122

Annual Report

2015

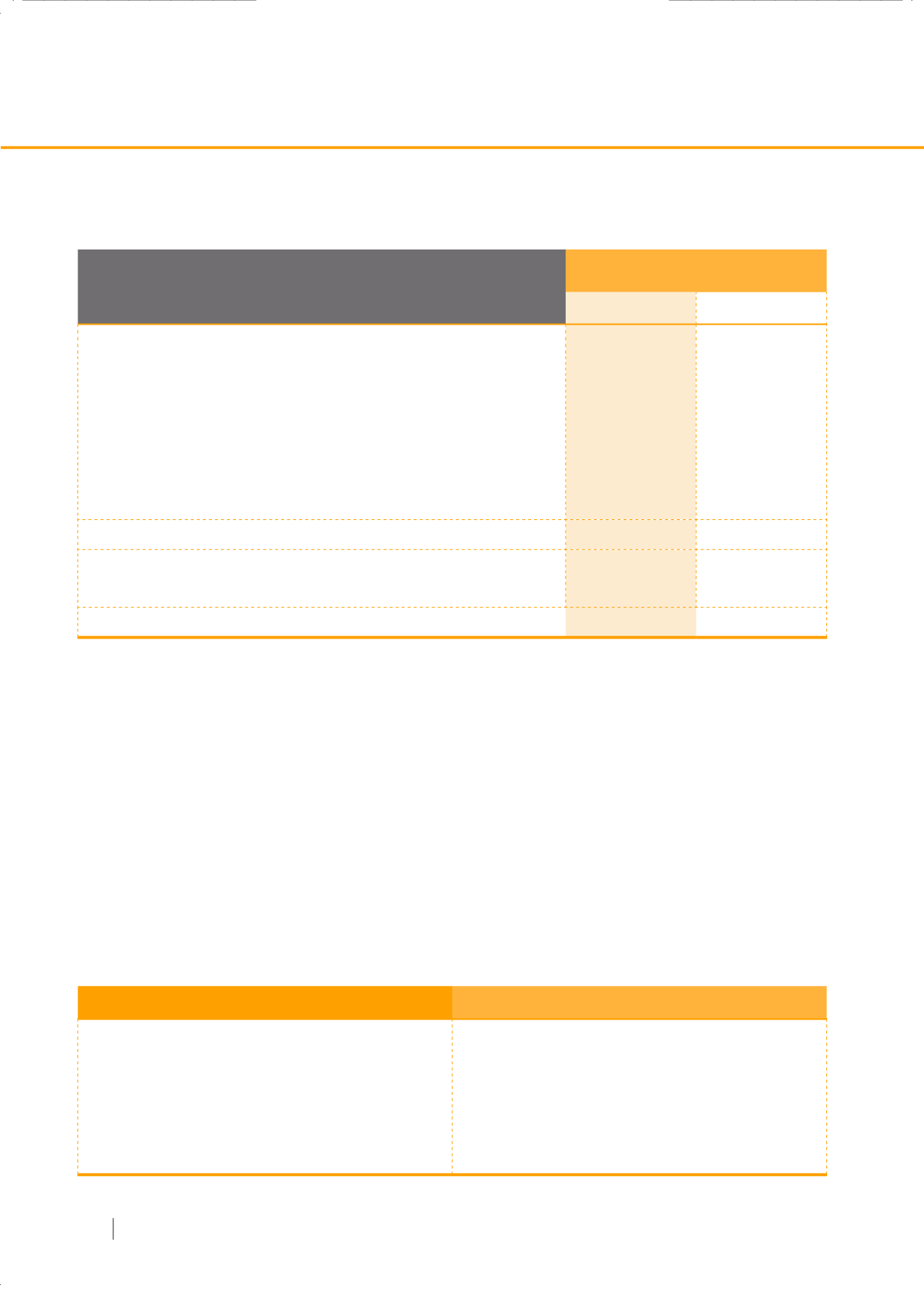

Reconciliation of reportable segment assets/liabilities were as follow:

Consolidated

2015

2014

Assets

17,482,753

13,387,599

Assets for reportable segments

Unallocated amounts:

- Cash and investments

16,555,357

17,248,977

- Investments in related parties

87,600

945,069

- Accrued interest receivables

967,734

103,555

- Land and building under construction

1,042,675

2,767,245

Total assets

36,136,119

34,452,445

Liabilities

Liabilities for reportable segments

12,746,563

12,213,768

Total liabilities

12,746,563

12,213,768

8. Related party transactions

Enterprises and individuals that directly, or indirectly

through one or more intermediaries, control, or are controlled

by, or are under common control with, the entity, including

holding companies, subsidiaries and fellow subsidiaries are

related parties of the entity. Associates and individuals owning,

directly or indirectly, an interest in the voting power of the

entity that gives them significant influence over the enterprise,

key management personnel, including directors and officers

of the company and close members of the family of these

Transaction

Pricing policy

Service income

Purchase of services

Interest income

Interest expense

Contractually agreed price

Cost plus margin

With reference to the return of bank deposit and debt securities

The interest rate on the loan is based on the floating market interest

rate which is referred to the higher interest rate for one-year

government bond or one-year fixed deposit on average of 4 banks

for corporate credit line of Baht 10 million

(Unit : Baht’000)

individuals and companies associated with these individuals

also constitute related parties.

In considering each possible related-party relationship,

attention is directed to the substance of the relationship, and

not merely the legal form.

Transactions with related parties are conducted at prices

based on market prices or at contractually agreed prices where

no market price exists.

The pricing policies for particular types of transactions are explained below: