EJIP: An Employee Joint Investment Program

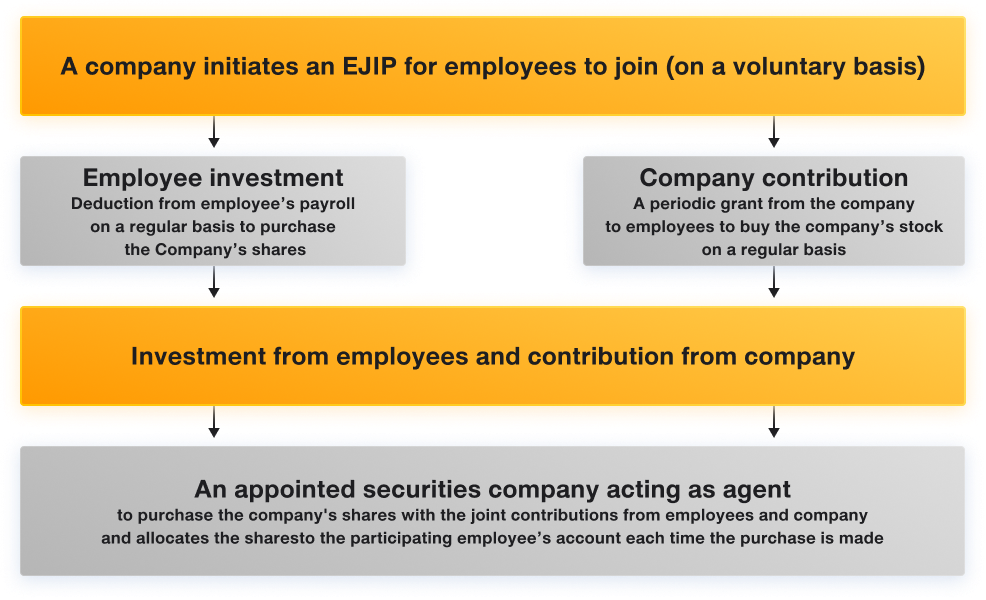

EJIP is a program for employees, management, and directors of a listed company where the employees and company can jointly invest on a voluntary basis by gradually purchasing the company's existing shares on the stock exchange in installments at regular intervals and in equal amounts, using the dollar-cost averaging principle*. The form and method of purchase will be clearly specified at the beginning of the program.

(*Note: Dollar-cost averaging is an investment strategy that reduces price fluctuation risks and provides good long-term returns by investing in equal amounts of money in each installment (e.g., weekly, monthly, or quarterly) over a predetermined time period, regardless of market conditions or stock prices on the investment date.)

| A long-term incentive for employees which builds a sense of ownership in the organization |

| An employee retention tool |

| An alternative to traditional compensation options such as salary, bonuses, and provident fund |

| No dilution effect |

| An effective human resource management and retention strategy adds value to the company and benefits shareholders over time |

