TSR: Transferable Subscription Rights

Transferable Subscription Rights (TSR) is an instrument issued by a listed company to existing shareholders after the company increased its capital and allocated the newly issued shares to the existing shareholders in proportion to their shareholding (Right Offering) without issuing to shareholders whose ownership of such shares would create obligations under foreign laws on the company (Preferential Public Offering: PPO). The listed company will issue TSR to existing shareholders in proportion to the share subscription rights they are entitled to at the capital increase. For instance, if a company issues one new share for every ten existing shares, a shareholder will receive one TSR for every ten existing shares, with one TSR granting the right to purchase one new share.

TSR benefits

Company

| Meet fund-raising target by setting conversion price of TSR so that the ordinary shares can be purchased at higher price than RO price at the capital increase |

| Expand the shareholder base |

Shareholders

| More options: i.e. can choose whether to exercise or sell the rights to subscribe to newly issued shares if unable to subscribe to the newly issued shares |

| Increase the liquidity of those securities |

How is TSR different from a Rights Offering?

When a company increases its capital for the existing shareholders (Rights Offering or Preferential Public Offering), existing shareholders may or may not exercise their rights which exposes the company to the risk of not being able to fully raise funds for the intended purpose. Therefore, issuing TSR will allow shareholders who do not wish to purchase the newly issued shares to sell their subscription rights on the SET and the TSR holder will have the rights to subscribe to the newly issued shares. This enables the company to fully raise funds for its intended purpose

