118

Annual Report

2015

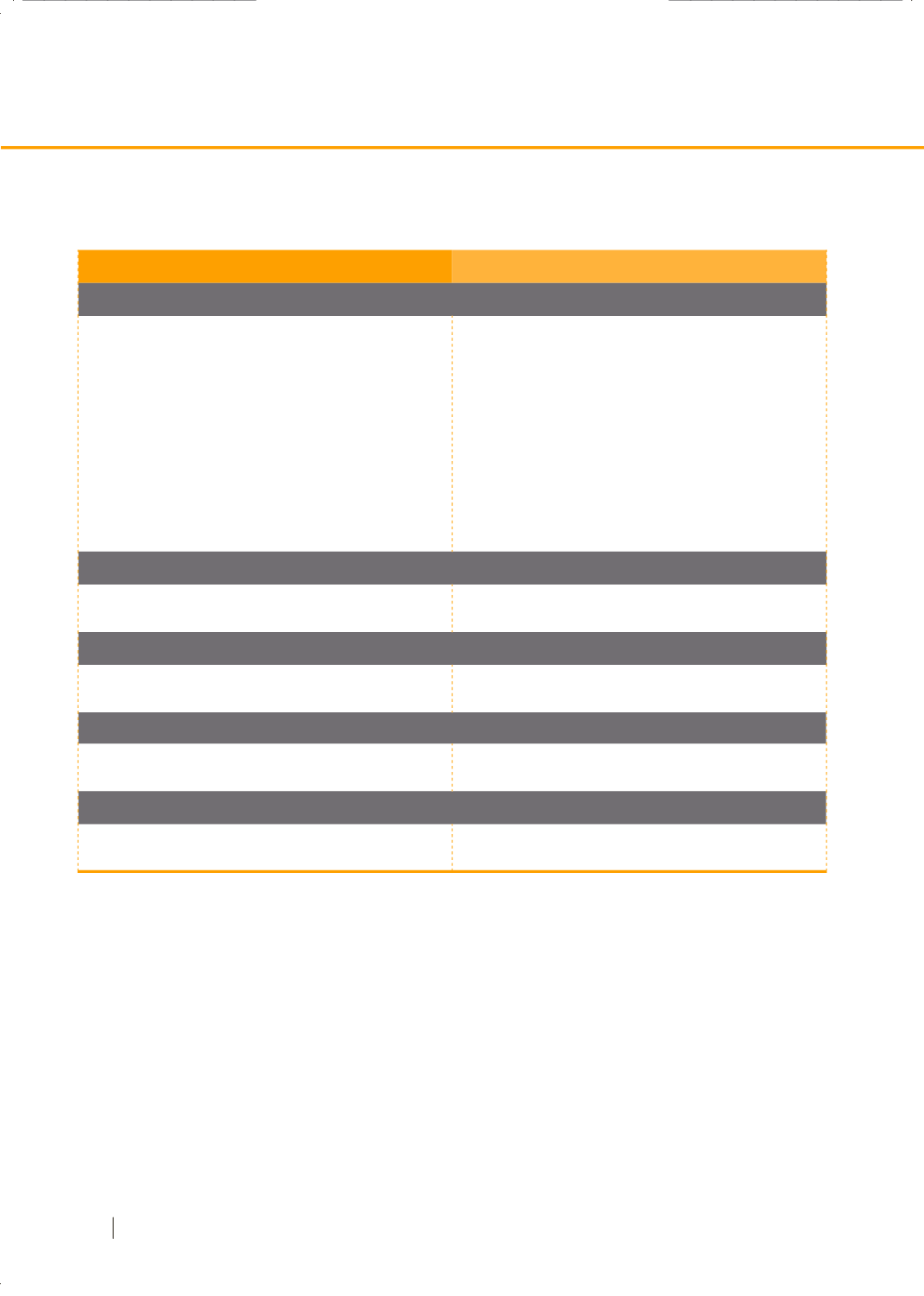

The investment policies framework regarding types and proportion of investments are as follows:

Type of investment

Proportion of total investment

1.

Investments in debt securities

Government securities, debentures or bonds of state

enterprises or entities incorporated by specific laws and

guaranteed by the Ministry of Finance

Unlimited (2014: Unlimited)

Fixed deposits or NCDs at commercial banks and

promissory notes of finance companies or financial

institutions incorporated by specific laws

Not to exceed 15% per institution (2014: Not to exceed

15% per institution)

Debentures or warrants of debentures and bills of exchange Not to exceed 5% per issuer (2014: Not to exceed

5% per issuer)

Investment units or warrants of investment units in

mutual funds invested in debt securities

Not to exceed 10% per mutual fund (2014: Not to exceed

10% per mutual fund)

2.

Investments in equity securities

Investment units or warrants of investment units in

mutual funds invested in equity securities

Not to exceed 25% per mutual fund (2014: Not to exceed

15% per mutual fund)

3.

Investments in property funds

Property funds

Not to exceed 10% of total investment (2014: Not to exceed

10% of total investments)

4.

Investments in foreign investment funds

Foreign investment funds

Not to exceed 20% of total investments (2014: Not to exceed

7.5% of total investments)

5.

Investments in gold funds

Gold funds

Not to exceed 3% of total investments (2014: Not to exceed

3% of total investments)

Investments in each asset management company should not to exceed 40% of total investments (2014: Not to exceed

40% of total investments).