The listed company’s board of directors is representing the shareholders. They are responsible for making decisions on the company’s important policies and strategies. Hence, to ensure that the management has implemented policies and strategies laid down for the ultimate benefits of shareholders, the board of directors should thus be comprised of qualified persons who would efficiently perform the function. The proportion of executive directors and non-executive directors should be optimum to have a balanced yet diverse mix of expertise, plus the counter balance mechanism within the board to allow free discussion and protect against the influence from any persons over the board’s decisions.

| Subject | Details |

| Composition of the board of directors | The composition of the board of directors must be in line with SEC regulations: 1. There must be at least one third of independent directors out of total directors, and at least 3 persons 2. There must be at least three audit committee members |

| Qualifications of an independent director | 1. Holding no more than 1 % of total voting shares* including the shareholding of persons related to the independent directors |

| 2. Not currently be or never been the company’s executive director, worker, employee, salaried consultant, or controlling parties*. Exception: It has been at least two years after the person has held the position. | |

| 3. Not by blood or legally registered with other directors, executives, major shareholders, controlling parties, or persons who will be nominated as directors, executives, or controlling parties of the company or subsidiary. | |

| 4. Not currently having or never had any relations with the company* in the way that such relation may impede the person from having independent views. Also, the person should not currently be or never be a significant shareholder or controlling person for persons having business relations with the company*. Exception: It has been at least two years after the person has held the position. | |

| 5. Not currently being or never been the company’s auditor*. Also, the person should not currently be or never be a significant shareholder, controlling person, or partners of current auditor’s auditing firm*. Exception: It has been at least two years after the person has held the position. | |

| 6. Not currently be providing or never provided professional services, legal consulting, nor financial consulting services to the company with a fee more than THB 2 million per year*. Also, the person should not currently be or never be a significant shareholder, controlling person, or partners of current service providers. Exception: It has been at least two years after the person has held the position. | |

| 7. Not currently a director appointed to represent the company’s directors, major shareholders, or the shareholder related to major shareholder. | |

| 8. Not currently be operating under similar business nature and significant competition to the company or subsidiary; or not a significant partner of the partnership, executive director, salaried worker, employee, or consultant; or holding more than 1% of voting shares of any other companies operating under similar business nature and significant competition to the company and subsidiary. | |

| 9. Not under any conditions that may impede the person from having independent views towards the company’s operations. *Including the parent company, subsidiary, affiliate, major shareholder(s), or controlling parties of the company | |

| Qualifications of an audit committee member | 1. Having been appointed by the board of directors or shareholders’ meeting to act as audit committee member. |

| 2. Qualified for an independent director. | |

| 3. Not currently the director authorized by the board to make administrative decisions of the company, parent company, subsidiary, same-level subsidiary, major shareholders, or controlling persons. | |

| 4. Not currently the director of the parent company, subsidiary, or same-level subsidiary of listed companies only. | |

| 5. Having sufficient knowledge and experience to perform the duty of an audit committee. There must be at least one audit committee member, who is sufficiently knowledgeable and experienced to review the reliability of financial statements. | |

| Roles of an audit committee member | 1. Review the company’s financial reporting process to ensure that it is accurate and adequate. |

| 2. Review to ensure that the company has appropriate and efficient internal control and internal audit systems. Also consider the independence of internal audit unit, approve an appointment, transfer, or termination of the head of internal audit unit, or any other units in charge of an internal audit. | |

| 3. Review to ensure that the company is compliance with SEC’s laws, SET’s regulations, and other related business laws. | |

| 4. Consider, select, and nominate independent persons to act as auditor, suggest the remuneration, and attend non-management meeting with the auditor at least once a year. | |

| 5. Consider the connected transactions or the transactions that may cause conflicts of interests, making them in line with the laws and SET’s regulations. This is to ensure such transactions are reasonable and for the highest benefit of the company. | |

6. Prepare an audit committee’s report and disclose it in the company’s annual report. The report must be signed by the audit committee’s chairman and consist of at least following information:

| |

| 7. Other operations as assigned by the board of directors, and approved by the audit committee | |

| What to do when the audit committee has changed, or its scope of duty has changed | 1. When an audit committee member resigns, the listed company must notify to the SET immediately via SETLink and specify the reason. |

2. When a new audit committee member is appointed to replace former committee who has resigned, or to assume additional post, the listed company must notify to the SET via SETLink. The documents are as follows

| |

| 3. In case the scope of work and responsibilities of an audit committee has been changed, the listed company must notify SET by sending the F24-1 form, within three business days. | |

