128

Annual Report

2015

3. In 2008, invested in a non-retail fund which primarily

invests directly in businesses and industries which have potential

growth the majority of which was long-term investment. The fund

has an automatic redemption from the fourth year (2012).

The specific-purpose investments in 2. have a commitment

subscription for additional investment until the end of the contract

(Note 33).

As at 31 December 2015, Bank of Thailand bonds, foreign

bonds and debentures, which had coupon rates ranging from

4.17% - 6.00% per annum (2014: from 3.95% - 5.19%

per annum) and market yields ranging from 1.50% - 2.60%

per annum (2014: from 2.59% - 2.98% per annum).

Investments managed by private funds

As at 31 December 2015 investments in private funds are

managed by two asset management companies (2014: three

asset management companies). The investment policy for private

funds is subject to the SET’s regulations on deposits at financial

institutions and investment policies as disclosed in Note 4 -

Financial risk management. The Group presented investments

managed by private funds as short-term investments.

For the year ended 31 December 2015, the return

rates for investments managed by private funds ranged from

3.34% - 3.77% per annum (2014: from 3.82% - 5.13%

per annum).

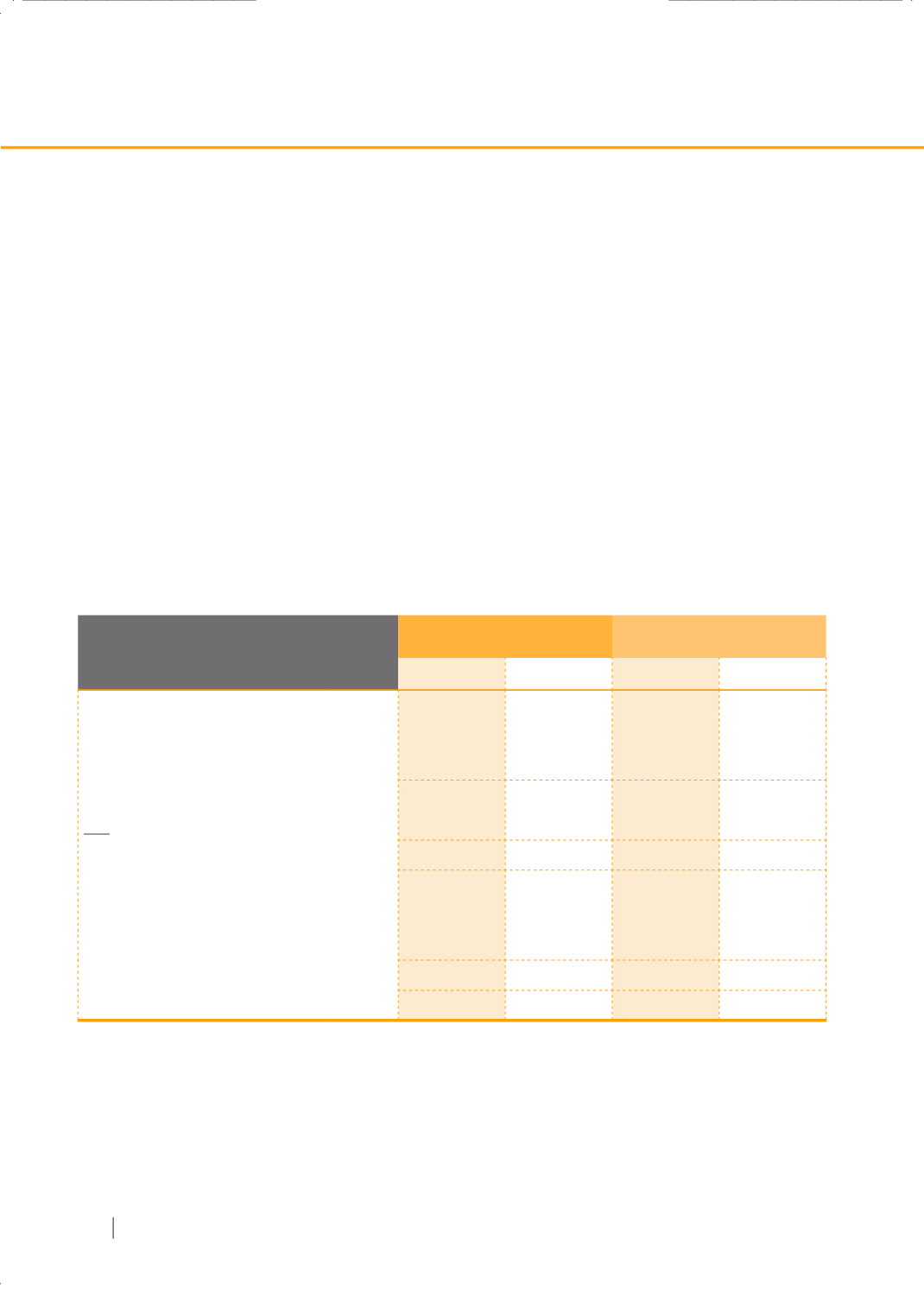

11. Accounts receivable and accrued income, net

Note

Consolidated

SET

2015

2014

2015

2014

Accounts receivable

Related parties

8

191

-

137

-

Other parties

83,228

93,337

44,141

47,346

83,419

93,337

44,278

47,346

Less Allowance for doubtful accounts

(19,041)

(19,014)

(8,910)

(8,883)

64,378

74,323

35,368

38,463

Accrued income

Related parties

8

571

577

145,238

151,417

Other parties

284,083

290,620

131,898

116,070

284,654

291,197

277,136

267,487

349,032

365,520

312,504

305,950

(Unit : Baht’000)