| EJIP | ESOP | |

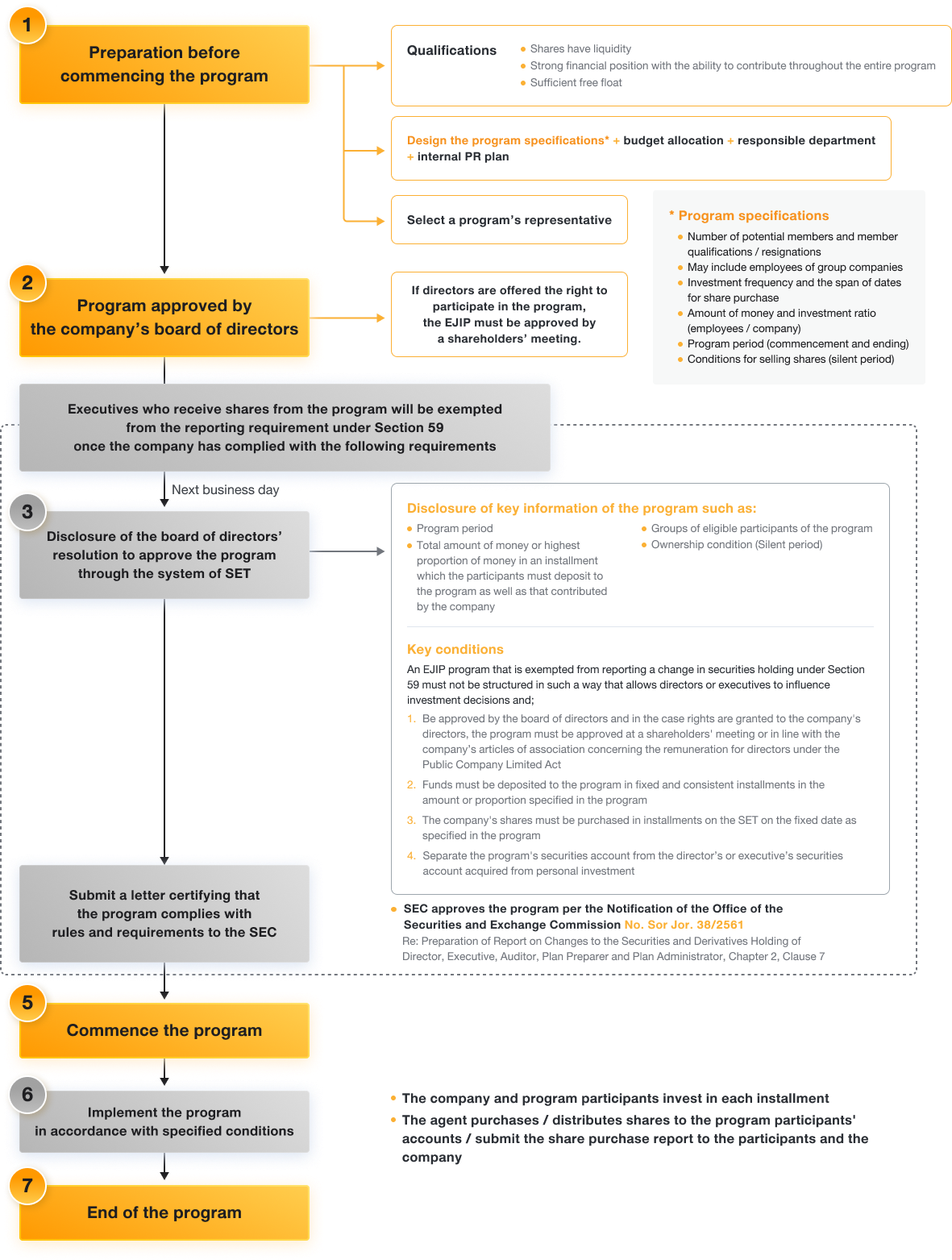

| Approval to commence the program | The board of directors can approve the program except in case there are directors participating in the program where the approval from the shareholders' meeting is required | The board of directors must propose the program to the shareholders' meeting for approval according to the conditions set out by the SEC |

| Forms of returns | Contribution by the company for the purchase of company’s shares Capital gains and dividends (if any) | Shares or warrants Capital gain and dividends (if any) |

| Impacts on shareholders | No dilution effect. There may be a negative impact on the company's profits but this can be offset in the long run with the improved performance which will result in more stable securities prices. | Possibility of the dilution effect |

| Offering period | As specified in the program | |

Participants must pay personal income tax according to the amount contributed by the company as the contribution is deemed remuneration to the employees and the company can deduct the contributions as expenses in the income tax calculation.

Key Procedures

- Notification of the Office of the Securities and Exchange Commission No. SorJor. 38/2561 Re: Preparation of Report on Changes to the Securities and Derivatives Holding of Director, Executive, Auditor, Plan Preparer and Plan Administrator, Chapter 2, Clause 7