The shares distribution of minority shareholders or free float shares is important for company’s trading liquidity. It helps to facilitate the company’s shareholders and investors in trading securities with flexibility and appropriate price levels. Investing in the company’s shares will thus be attractive. Therefore, the SET has the free float as one of listing requirements as well as maintaining the listing status.

A listed company must have no less than 150 minority shareholders, who collectively hold no less than 15% of the company’s paid-up capital. The SET will consider a report on the distribution of strategic shareholders, which the company prepares from the shareholders list as of book closing date (BC) or the record date (RD) for attending the annual general meeting of shareholders (AGM).

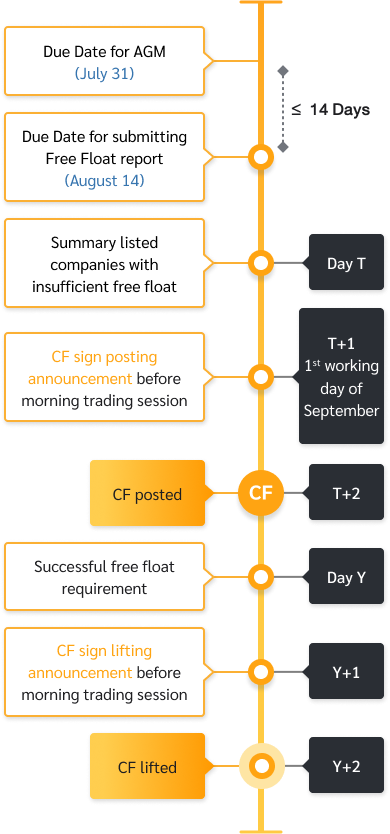

Nevertheless, the SET has laid out measures for listed company which does not meet the free float requirement by posting CF (Caution – Free Float) sign on the company’s securities. Details as mentioned in the topic of what to do when the company does not meet the free float requirement.

Minority shareholders (Free Float) means the shareholders who are not the strategic shareholders playing roles in managing the company.

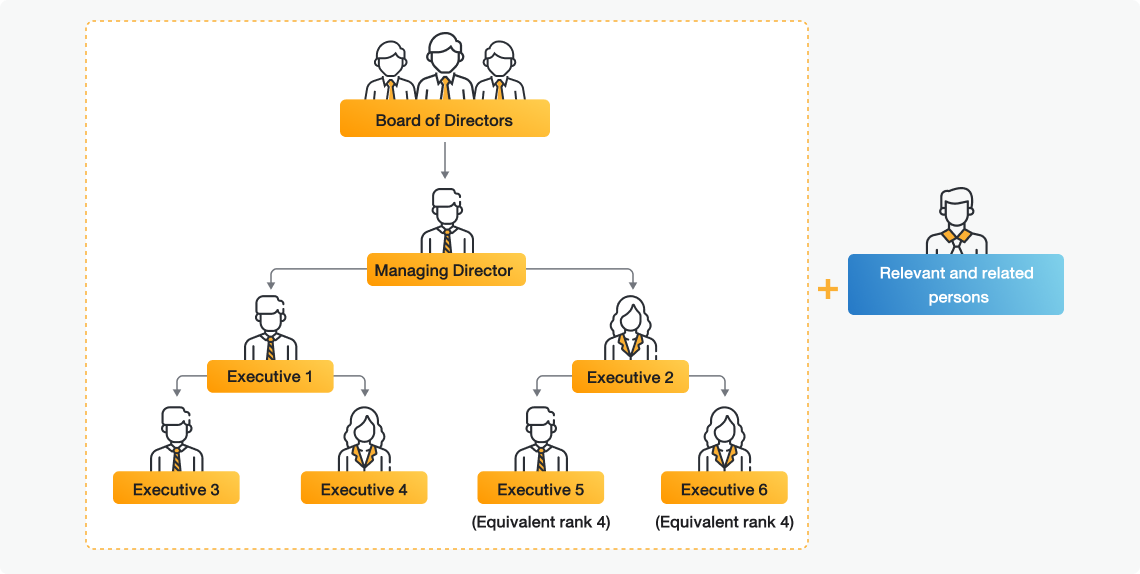

Strategic Shareholders are:

1. Managing director or the first four executives next to the managing director, and every person in the position equivalent to the 4th executive. The shareholding of related persons-parents, spouses, siblings, children and children-in-law – and any juristic persons defined as related under the law also must be included.

