161

(Unit: Baht’000)

(Unit: Baht’000)

(Unit: Baht’000)

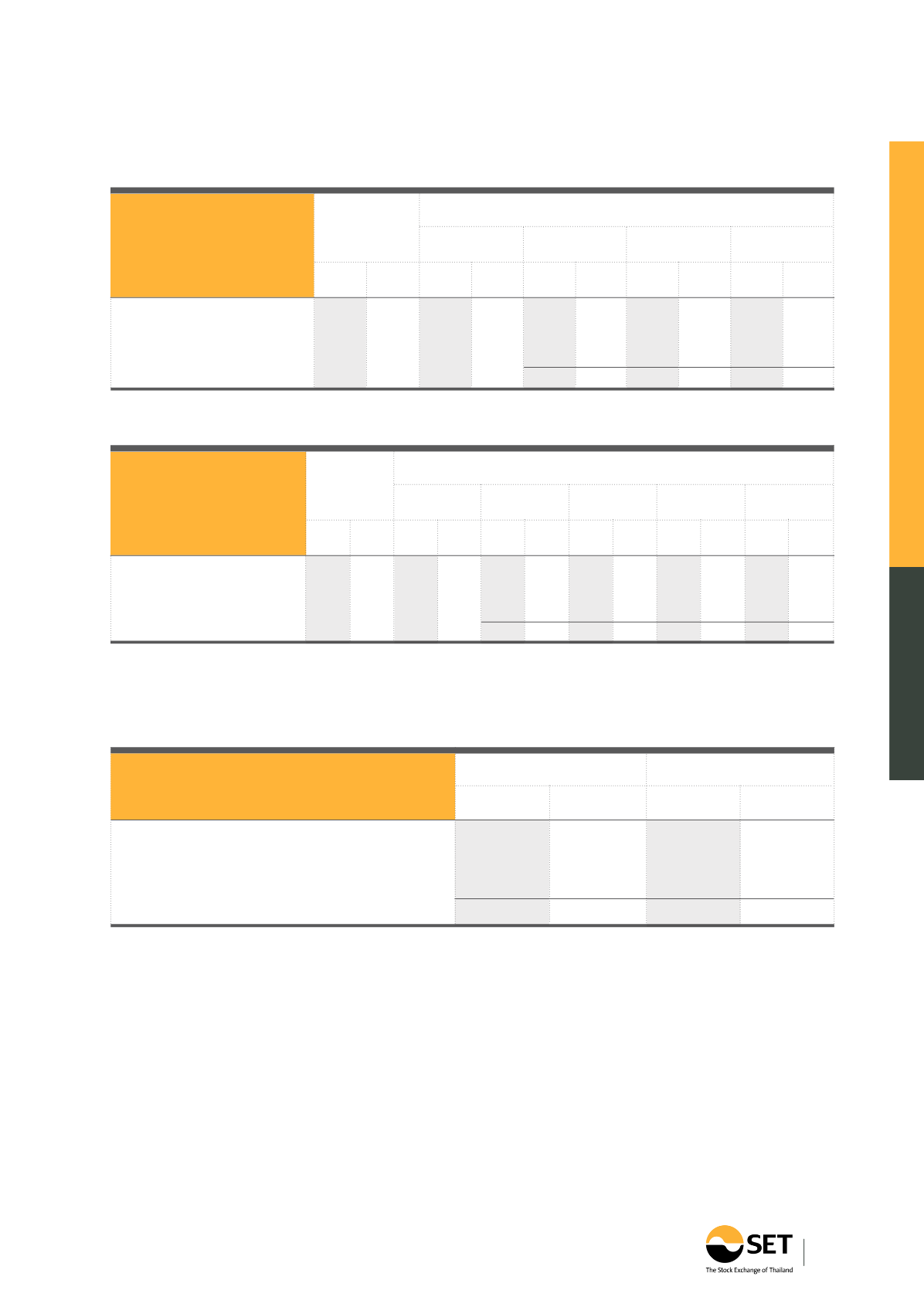

Investments in associates as at 31 December 2014 and 2013, and dividend income for the years then ended

were as follows:

2014

2014

2013

2013

Consolidated

SET

15. Long-term investments, net

2014

2014

2014

2013

2013

2013

Paid-up capital Costmethod, net Equity method

Consolidated

Ownership

interest

%

2014 2013

2014 2013

Dividend income

SET

2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013

Paid-up capital

Impairment

Cost method

At cost, net

Dividendincome

Associates

Clearing Fund

TSFC Securities Public Company Limited

14.03 15.18 1,307,134 1,176,471 100,000 100,000

-

- 100,000 100,000 -

-

40.65 24.66 1,549,126 1,016,740 679,015 300,000 (3,395) (3,395) 675,620 296,605 26,325

-

779,015 400,000 (3,395) (3,395) 775,620 396,605 26,325

-

14.03

15.18 1,307,134 1,176,471 100,000 100,000 188,975 183,495

-

-

40.65

24.66 1,549,126 1,016,740 675,620 296,605 693,067 325,441

-

-

775,620 396,605 882,042 508,936

-

-

Associates

Clearing Fund

TSFC Securities Public Company Limited

As at 31 December 2014, fixed deposit accounts

represented fixed deposits at banks which had maturities

over one year and carried interest at rates ranging from

3.28% - 4.00% per annum.

Cash at banks by M.O.U. is used as security for

housing loans provided to employees of the Group by

a bank under a Memorandum of Understanding.

As at 31 December, 2014, investments in general

mutual funds represented investments in fifteen open-

ended funds, which have a policy of emphasising

investment in equity securities of listed companies

(2013: 19 funds) gold fund seven funds (2013: 9 funds).

4,778,889 3,456,754 4,778,889 3,453,979

3,899,117 1,656,143 3,899,117 1,656,143

12,336

13,179

12,336

13,179

8,690,342 5,126,076 8,690,342 5,123,301

Available-for-sale investments

Held-to-maturity debt securities

General investments

Ownership

interest

%