DW

DWs are distinctive in that they have effective gearing which helps enlarge the capital gains.

What is a DW?

A DW is a financial product that gives the holder the right to buy (Call DW) or sell (Put DW) the underlying asset at a predetermined quantity, price, and date.

What are Call DW and Put DW?

A Call DW gives the holder the right to buy the underlying assets. The price of Call DW will follow the underlying price.

When the underlying asset's price goes up, the Call DW holder will profit from the price difference.

A Put DW gives the holder the right to sell the underlying assets. The Put DW's price moves in the opposite direction of the underlying asset's price.

When the price of the underlying asset falls, the Call DW holders will profit from the price difference.

What are Call DW and Put DW?

A Call DW gives the holder the right to buy the underlying assets. The price of Call DW will follow the underlying price.

When the underlying asset's price goes up, the Call DW holder will profit from the price difference.

What are Call DW and Put DW?

A Put DW gives the holder the right to sell the underlying assets. The Put DW's price moves in the opposite direction of the underlying asset's price.

When the price of the underlying asset falls, the Call DW holders will profit from the price difference.

DW advantages

Require a small investment

Trading by using the stock trading account

Profits can be made

during both market ups and downs.

DW Risks

What are DW underlying assets?

Thai securities that are constituents of the SET50 index and rank 51 to 100 on the SET100 index | |

Foreign securities (e.g., Alibaba, Tencent, Meituan, Xiaomi, JD.com, Great Wall Motor) | |

Thai stock indexes (SET50, SET100, and SETHD) | |

Foreign stock indexes (e.e., Hang Seng Index, Hang Seng TECH Index, Dow Jones Industrial Average) |

DW news update

Key vocabularies

Factors influencing the price of a DW

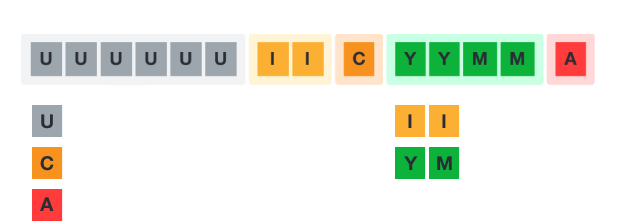

| Call DW | Put DW | |

| Underlying price | If the price of the underlying asset rises, so will the price of the Call DW. | If the price of the underlying asset rises, the price of the Put DW will fall |

| Time to maturity | The longer the remaining time, the higher the price of the Call DW and Put DW. On the contrary, the shorter the remaining time, the lower the warrant price. | |

| Volatility | The higher the volatility of the underlying asset price, the higher the price of the Call DW and Put DW. On the contrary, the lower the volatility, the lower the warrant price. | |

FAQs

- In-the-money DW means the warrant holder earns capital gains from the price difference

- At-the-money and out-of-the-money DW means the holder does not earn any capital gain from the price difference

- Intrinsic value is used to determine the difference between the current price of the underlying asset and the exercise price of an ITM warrant, to calculate how much profit it currently makes.

- Time value refers to the portion of the DW price due primarily to the amount of remaining time towards maturity. A warrant's value typically declines as it approaches its maturity because there is less time for the underlying security to move in a favorable direction.

For more information, click here