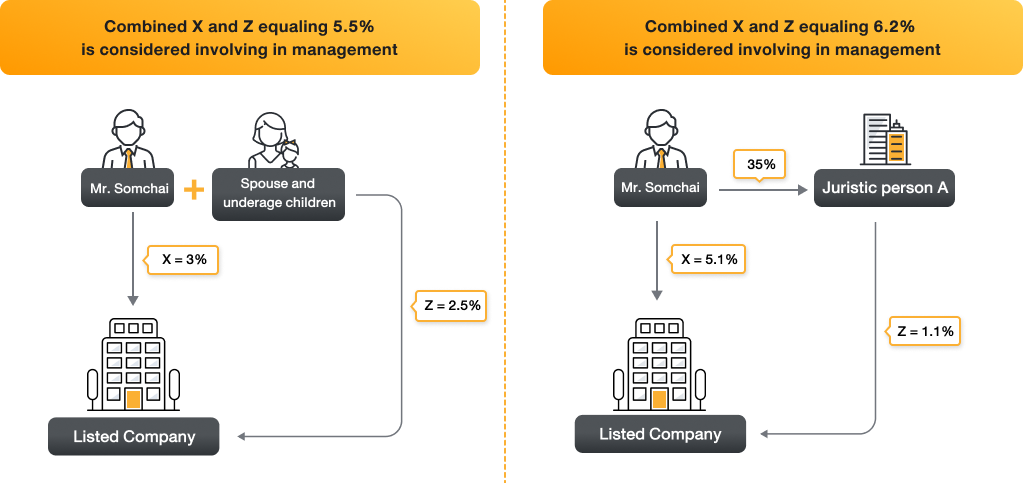

2. Shareholder with more than 5% of paid-up capital The shareholding of persons related to the shareholder must also be included, except the securities companies, insurance companies, life insurance companies, mutual funds, provident funds, social security funds, retirement funds, or other funds approved by relevant law (in case there are representatives of these funds in the board of directors and/or management, it will not be counted as a free float)

3. Controlling person refers to the person having an influence over policy-making, management, or the operation of the company significantly. Regardless of whether such an influence is acquired by shareholding or authorized by contract or any other means, the term includes with one of the following characteristics:- Person with voting right, directly or indirectly, holding more than 25% of all eligible voting shares

- Person whose actions can control an appointment or discharge of the company’s director

- Person whose actions can control the persons responsible for business policy making, managing, or operating the company, to follow suit in making the policy, management, or operation.

- Person who is involved in a company’s operation or exercises responsibility for its operation in a similar manner to an executive or any other senior company officer.

Relatives refer to the person having blood relation or registration under law:

(1) Spouse (2) Father, mother (3) Children

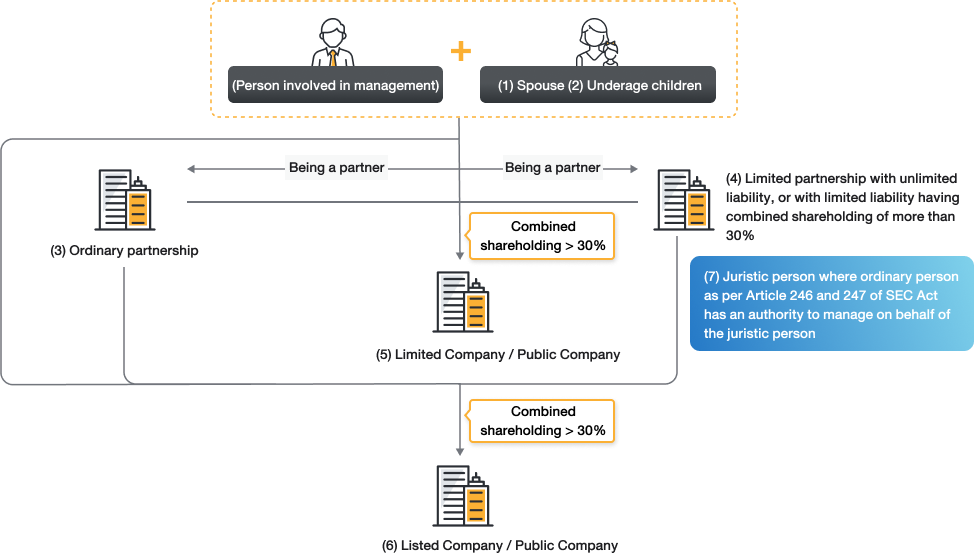

Related persons refer to individuals or partnerships under Section 258 (1)-(7) of the SEC Act B.E. 2535:

