164

Annual Report

2015

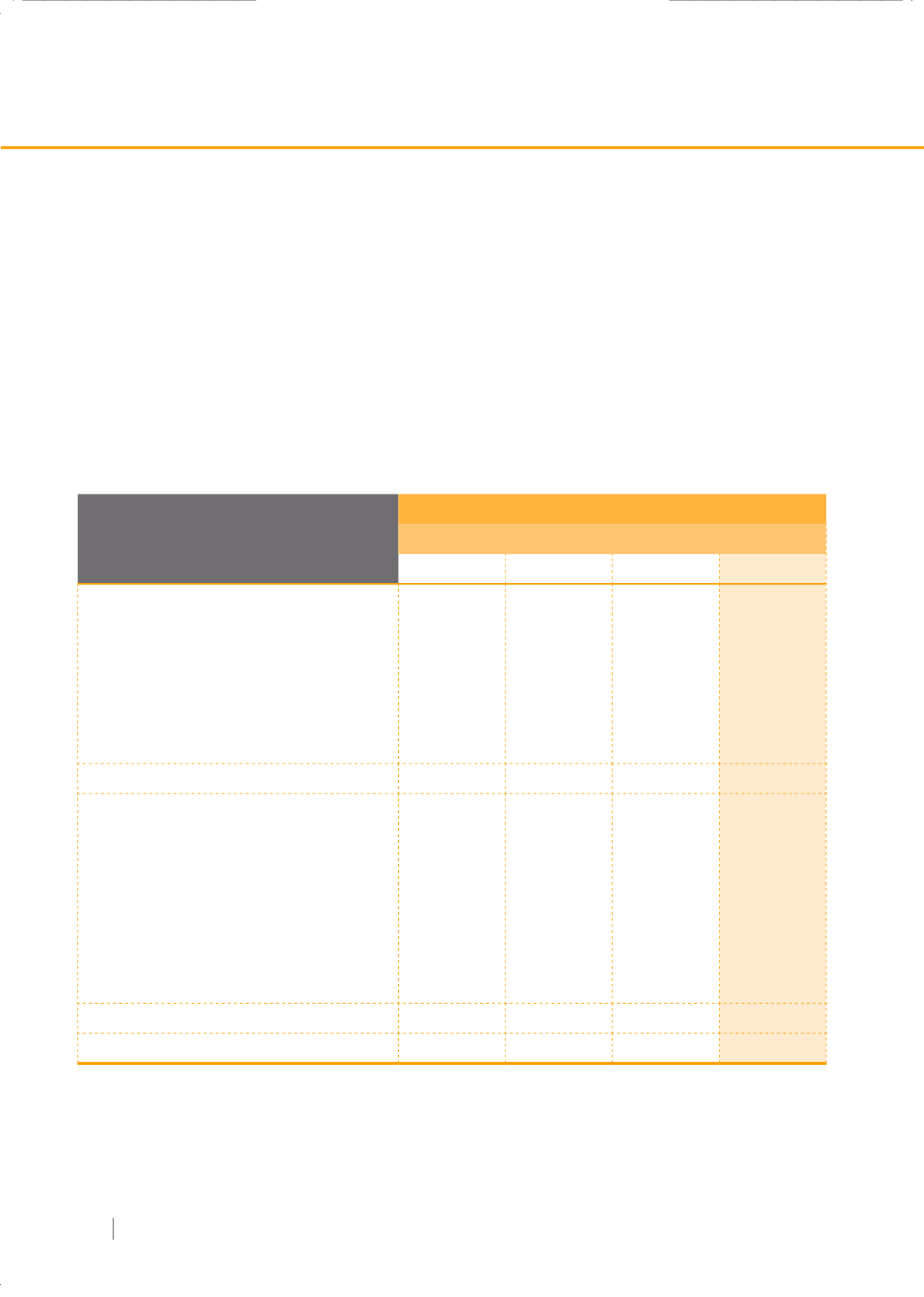

34. Fair value

34.1 Fair value estimation

The fair value of the financial instruments are defined into the following three different levels by valuation method as follows:

• Quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1).

• Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly

(that is, as prices) or indirectly (that is, derived from prices) (Level 2).

• Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs) (Level 3).

The following table presents the Group’s financial assets and liabilities that are measured at fair value at 31 December 2015.

Consolidated

2015

Level 1

Level 2

Level 3

Total

Assets

Current assets

Short-term investments

- Trading securities

-

2,797,737

-

2,797,737

- Available-for-sales

-

1,387,778

-

1,387,778

- Held-to-maturity debt securities

-

701,841

-

701,841

Total current assets

-

4,887,356

-

4,887,356

Non-current assets

Long-term investments

- Available-for-sales

1,005,978

5,509,264

-

6,515,242

Assets for clearing system protection and benefits

- Trading securities

-

647,101

-

647,101

Securities Investor Protection Fund

- Available-for-sales

36,057

77,439

-

113,496

Total non-current assets

1,042,035

6,233,804

-

7,275,839

Total assets

1,042,035 11,121,160

- 12,163,195

(Unit : Baht’000)