Annual Report 2014

58

In 2014, SET continued to provide co-location

service, that started in 2013, for any member company

interested in renting server space for submission of

trading instructions through SETNET3 network, a highly

efficient network, in line with the ISO27001 standard.

This service can save energy and reduce costs for the

capital market industry. Four firms have already used

this service.

In addition, SET is responsible for the IT data

management of key systems, controlling every step

of operation to ensure security, safety and service

flows, certified by ISO/IEC 27001, to further create

confidence among users.

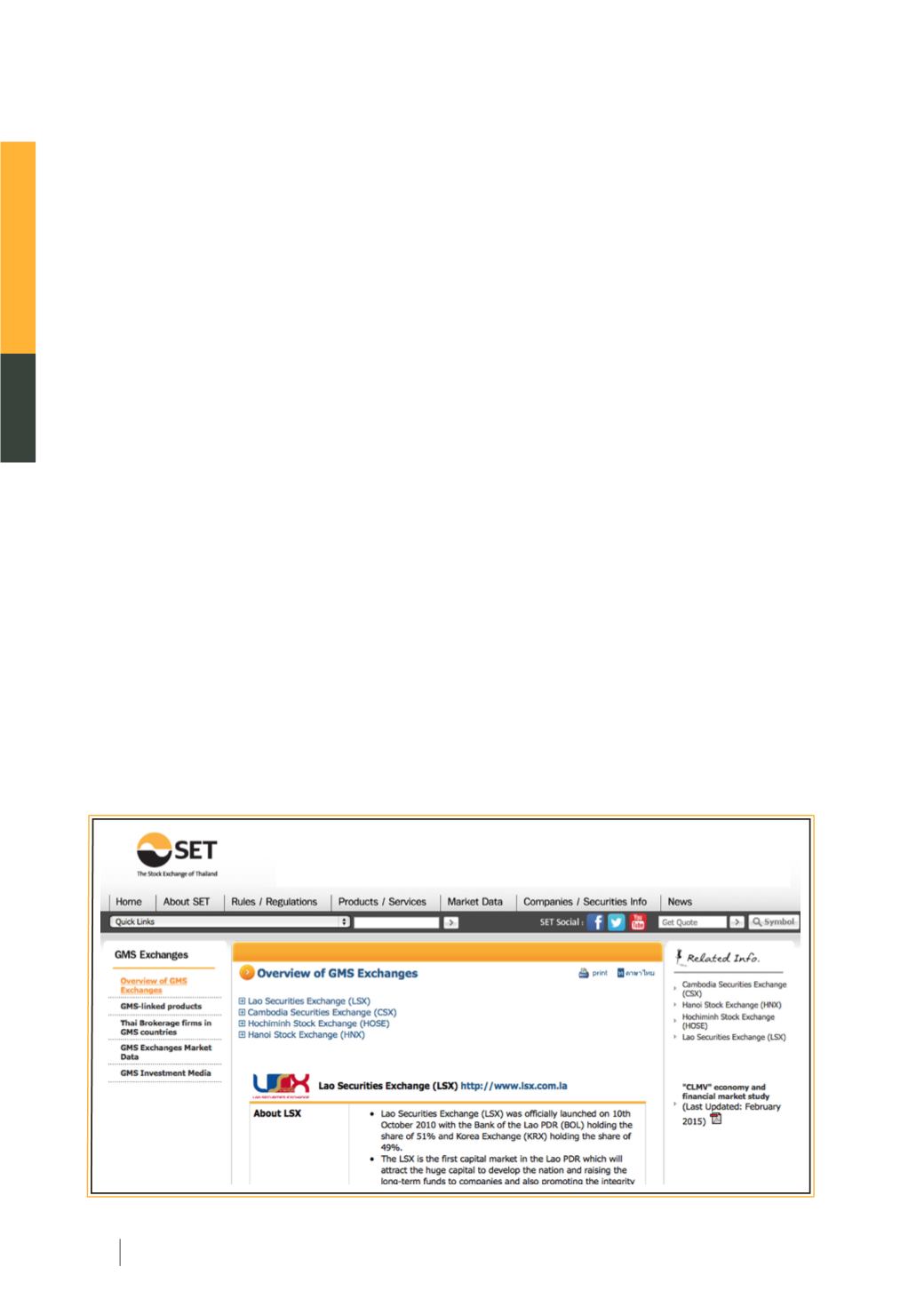

Development of data services on website

to support GMS cooperation

SET has developed a system to connect data among

the GMS countries, comprising the stock exchanges of

Cambodia, Hanoi, Hochiminh and Laos, to serve as the

GMS stock exchanges data center to facilitate investors.

Data on display will include trading transactions on

the GMS stock exchanges and investment channels.

Interested investors can view these via SET website.

Increase in settlement efficiency

of clearing house

In May 2014, the new clearing system was

launched. To increase competitive capabilities, Thailand

Clearing House Co., Ltd. (TCH), an affiliate of the

SET group, has developed a new clearing system

for futures contracts called SET CLEAR. It also

facilitates the development of new futures products to

cope with the market demand. The new system will

reduce operational procedures for members through

a straight through processing (STP) system, under

an integrated risk management that is efficient and

meets international standards. It can accommodate

the expansion of trading transactions and extension

of trading duration in the future.

Furthermore, TCH will develop one single platform to

accommodate settlement of equity and debt instruments

in preparation for business expansion and faster new

product development, enabling multi-market and

multi-currency settlement and depository services,

on top of the Thai baht denominated transactions.

These include the Pre-Settlement Matching System,

using STP via SWIFT. The new system will be ready

for use by Q2/2015.