- Spouse

- Minor children

- Ordinary partnerships having the person, including (1) or (2) as partner

- Limited partnerships having the person, including (1) or (2) as partner either by having unlimited liability, or by holding an aggregate of more than 30% of stock

- Limited company or Public Company Limited in which the person, including (1) or (2) or (3) or (4) have a combined shareholding of more than 30%

- Limited company or Public Company Limited in which the person, including (1) or (2) or (3) or (4) or (5) have a combined shareholding of more than 30%

- Juristic persons where ordinary person under Section 246 and Section 247 (SEC Act) acting as representatives.

| Reporting and submission |

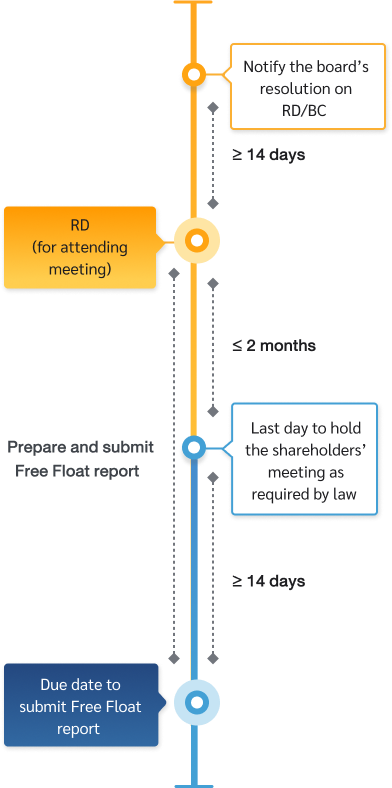

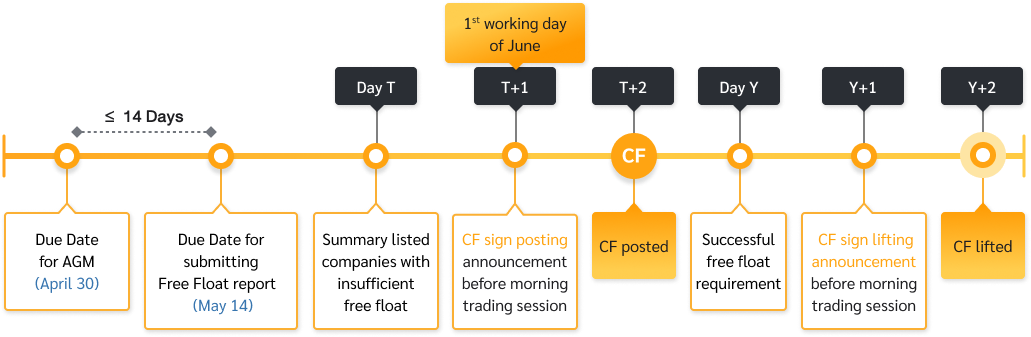

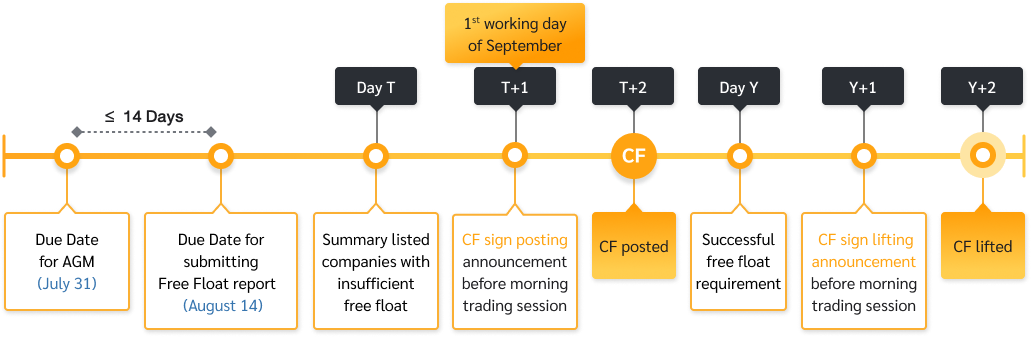

- Prepare the report on the distribution of strategic shareholders on SETLink system based on the shareholder list on the record date (RD)/book closing date (BC) for attending AGM.