TSR Issuers: Listed Companies

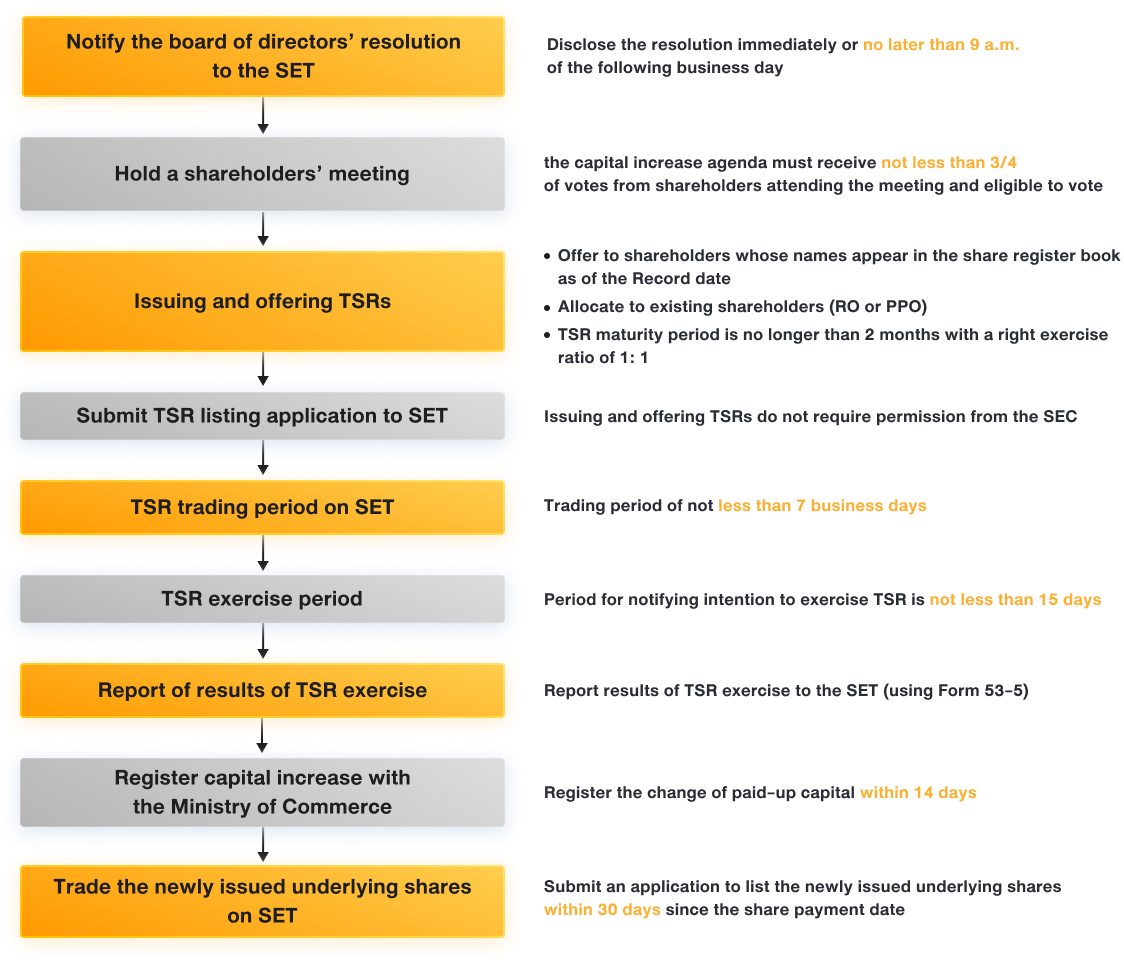

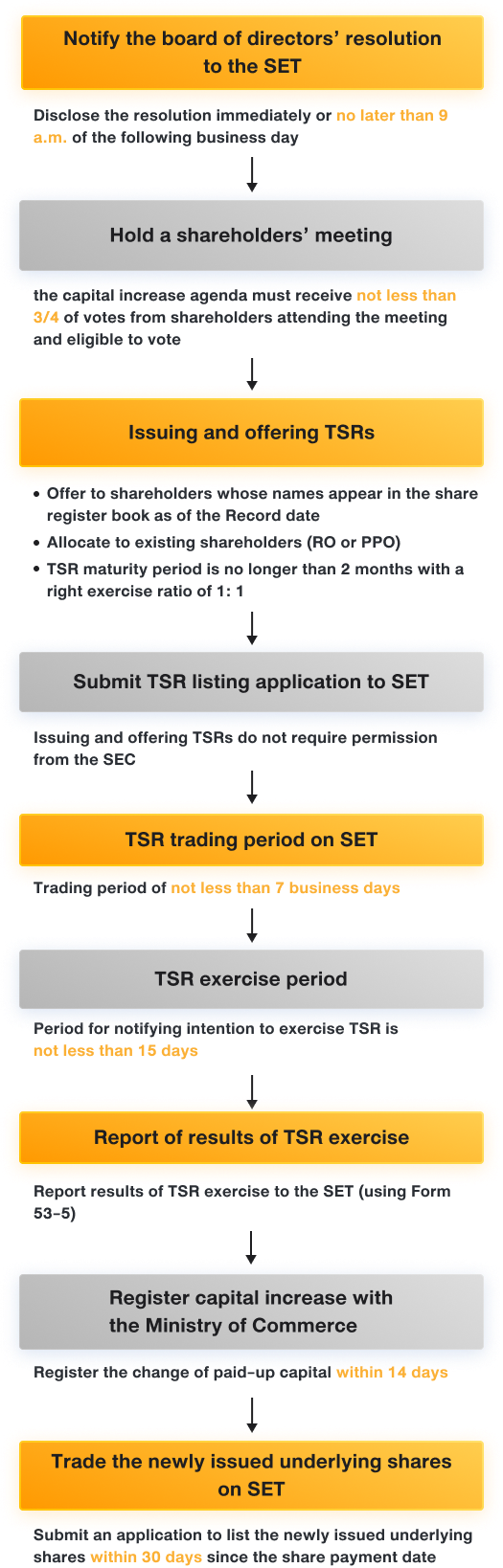

- Companies issuing TSR must specify that the maturity period of TSR is no more than 2 months, the trading period on the exchange no less than 7 business days, and the last right exercise period no less than 15 days prior to the exercise date

- Set the right exercise ratio to one unit of TSR per one ordinary or preferred share

- Companies issuing TSRs must have no potential to be delisted or be in the process of resolving the cause for delisting, or under a rehabilitation plan in accordance with the bankruptcy law, or being prohibited from trading securities, as these causes may adversely affect shareholders' rights and benefits.

