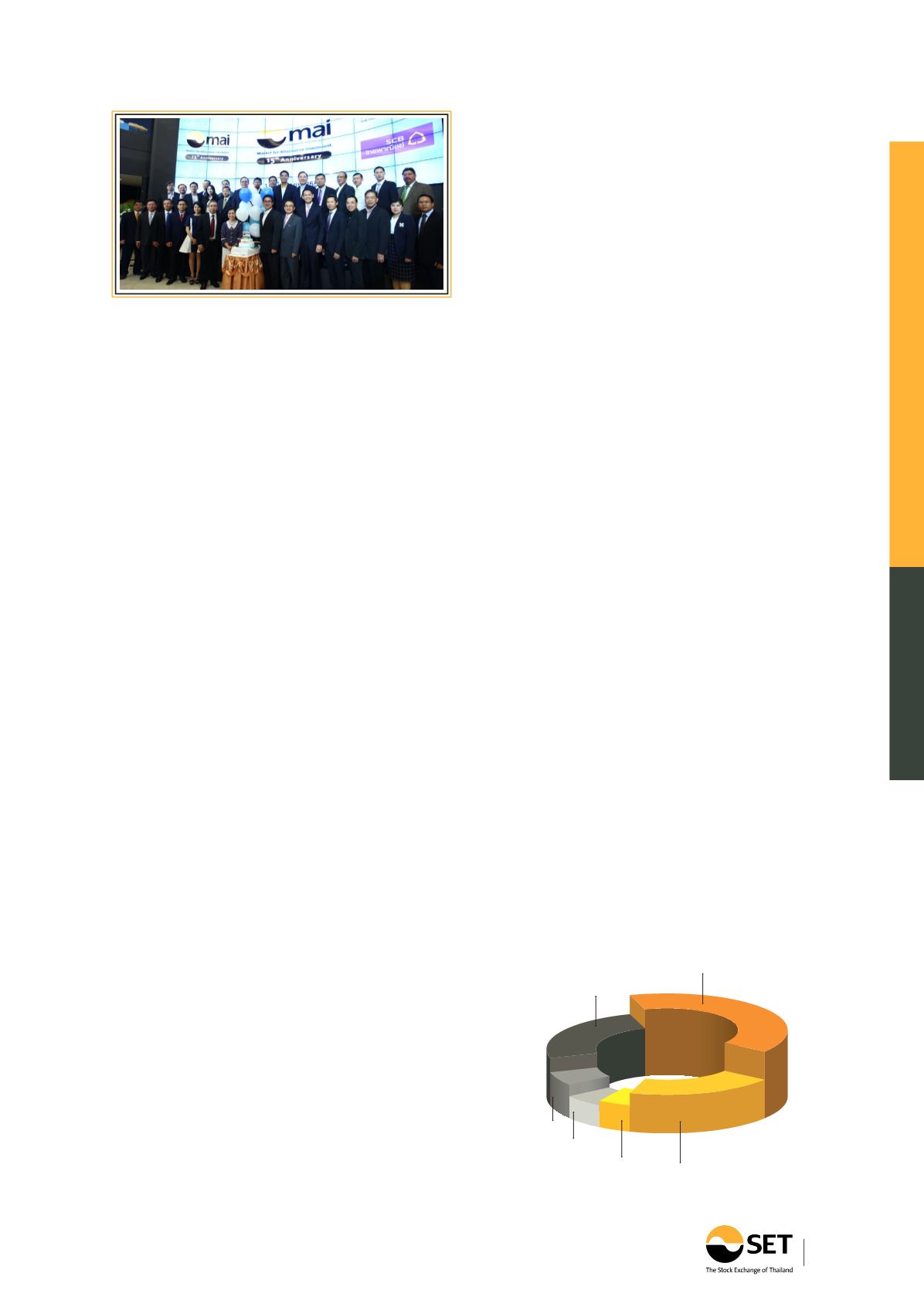

47

Information &

Communication Technology

Property

Derclopment

Property

Fund & REITS

Construction

Services

Media &

Publishing

Others

27%

40%

Fundraising value in 2012 - 2014

by sector (unit: percent)

18%

6% 5%

4%

The year 2014 also marked the success of mai

in serving as a fundraising venue for medium and

small-scale enterprises to expand and enhance business

opportunities in order to achieve sustainable growth.

There were 20 new listed companies raising funds via

IPO with total value of THB 9.92 billion, the highest

record in 15 years since mai’s inception. In addition,

it was the first year that the coverage of stock analysis

could extend to 51 mai-listed firms, the highest

number to-date, resulting from the signing of agreement

on April 2014 with 11 leading securities companies

to analyze securities listed on mai.

In addition, mai launched the classification of its

listed securities in eight industry groups, according

to the nature of business of each company, using the

same classification criteria as SET, which will reflect a

clearer overview of mai listed firms, starting from 2015.

Development of regulations facilitating

listing of foreign firms

SET has continuously cooperated with the Securities

and Exchange Commission (SEC) in developing

regulations to facilitate the listing of securities for foreign

companies. In fact, SET has already set the regulations to

facilitate the listing of foreign companies’ securities

that are currently trading in foreign markets (secondary

listing) since 2009, under the condition that the said

companies must have been listed on foreign stock

exchange markets for not less than three years, with

minimum market capitalization of THB ten billion.

In 2014, SET pushed forward the adjustment of

regulations for more flexibility, by taking out the minimum

requirement for listing duration in foreign market and

market capitalization, while maintaining the conditions

of the paid-up capital and performance at the same

level as the Thai listed firms.

Moreover, SET provided more options for foreign

companies to get listed in Thailand without prior listing

in foreign markets (primary listing), which will enable

competitiveness of Thailand’s stock market globally. It

is expected that SET will accept foreign company listing

in 2015. On top of that, foreign companies handling

infrastructure business can get their securities listed

in the form of infrastructure trust. SET and the SEC are

now drafting the regulations governing infrastructure trust

to promote fundraising for infrastructure development

in foreign countries, by getting their infrastructure trusts

listed on SET. The drafting regulations are expected to

be ready in Q1/2015.

Promotion of fundraising

and financial instruments

In 2014, listed companies on SET and mai

used financial instruments for fundraising, totaling

THB 166.88 billion, a slight increase from the year

before. This resulted from SET’s commitment in

creating understanding about financial instruments

among listed firms combined with the listed firms’

continuous information distribution to investors. There

was increasing number of listed firms in the second half

of 2014, due mainly to the more favorable condition

of the stock market, both in terms of SET Index and

securities trading liquidity. Among the listed firms

that wanted to increase capital, 47 percent of the

amount fundraised from the existing shareholders, 36

percent via private placement and 16 percent via other

fundraising methods, covering warrants, convertible

bonds, preferred bonds and dividend stocks.

Source: SETSMART