Annual Report 2014

108

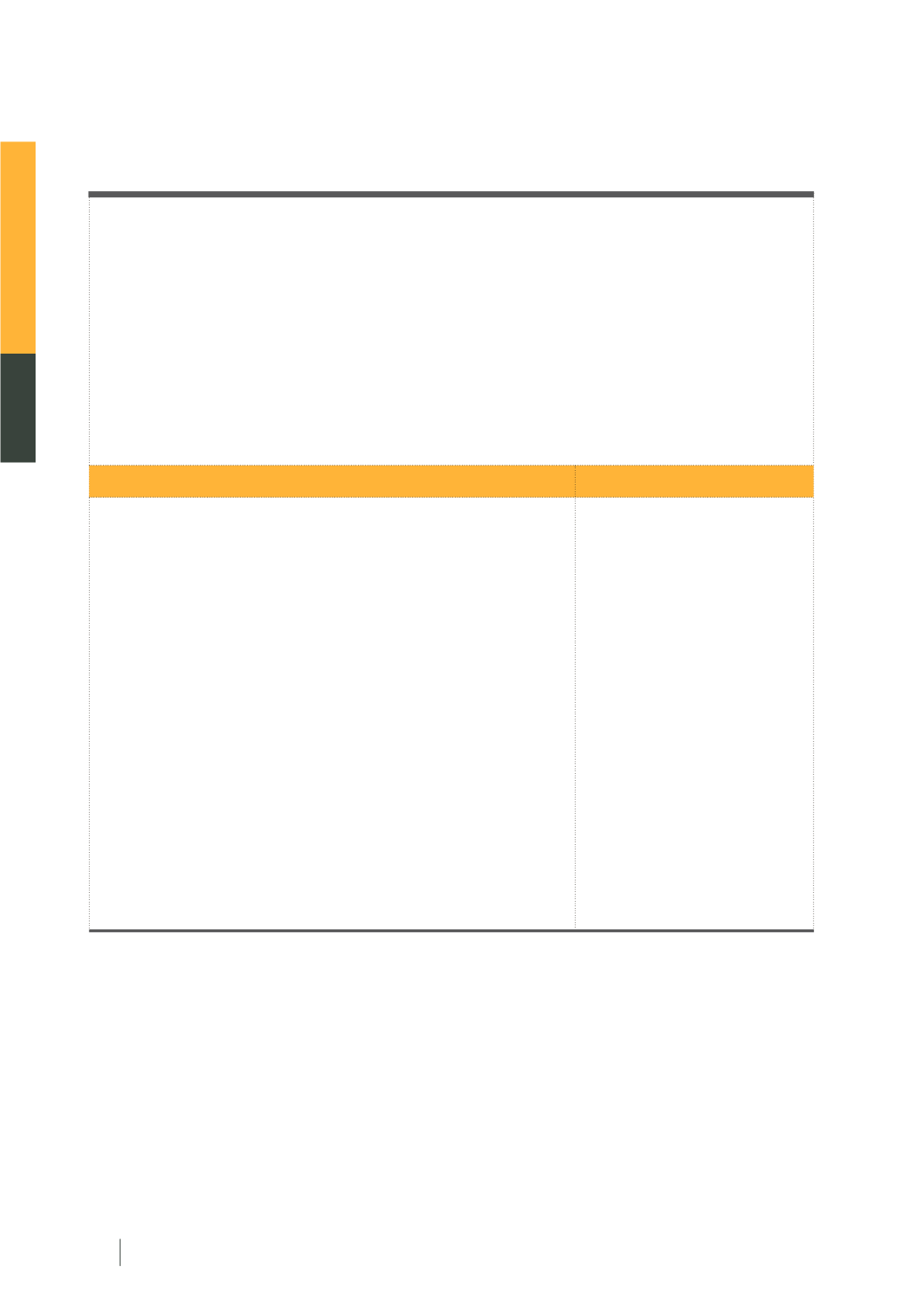

Support unit:

Issuer and Listing Division

Name

Position

Structure:

Sixteen members, consisting of the SET chairman, three SET governors, the SET

president, including representatives from related organizations and one or more experts

such as the Fiscal Policy Office, State Enterprise Policy Office, Thailand Board of Investment,

Federation of Thai Capital Market Organizations, The Federation of Thai Industries, The Office

of the Securities and Exchange Commission, The Thai Banker’s Association, The Thai Chamber of

Commerce & Board of Trade of Thailand, etc. It should be geared to promote and support high

potential companies to be listed on SET and mai. It also includes SET’s executive vice president,

Head of Issuer & Listing Division, to serve as committee member and secretary.

Term:

January 1, 2015 to December 31, 2015

1. Sathit

Limpongpan

2. Boontuck

Wungcharoen

3. Chutima

Bunyapraphasara

4. Isara

Vongkusolkit

5. Professor Kitipong Urapeepatanapong

6. Krisada

Chinavicharana

7. Kulit

Sombatsiri

8. Pattera

Dilokrungthirapop

9. Tipsudu

Thavaramara

10.Sarun

Charoensuwan

11.Somchai

Thaisa-Nguanvorakul

12.Supant

Mongkolsuthree

13.Voravan

Tarapoom

14.The Secretary General of Thailand Board of Investment

15.The SET President

16.The Executive Vice President - Head of Issuer & Listing Division

Chairman

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member

Member and Secretary

7. Listing Expansion Committee

Responsibilities of the Listing Expansion Committee

are to support the SET policy to persuade high potential

Thai and foreign companies, especially companies in the Greater Mekong Subregion (GMS) and ASEAN, to raise

fund through SET and Market for Alternative Investment (mai) in various models. It includes supporting listed

companies in efficiently utilizing the capital market, urging or amending SET rules, regulations and investment

limitations for the benefit of new listing, as well as maintaining the status of listed companies on SET and mai.