Stock dividends are paid to shareholders in the form of newly issued ordinary shares which is another way for a company to pay returns to shareholders in addition to cash dividends. Shareholders will receive stock dividends in proportion to their shareholding and therefore the company must increase its capital in order to pay such stock dividends. Stock dividends have no effect on shareholders' equity in the financial statements. However, accumulated profits will decrease while the number of ordinary shares increases in the same amount.

| Keep cash on hand to invest and expand the business without having to raise funds from outside sources which may have more financial costs | |

| Maintain financial liquidity | |

| The debt-to-equity ratio (D/E Ratio) remains unchanged | |

| Increase stock liquidity as the number of free-float shares increases which is advantageous for future fundraising | |

| Maintain investment attractiveness by continuing to pay dividends |

| Similar to receiving investment returns: shareholders can sell the stocks in exchange for a quick cash or keep them for long-term gains | |

| Stock liquidity increases due to rising number of free float shares |

be considered

| Proportion of stock dividends payment to existing shares: taking into consideration the effect on share profits and share price which may decrease due to the increased number of shares (Price Dilution) | |

| Revenue and profit growth rate | |

| Stock market conditions | |

| Ability to pay stock dividends along with cash dividends |

Tax for investors when receiving cash and stock dividends

| Individual investor | Juristic Investor | |

| Thai and foreign investors doing business in Thailand |

|

|

| Foreign investors doing business outside of Thailand |

|

|

- The company may pay stock dividends along with cash dividends to accommodate the 10% withholding tax that the company is liable to. Transferring accumulated profits at par value will result in the amount of withholding tax being lower than the market price

- An interim dividend can only be paid if it is already specified in the company's articles of association

- The board of directors may approve the interim dividend payment in cash without approval from a shareholders’ meeting, but it must notify the shareholders at the next shareholders' meeting

- The board of directors must seek approval from a shareholders' meeting for a capital increase in order to accommodate the payment of interim stock dividends

- The board of directors may approve the interim dividend payment in cash without approval from a shareholders’ meeting, but it must notify the shareholders at the next shareholders' meeting

Key procedures

Related Regulations

|

|

|

Pay stock dividends along with cash dividends

To accommodate the 10% withholding tax on dividends that the company is liable to and transfer the accumulated profits at par value (Par) (Announcement of the Federation of Accounting Professions No. 15/2557 regarding accounting practices for stock dividend accounting, effective January 1, 2014).

Dividends must be paid within 1 month

Section 115 of the Public Company Limited Act requires companies to pay dividends within 1 month of receiving approval from the shareholders' meeting or the Board of Directors.

Interim dividend

payment

Interim dividend payment

- For payment of interim cash dividends, the board of directors may approve the payment without shareholders’ approval but it must report to the shareholders' meeting for acknowledgment at the next shareholders' meeting.

- For payment of interim stock dividends, if the company intend to proceed in accordance with the Public Company Limited Act, Section 117, the company should consult the Department of Business Development of the Ministry of Commerce before execution.

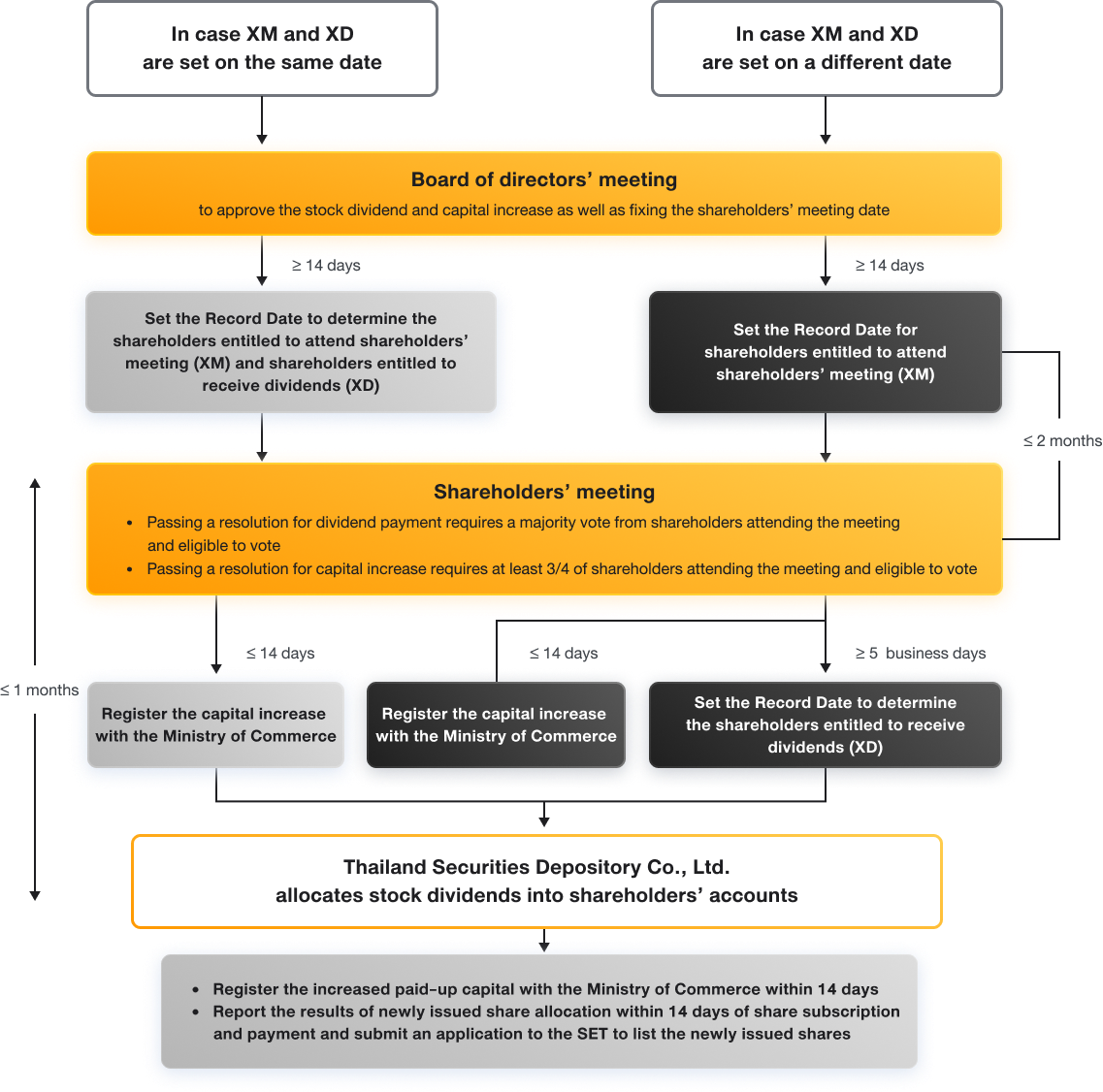

Closure of register book for the rights to subscribe to newly issued shares and rights to dividends

If the Record Date set for granting the rights to attend the shareholders' meeting to vote for capital increase is the same date set for payment of stock dividends, the board of directors’ resolution must state that "the granting of such rights by the Company is still uncertain because it is pending the approval of the shareholders' meeting." This is due to the risk that the shareholders' meeting may not approve the stock dividend payment which may affect the shareholders in terms of changes in rights or price dilution. The information must be disclosed to investors and shareholders (SET Circular Bor. Jor. (Wor.) 25/2550).