160

Annual Report

2015

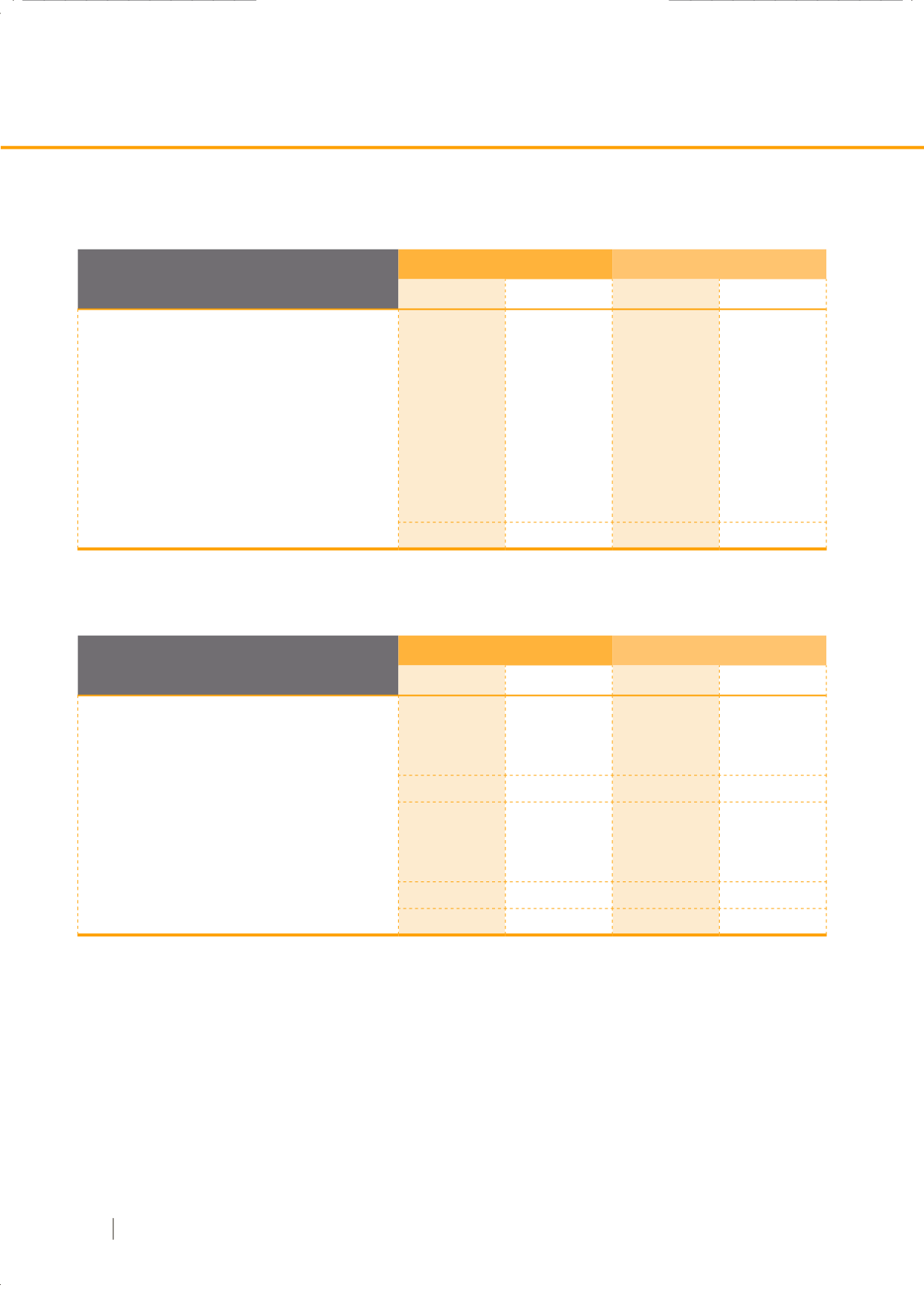

28. Other income

Consolidated

SET

2015

2014

2015

2014

Educational activities income

53,757

44,370

53,757

44,370

Revenues from marketing event

34,214

34,728

34,214

34,728

Revenues from fees and management funds

22,099

25,355

-

-

Transfer rights of membership

18,500

-

18,000

-

Service income

13,566

15,009

1,643,421

1,587,607

Rental & utilities revenue

11,471

11,189

11,471

11,189

Fines

11,139

14,546

7,859

10,291

Other income

39,919

19,977

29,530

10,938

204,665

165,174

1,798,252

1,699,123

Consolidated

SET

2015

2014

2015

2014

Management

Salaries and other benefits

162,066

157,390

162,066

157,390

Contributions to provident fund

10,003

10,745

10,003

10,745

172,069

168,135

172,069

168,135

Other employees

Salaries and other benefits

1,138,378

1,031,423

1,138,478

1,031,522

Contributions to provident fund

61,476

60,360

61,476

60,360

1,199,854

1,091,783

1,199,954

1,091,882

1,371,923

1,259,918

1,372,023

1,260,017

29. Employee benefit expenses

The defined contribution plans comprise provident funds established by the Group for its employees. Membership to the

funds is on a voluntary basis. Contributions are made monthly by the employees at rates ranging from 3.00% to 10.00% of their

basic salaries and by the Group at the rate of 10.00% of the employees’ basic salaries. The provident funds are registered with

the Ministry of Finance as juristic entities and are managed by a licensed Fund Manager.

(Unit : Baht’000)

(Unit : Baht’000)