and approve the transaction by 13.25 and by 15.10 on the transaction date. If there is any pending for approval transaction after such time, TCH shall cancel such transaction and the Member can conduct a new transaction within the normal operating hours of TCH.) |

| 3.2 Cash / Collateral Withdrawal | |

| 3.2.1 Cash (Thai Baht and Foreign Currency) | |

| Within 10:00 (Receive 10:30) |

| Within 12:00 (Receive 13:15) |

| 3.2.2 Securities and Bond | |

| 7:00 - 19:00 (Transaction cannot be conducted between 13.25 – 14.15 and between 15.10 – 16.15, additionally, member shall conduct the transaction and approve the transaction by 13.25 and by 15.10 on the transaction date. If there is any pending for approval transaction after such time, TCH shall cancel such transaction and the Member can conduct a new transaction within the normal operating hours of TCH.) |

| 3.2.3 Collateral in relation to Physical Delivery | |

| Within 12:00 (Receive 14:15) |

| 4. Post Trade Transaction via SET CLEAR System | |

| 7.00 - 19.00 For products trade during night session, transcation can be performed futher during 19.30 - 03.00 For Last Trading Day of Gold-D Futures, transaction must be completed within 16:30 |

| 5. Transactions in relation to Options via SET CLEAR System | |

| 5.1 Exercise Notification and Exercise Exclusion | |

| Within 19:00 |

| 5.2 Exercise /Assign Results of Options | |

| Within 20:00 |

| 6. Transaction in relation to Physical Delivery | |

| 6.1 GOLD-D Futures (Gold Bar with a Purity of 99.99%) | |

| 6.1.1 Deposit / Withdrawal of Gold Bar | |

| Within 10:30 |

| Within 11:30 |

| Within 14:00 |

| Within 16:00 |

| 6.1.2 Physical Delivery of gold bar via SET CLEAR System | |

| 16:00 – 16:30 |

| 17:10 |

| Within 19:00 |

| Within 20:00 |

| 6.2 RSS3 / RSS3D Futures (Ribbed Smoked Rubber Sheet Grade 3) | |

| Within 19:00 |

| Within 20:00 |

| 6.3 Settlement in relation to Physical Delivery via SET CLEAR | |

| 11:00 |

| 14:15 |

TCH acts as a central counterparty (CCP) for both buyer and seller members.

TCH acts as

a central counterparty (CCP)

for both buyer and seller members.

As a central counterparty, TCH must bear the risks associated with all trading on the exchange, so it has established a risk management policy and tools to manage risks, prevent potential damages from default, and build confidence among all market participants.

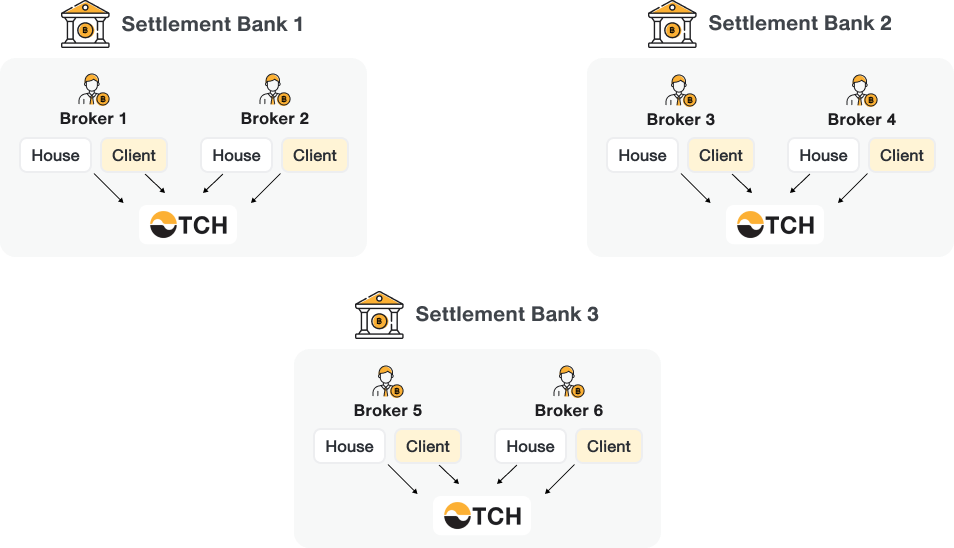

2. TCH will calculate and collect margins without offsetting futures positions in the member's account (House Account) and its client account (Client Account), and must not offset positions between different individual client accounts (Individual Client Account) unless they are for the same client.

