162

Annual Report

2015

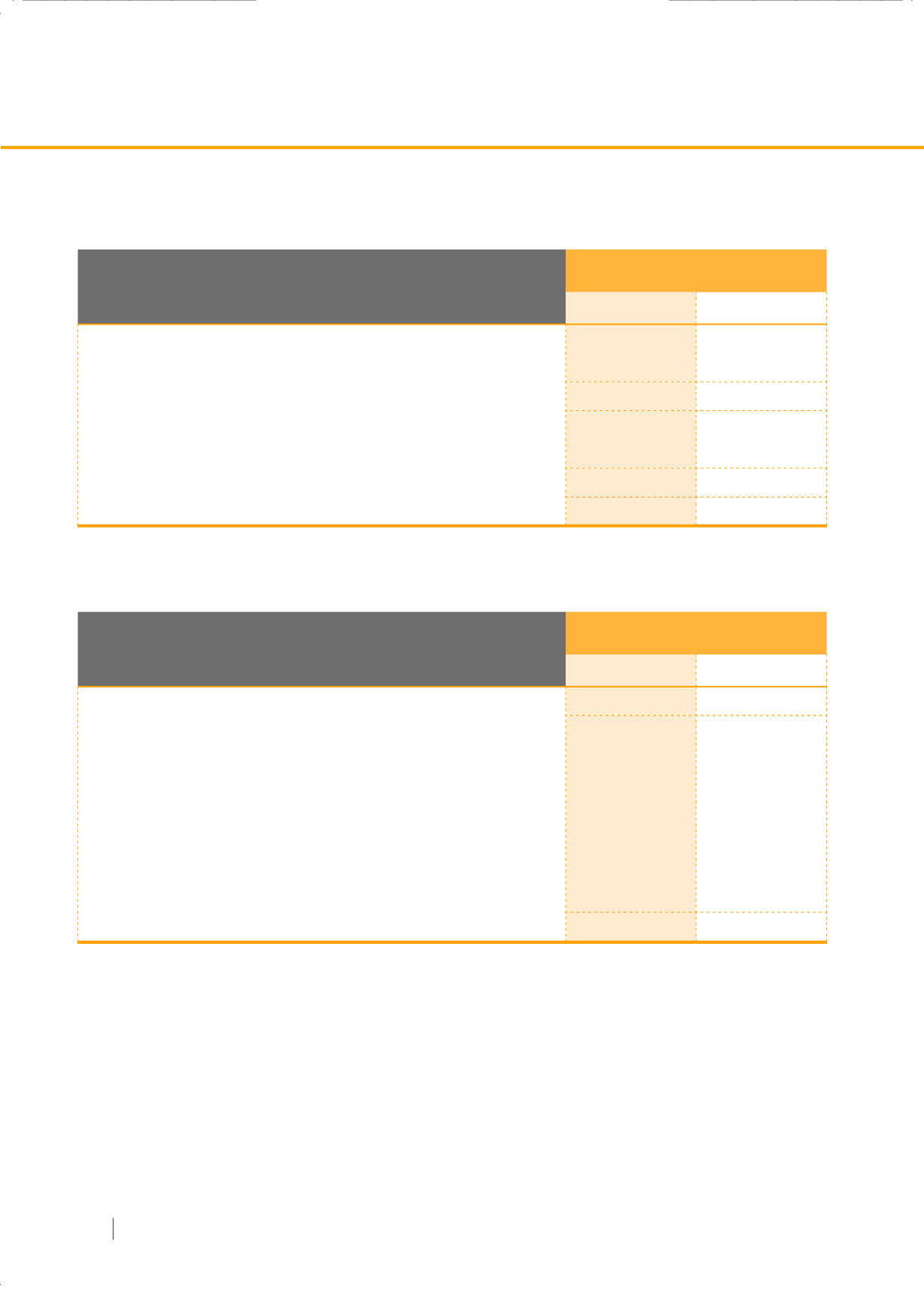

Consolidated

2015

2014

Current income tax

Current income tax

139,700

112,095

Total current income tax

139,700

112,095

Deferred income tax

Origination and reversal of temporary differences

266

579

Total deferred income tax

266

579

Total income tax expense

139,966

112,674

Consolidated

2015

2014

Revenues over expenses before income tax expense

1,522,322

1,648,151

Tax calculated at a tax rate of 20% (2014: 20%)

304,464

329,630

Income not subject to tax

(439)

(70)

Expenses not deductible for tax purposes

1,242

1,812

Eliminated transaction between related party, net of income tax

83,148

78,185

Revenues over expenses - The Stock Exchange of Thailand, net of income tax

(248,232)

(296,644)

Revenues over expenses - Derivatives Investor Protection Fund (TFEX’s portion),

net of income tax

(217)

(239)

Current income tax

139,966

112,674

32. Income tax expense

The tax on the Group’s profit before tax differs from the theoretical amount that would arise using the Thailand basic tax

rate as follows:

The weight average applicable tax rate was 9.19% (2014: 6.84%).

(Unit : Baht’000)

(Unit : Baht’000)