- In order to provide information to the SET, please submit the report signed by authorized directors via SETLink system within 14 days from the last day of shareholders’ meeting as required by law e.g. For accounting period ended on December 31, the due date for report submission will be May 14 of every year.

- In case the listed company does not hold the annual general meeting of shareholders or hold the meeting later than required by the law, the company is still subjected to submit the report on the distribution of strategic shareholders via SETLink within due date. If the company does not submit the report, SET will consider that the company does not meet the free float requirement.

| What to do when the company does not meet the free float requirement |

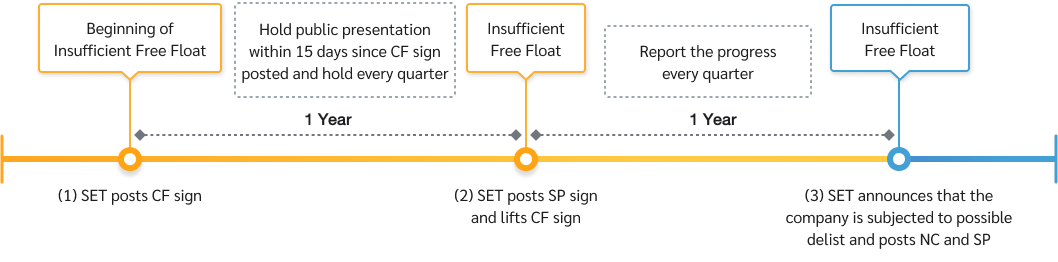

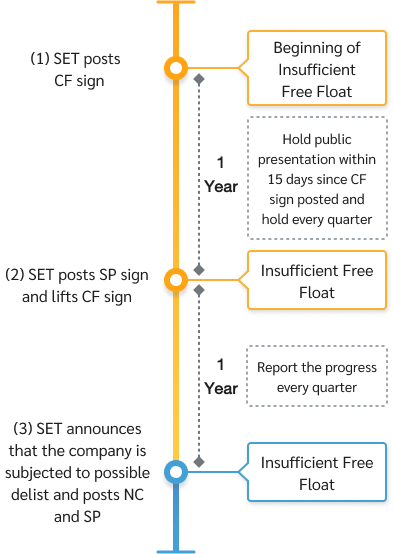

- Listed company with insufficient free float for 1st year: SET will publicly announce and post CF sign and the company is required to set up a meeting in order to provide information to the investors and concerned persons (Public Presentation) within 15 days since the day that CF sign is posted.

- Listed company with insufficient free float for 2nd year: In case CF sign is posted for 1 year and the company still does not meet the free float requirement, SET will lift the CF sign and post SP (Suspension) sign.

- Listed company with insufficient free float for 3rd year: In case SP sign is posted for 1 year, SET will announce that the company is subjected to possible delisting and NC (Non-Compliance) sign will be posted. In addition, SP sign is still posted and SET may consider delisting.

(Details as shown in the process for the case of the company does not meet free float requirement)

| Report of the progress |

- While CF sign is posted, the company is required to arrange the public presentation every quarter.

- After SP sign is posted, the company must report the progress on the distribution of strategic shareholders in order to meet free float requirement together with financial statements submission or within the day that the company must submit the financial statements in each quarter. In case the company has significant progress, the company must disclose via SET’s disclosure system immediately.

Schedule of additional fees

(Times of the annual fee)

| Free float shortfall (%) | No. of years shortfall beyond the grace period |

| Year 1 | Year 2 | Year 3 | Year 4 | ... n |

| 0 < Free Float ≤5 | 1 | 1.5 | 2 | 2.5 | ... |

| 5 < Free Float ≤10 | 1.5 | 2 | 2.5 | 3 | ... |

| 10 < Free Float ≤15 | 2 | 2.5 | 3 | 3.5 | ... |

Remarks: In case the minority shareholders are less than 150 persons, the company must pay additional fees at the rate apply to those whose free-float deficit falls between “0% < Free Float ≤ 5%”.

| What to do when the company’s free float condition has been met |

- The company must determine the latest RD/BC to prepare the report on the distribution of strategic shareholders and submit via SETLink for SET’s consideration process.

- SET will consider the company’s qualifications within seven business days from the day SET has received completed information.

- Once SET has considered that the company has met the requirements,

- The company has to announce to investors about successful free float requirement.

- The SET will announce to investors that the company has met the free float requirement and lift CF, SP or NC sign, depending on circumstances.