3. TCH will collect and record the margin in the margin account and keep a member’s margins separately from those of its clients

4. A member must collect margins from its client not less than the amount it has pledged to TCH

Types of Margins

1. Maintenance Margin

1.1 Maintenance margin for the Derivatives position in Each Contract Month (Maintenance Margin)

Objective:

To cover the maximum loss that may arise from any fluctuations in the price per one contract at the minimum 99% confidence level.

Calculation method:

TCH shall calculate the volatility by using the Exponentially Weighted Moving Average method consistent with the decay factor and shall determine the minimum value of the volatility as prescribed by TCH. In this regard, TCH shall process the data on the change in the prices of Derivatives and/or Underlying for at least the previous 250 business days (Lookback Period).

Margin deposit deadline:

Within TCH's specified timeframe on the business day following the trading day (T+1).

1.2 Spot Month Margin

Objective:

To cover the maximum loss that may arise from any fluctuations in the price of the Derivatives for the period preceding the Spot Month and/or Next Month at the minimum 99% confidence level.

Calculation method:

TCH shall calculate the volatility by using the Exponentially Weighted Moving Average method consistent with the decay factor and shall determine the minimum value of the volatility as prescribed by TCH. In this regard, TCH shall process the data on the change in the prices of Derivatives and/or Underlying for at least the previous 250 business days (Lookback Period).

Margin deposit deadline:

Within TCH's specified timeframe on the business day following the trading day (T+1).

1.3 Inter-month Spread Maintenance Margin

Objective:

To cover the maximum loss that may arise from any fluctuations in the prices of the Derivatives based on the opposite positions of the contracts with different maturity months (Calendar Spread), at the minimum 99% confidence level.

Calculation method:

TCH shall calculate the volatility by using the Exponentially Weighted Moving Average method consistent with the decay factor and shall determine the minimum value of the volatility as prescribed by TCH. In this regard, TCH shall process the data on the change in the prices of Derivatives and/or Underlying for at least the previous 250 business days (Lookback Period).

Margin deposit deadline:

Within TCH's specified timeframe on the business day following the trading day (T+1).

1.4 Inter-commodity Spread Credit

Objective:

To take into account the offsetting risk if the price movements of the underlying commodities or variables are correlated

Calculation method:

TCH shall calculate the Inter-commodity Spread Credit based on the correlation between the price movements of the underlying for the previous 20 business days, 60 business days, 120 business days, or at least 250 business days that are consistent with the Decay Factor prescribed by TCH. The correlation shall be calculated by using the Exponentially Weighted Moving Average method, and such correlation is the lowest calculated, whose direction must be consistent in every time period and must be statistically at least 99% confidence level.

Margin deposit deadline:

Within TCH's specified timeframe on the business day following the trading day (T+1).

2. Variation Margin

Objective:

To adjust the position of margin accounts on a daily basis to reflect actual profits and losses so that losses do not accumulate.

Calculation method:

TCH will calculate the profit or loss from the derivatives position at the end of each business day (Mark to Market) by adjusting the value based on the settlement price.

Margin deposit deadline:

Within TCH's specified timeframe on the business day following the trading day (T+1).

3. Additional Margin

3.1 Super Margin

Objective:

To cover a risk that may arise from fluctuations in the prices of derivatives with foreign underlying when TFEX does not operate for a certain continuous period of time

Calculation method:

The calculation is based on the maximum loss which may arise from the movements of the price of Derivatives of outstanding positions during the period in which TFEX closes its operations due to a special holiday occasion for at least two consecutive business days (excluding Saturday – Sunday)

Margin deposit timeframe:

Within TCH's specified timeframe on the last business day before a special holiday.

3.2 Concentration Margin

Objective:

To cover a risk that may arise from the concentration of outstanding Derivatives positions

Calculation method:

The calculation is based on the value of damage that may arise if the member is unable to fully close such outstanding Derivatives positions within one business day.

Margin deposit timeframe:

Within the time specified by TCH on the business day following the trading day (T+1).

3.3 Uncovered Risk Margin

Objective:

To cover a risk that may arise from the maximum loss of a member whose derivatives positions exceed the stress limit

Calculation method: The calculation is based on the maximum loss of a member whose derivatives positions are, in each circumstance prescribed by TCH, higher than the sum total of the margin of such member and the assets for the security

Margin deposit deadline:

Within TCH's specified timeframe on the business day following the trading day (T+1).