- A listed company can offer TSRs within one year from the date the shareholders’ meeting approves the capital increase with no filing with the SEC Office required and without the need for a financial advisor

- There must be an explicitly written term stating the company's obligation to compensate TSRs holders if the company is unable to provide sufficient newly issued underlying shares for TSR holders to fully exercise their rights

- The company must submit a copy of the shareholders’ resolution approving the capital increase, copy of the written terms, and other supporting documents, along with a report on result of sale of newly issued shares to the SEC Office

- TSR listing fees are waived by the SET

TSR Trading on SET

| In trading the TSR, the name of the issuing company followed by "-T#," must be used, for example, XXX-T1 |

| TSRs can be traded on the SET trading system |

| The Ceiling – Floor + board lot + tick size prices are as specified by the SET |

| The SET will post the SP sign for TSRs for two business days before the commencement of subscription and payment dates to determine the name list of TSR shareholders who wish to exercise the rights to convert to ordinary or preferred shares |

| The XT symbol indicates that such price excludes the rights to receive TSR |

Key Procedures

Notes

- The issuer must report the result of offering of TSR and underlying share together with supporting documents and checklist to the SEC within 15 days from the date the offer period comes to an end.

- If there are grounds for suspicion, the SEC Office may suspend the offer or revoke the approval to offer newly issued shares in the part that has not been registered as paid-up capital

Related regulations

|

|

|

|

Details of Capital Increase

To ensure timely execution, the company should explicitly specify details of the capital increase, conditions, offering price, subscription and payment period as well as the record date, so that the subscription rights and the notification of the Board of Directors' resolution occur simultaneously.

To ensure timely execution, the company should explicitly specify details of the capital increase, conditions, offering price, subscription and payment period as well as the record date, so that the subscription rights and the notification of the Board of Directors' resolution occur simultaneously.

Disclosure of implementation details

When seeking shareholders’ approval for TSR issuance, the company should disclose the details and procedures by including in the notice of shareholders’ meeting the TSR details such as the number, maturity period, offering price, and exercise price. Such details should also be included in the notice informing eligible shareholders of their rights to receive TSR.

When seeking shareholders’ approval for TSR issuance, the company should disclose the details and procedures by including in the notice of shareholders’ meeting the TSR details such as the number, maturity period, offering price, and exercise price. Such details should also be included in the notice informing eligible shareholders of their rights to receive TSR.

| How long is a TSR maturity period? |

Since TSRs maturity period is 2 months and can be traded for a period no less than 7 days, the company should record TSR in the scripless system to ensure prompt and efficient transfer. |

| How to count TSR maturity period |

TSR maturity period commences from the Issue Date, which is the date the shareholder receives the TSR and is ready to begin trading until the Exercise Date, with a total period being no more than 2 months. |

Key to successful TSR issuance and offering

The ability to provide information and understanding to shareholders and investors. If there is a lack of understanding, the issuance and offering of TSRs may not be approved in the shareholders' meeting. It may also affect the price of the parent company's shares or result in a trading price of TSR in the SET after listing not reflecting its true value.

The ability to provide information and understanding to shareholders and investors. If there is a lack of understanding, the issuance and offering of TSRs may not be approved in the shareholders' meeting. It may also affect the price of the parent company's shares or result in a trading price of TSR in the SET after listing not reflecting its true value.

Dissemination of TSR information

Shareholders who hold the company's shares in the form of scrip may not closely follow the company's news and may miss out on exercising their TSR options and rights, preventing the company from meeting its fund-raising target. Therefore, the company should directly inform this group of shareholders about the TSR issuance so that they have all the information needed to make the decision.

Shareholders who hold the company's shares in the form of scrip may not closely follow the company's news and may miss out on exercising their TSR options and rights, preventing the company from meeting its fund-raising target. Therefore, the company should directly inform this group of shareholders about the TSR issuance so that they have all the information needed to make the decision.