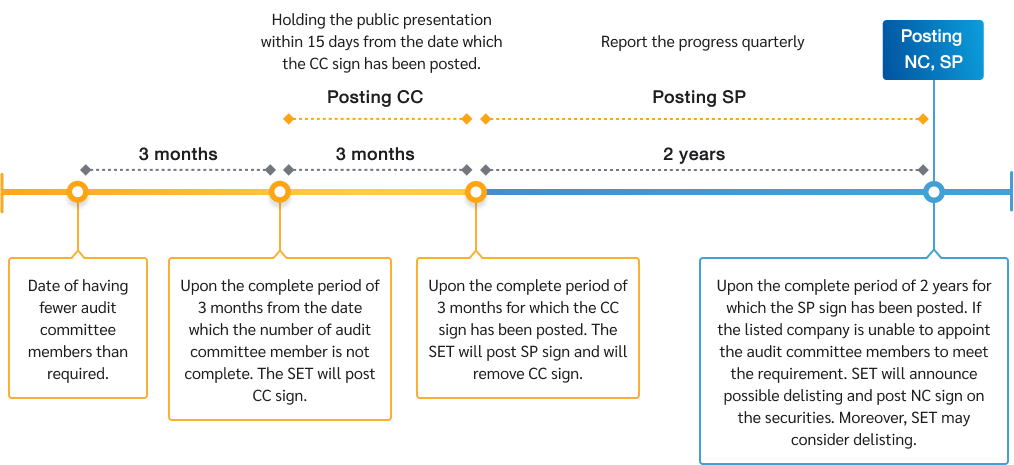

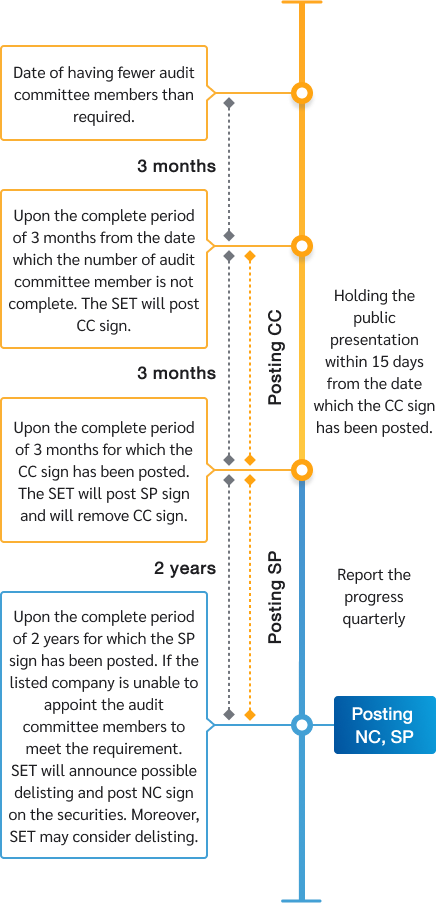

| What to do when number of audit committee members are less than required | 1. If the audit committee has fewer members than required, the listed company must appoint a member of audit committee within three months of the shortfall. |

2. During the time when the company could not appoint audit committee members to meet the requirement, the SET will proceed as the following:

| |

| 3. Report of Progress The company which has been posted with SP sign shall report the progress of appointing the audit committee to the SET quarterly together with the submission of financial statement, or within the financial statement submission due date, until the SET remove the SP sign. Nonetheless, in case there is any material progress, the company shall disclose such progress without delay. | |

| Extension period for audit committee appointment | 1. The listed company must submit a written explanation to SET at least seven days before the deadline for appointment, and provide reasons and supporting documents/evidence for SET’s consideration. Such extension shall not exceed 6 months from the due date to appoint the audit committee. |

| 2. In case SET has granted the extension of the period for the audit committee members appointment, the listed company must disclose the period which it expects to be able to appoint the audit committee members to meet the requirement. | |

3. The need and appropriateness that SET may consider extension are such as:

|

The company is subject to possible delisting.

When the listed company has fewer audit committee members less than required, SET will proceed as follows.

|

|

Not necessary. However, the audit committee must be knowledgeable and experienced in reviewing the credibility of financial statements. The committee must give a testimony and mention in the 56-1 One Report clearly about who has such qualifications.

The audit committee must be appointed out of the board of directors only. They will bear similar responsibilities as other members of the board.