Definition of Default

A member is deemed to be in default of clearing when it fails to make payment or deposit of margin, place the security deposit, pay fees, interests, fines, damages, and other expenses as the member has obligation to settle from clearing with TCH, goes through bankruptcy case or receive court receivership order, or experiences a decline in a financial situation that makes it unable to settle for clearing, or fails to settle from clearing in any other obligations in relation to the derivatives.

Action measures

TCH may take one or more of the following actions in the event of default:

- Request TFEX to suspend trading of the defaulting member temporarily

- Transfer the derivatives position either in whole or in part within the defaulting member’s Client Account to another member with TCH’s approval. In the event the derivatives position cannot be transferred, TCH will undertake action to close out the derivatives position and return to the client the deposits on which there are no longer any obligations.

- Undertake action to close out the derivatives position either in whole or in part within the defaulting Member’s House Account. TCH may use the outstanding derivatives position within the defaulting member’s Client Account to set off against the outstanding derivatives position within such member’s House Account

- Use the defaulting member’s margin and Security Deposit to settle or set off against the outstanding obligations the member owes to TCH

- If the default by the member results from the default of clearing within the Client Account, the member shall notify TCH the name of such defaulting client, the amount of the defaulting derivatives position, and the outstanding derivatives position

- Undertake any other actions as TCH deems appropriate

TCH requires the Security Deposit and the Clearing Fund to cover losses caused by price fluctuations in derivatives that exceed the maintenance margin. The Security Deposit will be used to cover each member's loss (Non-mutual Loss), while the Clearing Fund to which members have contributed will be used to compensate for any damage caused by other members (Mutual Loss).

If a member is unable to complete the settlement for open contracts, TCH will first use the member's margins. If the margin is insufficient to cover all damages, TCH will use the Security Deposit and the Clearing Fund, in which the defaulting member must repay the amount spent, as well as any interest, fines, and damages accrued since the date of use.

A member is required to make an initial contribution to the Security Deposit and the Clearing Fund upon joining, as well as a variable contribution to the Clearing Fund based on the risk it has created and within the time frame specified by TCH.

Concerning the return of benefits derived from the Security Deposit and the Clearing Fund, TCH will return the benefits derived from the Security Deposit to the members but will accrue the benefits of the Clearing Fund and return them to the members when their memberships expire and they have paid all outstanding debts.

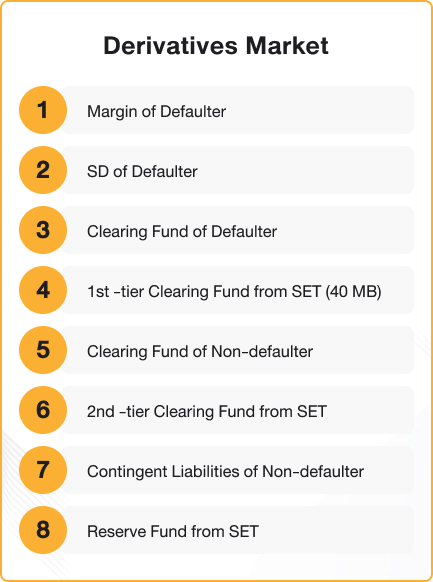

TCH Financial Resources for Derivatives

TCH has prepared financial resources, including the Clearing Fund and the SET Reserve Fund, based on the assessment of the two members with the highest risk exposures to cover losses that may occur during crisis situations or from clearing defaults that exceed the value of the defaulting members’ margins.

An Order of utilization of financial resources (Default Waterfall)

TCH has established the following sequence of financial resources from which it can draw to cover the loss of a defaulting member in derivative transactions or when necessary:

1. Margins placed by the defaulting member

2. Security Deposit placed by the member in default

3. Contributions to the Clearing Fund by the defaulting member

4. Contributions to the Clearing Fund by the SET according to the amount prescribed by TCH (THB40 million)

5. Contributions to the Clearing Fund by other members who are not in default

6. The remaining amount of contributions to the Clearing Fund by the SET after deducting the first part of the contributions of the SET

7. Additional assets in proportion to each member's contribution to the Clearing Fund

8. SET Reserve Fund.jpg)

Related Information

The Thailand Clearing House Co. Ltd.

The Stock Exchange of Thailand Building 93 Ratchadaphisek Road, Din Daeng, Bangkok 10400

Open : Mon - Fri 08:30 - 17:00

Closed : Sat - Sun and according on SET Holidays

Securities

Derivatives

| Member Corner (SET Portal) Equity & Debt Member |  |

| login |

| Member Corner (SET Portal) Equity & Debt Member |  |

| login |