Annual Report 2014

122

2,140

2,195

(55)

(2.51)

1,114

1,233

(119)

(9.65)

300

336

(36)

(10.71)

435

361

74

14.97

260

234

26

20.50

31

31

-

-

1,497.67

1,298.71

198.96

15.32

45,466

50,329

(4,863)

(9.66)

13.50

12.71

0.79

6.22

1,742

1,268

474

37.38

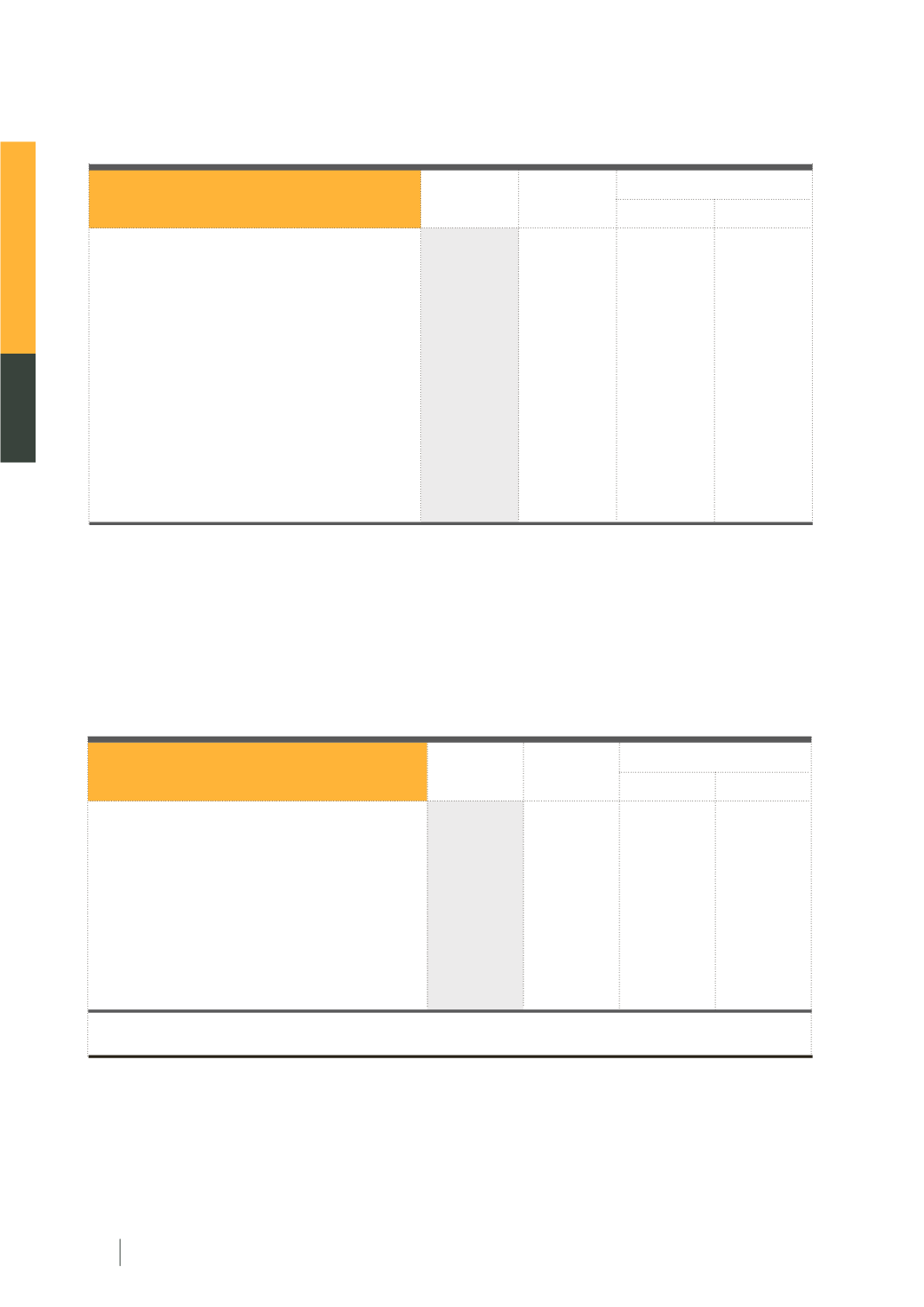

2014

2013

Increase / (Decrease)

Amount

%

1.1.1 Securities Markets

Revenue - Securities Markets

Trading fees

Clearing and settlement fees

Listing fees

Depository fees

Membership fees

Key market indicators

SET Index (Point)

Daily average trading value - Equity (THB million)

Average market capitalization (THB trillion)

No. of listed Securities (Securities)

Operating revenues from securities markets dropped by THB 55 million, or 2.51%, in comparison with

2013. This was mainly due to the decrease in trading and clearing and settlement fees because daily average

trading value decreased. On the other hand, listing fees increased as the number of listed securities rose.

In addition, depository fees increased as average market capitalization went up.

380

577 (68)

(11.79)

230

355

(34)

(9.58)

99

152

(15)

(9.87)

51

70

(19)

(27.14)

147,025

68,017

79,008

116.16

169,363

160,889

8,474

5.27

2014

2013

Increase / (Decrease)

Amount

%

1.1.2 Derivatives Markets

Revenue - Derivatives Markets

Trading fees

Clearing fees

Membership fees

Key market indicators

Daily average trading volume - Derivatives (Contracts)

Daily average trading volume - Derivatives (Contracts)

*

Operating revenues from derivatives markets dropped by THB 68 million, or 11.79%, in comparison with

2013. Though overall trading volume was higher, trading volume of SET50 Index Futures and Gold Futures which

had a higher fee than the others, decreased. In addition, the fees of those products were reduced since May 2013.

* For comparison purpose, rebased of SET50 Index Futures to mini SET50 Index Futures (a Multiplier was reduced from THB 1,000

to THB 200 Baht since 6 May 2014)

(Unit: THB million)

(Unit: THB million)