91

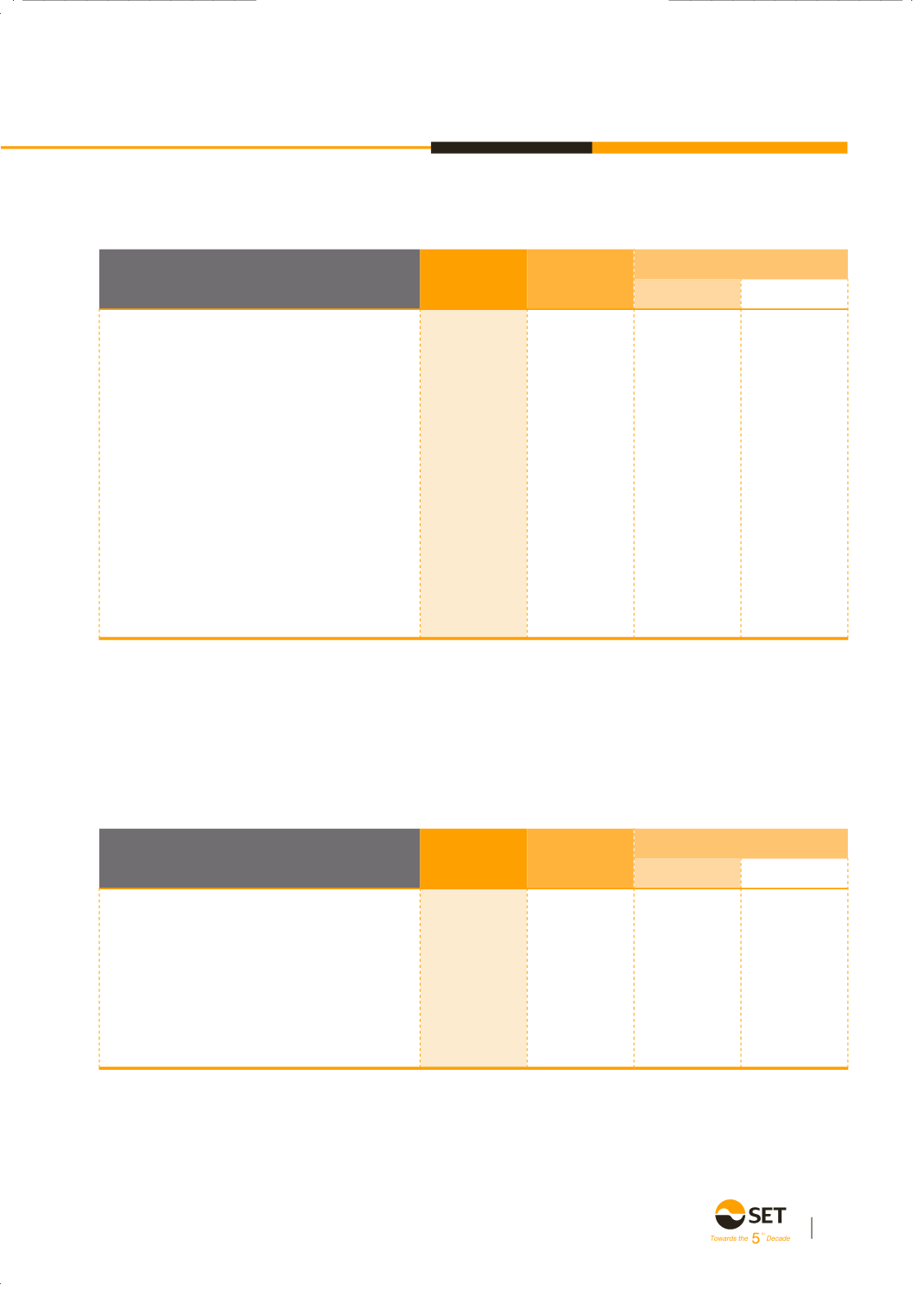

1.1.1 Securities Market

(Unit: THB million)

2015

2014

Increase /(Decrease)

Amount

%

Revenue - Securities Market

2,184

2,140

44

2.06

Trading fees

1,077

1,114

(37)

(3.32)

Clearing and settlement fees

293

300

(7)

(2.33)

Listing fees

494

435

59

13.56

Depository fees

283

260

23

14.38

Membership fees

37

31

6

19.35

Key market indicators

SET Index (point)

1,288

1,498

(210)

(14.02)

Daily average trading value - Equity (THB million)

44,302

45,466

(1,164)

(2.56)

Average market capitalization (THB trillion)

14.04

13.50

0.54

4.00

No. of listed securities (securities)

1,812

1,742

70

4.02

(Unit: THB million)

2015

2014

Increase /(Decrease)

Amount

%

Revenue - Derivatives Market

472

380

92

24.21

Trading fees

295

230

65

28.26

Clearing fees

127

99

28

28.28

Membership fees

50

51

(1)

(1.96)

Key market indicators

Daily average trading volume - Derivatives (contracts)*

199,749

169,363

30,386

19.74

Operating revenue from securities market rose by THB 44 million, or 2.06%, compared to 2014. This resulted from the

rise in listing fees as the number of listed securities rose. In addition, depository fees increased according to the increased in

average market capitalization. On the other hand, trading as well as clearing and settlement fees decreased because daily aveage

trading value decreased.

1.1.2 Derivatives Market

Operating revenue from derivatives market rose by THB 92 million, or 24.21%, compared to 2014, resulting from the rise

in daily average trading volume of derivatives, especially from SET50 Index Futures, which increased to an average of 110,842

contracts per day in 2015 (from 81,129* contracts per day in 2014).

* For comparison purpose, rebased of SET50 Index Futures to mini SET50 Index Futures (a multiplier was reduced from THB 1,000 to THB 200 Baht

since May 6, 2014)