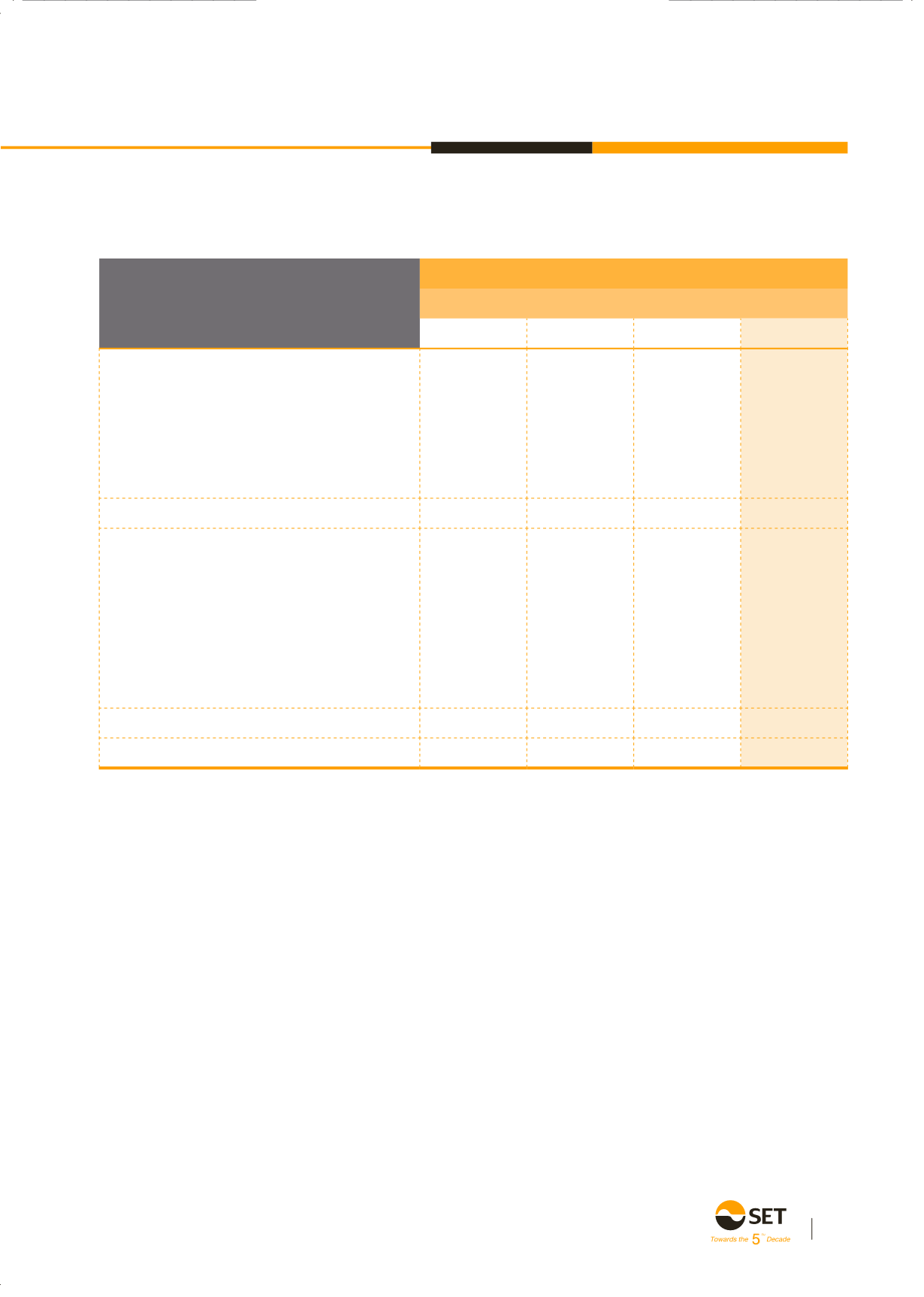

167

SET

2015

Level 1

Level 2

Level 3

Total

Assets

Current assets

Short-term investments

- Held-to-maturity debt securities

-

1,178,672

-

1,178,672

- General investments

-

26,522

-

26,522

Total current assets

-

1,205,194

-

1,205,194

Non-current assets

Long-term investments

- Held-to-maturity debt securities

-

2,758,925

-

2,758,925

- General investments

-

-

12,336

12,336

Securities Investor Protection Fund

- Held-to-maturity debt securities

-

196,621

-

196,621

Total non-current assets

-

2,955,546

12,336

2,967,882

Total assets

-

4,160,740

12,336

4,173,076

The following table presents SET’s financial assets and liabilities that are not measured at fair value at 31 December 2015.

There was no transfers between Levels 1 and 2 during the year.

Other financial instruments not carried at fair value are

typically short-term in nature and reprice to current market

rate frequently. Accordingly, their carrying amount is a

reasonable approximation of fair value. This includes cash and

cash equivalents, cash at banks for financial benefits payable,

assets for margin deposits and benefits, accounts receivable,

accrued interest receivable, deposits and other benefits in assets

for clearing system protection, deposits and other benefits in

Securities Investor Protection Fund, deposits and other benefits

in Derivatives Investor Protection Fund, accounts payable and

short-term borrowings from subsidiaries.

The management believes that the fair value of the Group’s

financial assets and liabilities does not materially differ from

their carrying value.

Valuation techniques used to derive Level 1

fair values

Available-for-sale securities presented as long-term

investments and Securities Investor Protection Fund. The

fair value of investments is measured by using last bid

price at the close of business on the statement of financial

position date by reference to the Stock Exchange of

Thailand.

Valuation techniques used to derive Level 2

fair values

Available-for-sale securities presented as short-term

investments, long-term investments, Securities Investor

Protection Fund and general investments, which are

short-term. General investments comprise of investments

(Unit : Baht’000)