50

SET established Thailand Securities Institute (TSI) in 2000 to serve as a center for the development

of financial and investment literacy for investors, general public and youth, while developing professional

skills and ethics in the capital market towards long-term financial stability. TSI creates a broad range of

courses for investment planning for all target groups across the board in such a way as to help strengthen

the national economic foundation and develop quality investors for the Thai capital market.

2

Investment and financial education

Promotion of financial planning

SET promotes financial planning to the public

through various learning channels, aiming to enable

the people to conduct their financial planning

towards quality and stability in each life span.

Revolutionary Thinking for

Wealthier Life project

Initiated since 2013, the project aims at encouraging

working people, aged between 21-45 years, to learn

about systematic financial planning, being able to

use their savings to gain fruitful benefits from

investment. The project also promotes reasonable

spending, under the concept of “Clearing all debts,

planning to save and invest more before retirement”

in order to assure their future wealth. In 2014 the

key messages and contents were promoted above

the line and below the line, offline and online

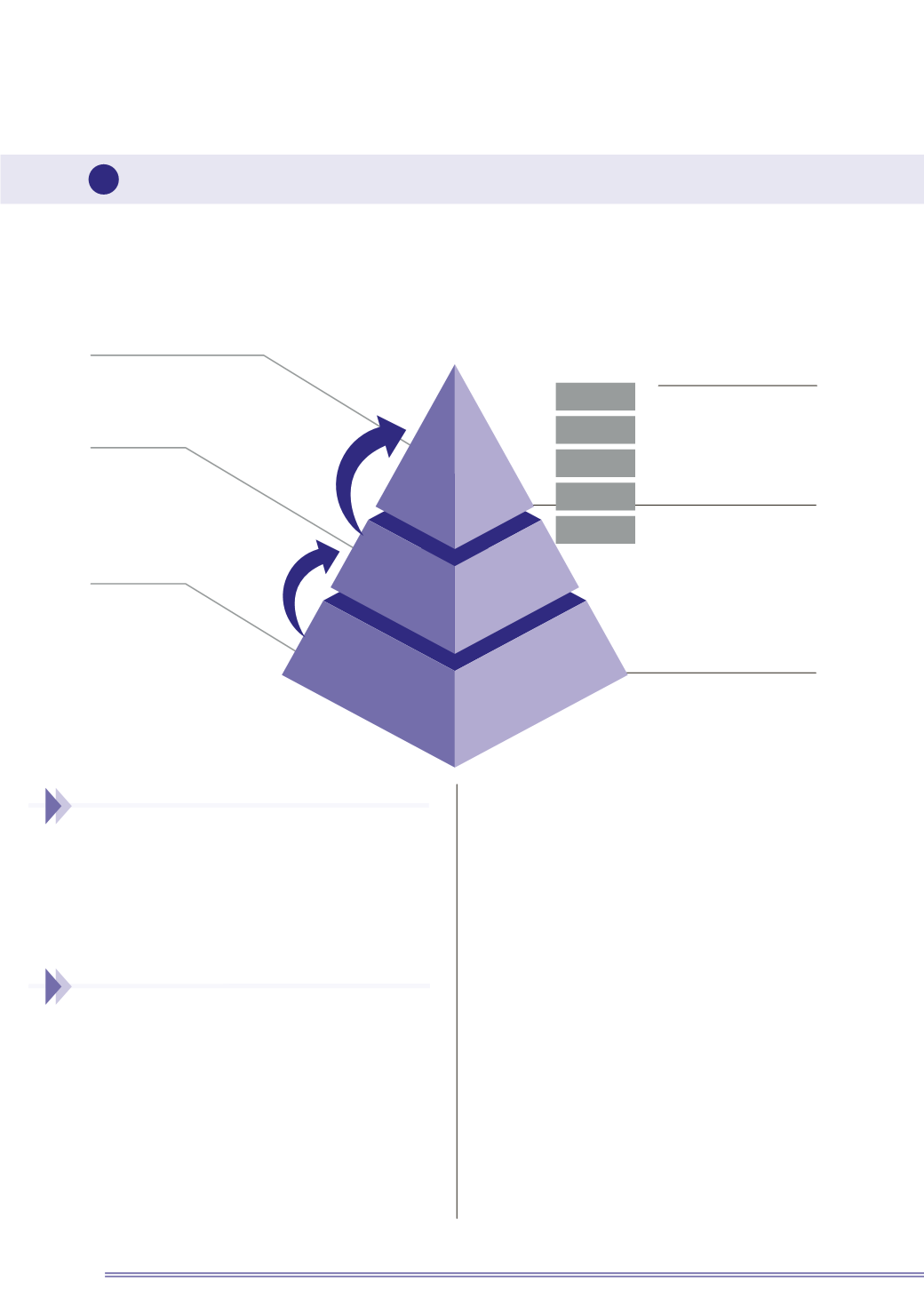

Basic

& Sophisticated Investors

Potential Investors

Middle-to-High

Income Earners

with Savings

General Public

Income earners/

with low savings and/

or being indebted,

Youth (students)

Products

Development Targets

Stock

ETF

Derivatives

Mutual fund

Provident

Fund

Develop quality investors

for long-term sustainability

of the Thai capital market

Promote financial and

investment planning for

retirement to achieve

savings and investment

targets

Develop basic financial

skills towards financial

stability

channels to suit consumers among the new

generation with trendy lifestyle, mainly out-of-home

media, such as BTS Skytrain and MRT subway

stations, as well as roadshows to 16 office buildings

in greater Bangkok area. There were also TV

programs entitled “365-day Investment” and

“Necessity in Financial Planning” that featured the

perspectives and inspiration in financial planning.

In addition, in 2011 SET launched the “Employee’s

Choice @ Workplaces” project for employees with

an aim to increase awareness on financial planning

for retirement. It catered to provident fund members

with selection of investment policies according

to their choices, including savings via RMF and

LTF. The project has been going on each year.

In 2014, there were 136,797 participants from

28 organizations attended the training courses

and other learning channels.