Annual Report 2014

156

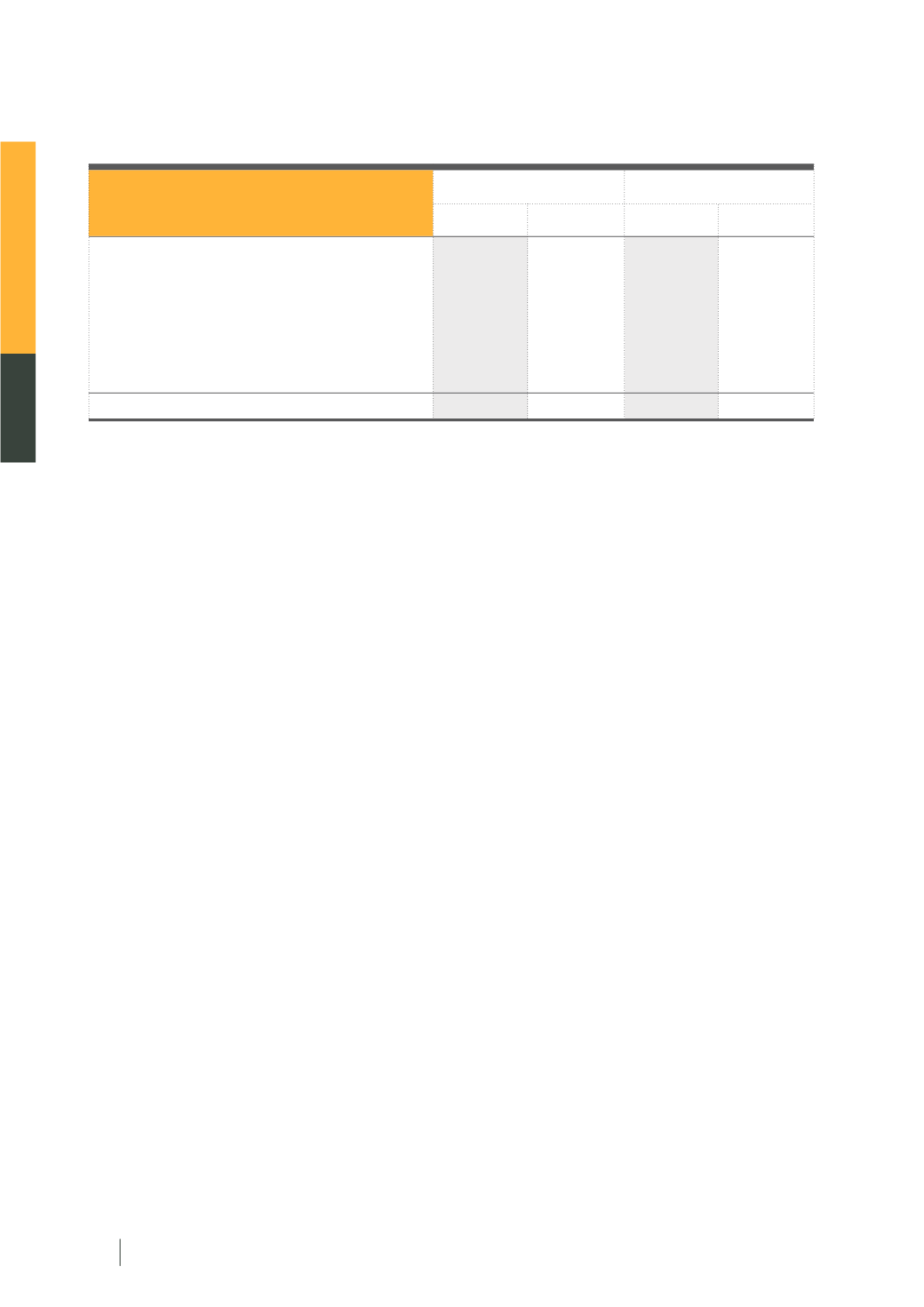

Movements of short-term investments for the years ended 31 December 2014 and 2013 were as follows:

2014

2014

2013

2013

Consolidated

SET

Investments managed by the SET

As at 31 December 2014, fixed deposit accounts

represented fixed deposit accounts at banks which

had maturities not over 12 months and carried interest

at rates ranging from 2.10% - 3.30% per annum

(2013: from 2.38% - 4.10% per annum).

As at 31 December 2014, investments in money

market funds represent investments in three open-ended

funds (2013: three open-ended fund). The investment

policy emphasises investments in short-term debt

securities.

As at 31 December, 2014, investments in specific-

purpose funds represented investments in three open-

ended venture capital funds (2013: three open-ended

venture capital funds). The details are as follows:

1) In 2005, invested in an investment fund established

by the government to strengthen and facilitate the

recovery of businesses which suffered from the tsunami.

The specific-purpose fund has a policy of investing

in securities of businesses involved in the tourism

industry that had been affected by the tsunami in the

six southern provinces. The fund has an automatic

redemption from the sixth year (2011) unless approval is

obtained from the investment committee for redemption

before the redemption restriction term.

2) In 2007, invested in a non-retail fund, which

primarily invests directly in energy, alternative and

renewable energy firms and businesses that support

the government’s energy policies. The fund is an open-

ended fund and has an automatic redemption from

the sixth year (2013) when the fund disposes of its

assets, and then no further re-investment.

3) In 2008, invested in a non-retail fund which

primarily invests directly in businesses and industries

which have potential growth the majority of which was

long-term investment. The fund has an automatic

redemption from the fourth year (2012).

The specific-purpose investments in 2) have a

commitment subscription for additional investment

until the end of the contract (Note 33).

As at 31 December 2014, government bonds, Bank

of Thailand bonds, state enterprise bonds and debentures,

which had coupon rates ranging from 3.95% - 5.19%

per annum (2013: from 3.00% - 4.90% per annum)

and market yields ranging from 2.59% - 2.98% per

annum (2013: from 2.77% - 2.91% per annum).

Investments managed by private funds

As at 31 December 2014 investments in private

funds are managed by three asset management companies

(2013: three asset management companies). The

investment policy for private funds is subject to the

SET’s regulations on deposits at financial institutions and

investment policies as disclosed in Note 3 - Financial

risk management. The Group presented investments

managed by private funds as short-term investments.

For the year ended 31 December, 2014, the return

rates for investments managed by private funds ranged

from 3.82% - 5.13% per annum (2013: from

3.45% - 4.33% per annum).

10,632,814 7,275,683 10,586,614 7,238,663

5,058,083 4,475,664 5,058,083 4,475,664

(6,111,593) (4,476,499) (6,065,393) (4,439,479)

(1,748,011)

3,368,057 (1,748,011)

3,321,857

4,013

5

4,013

5

2,530

(10,096)

2,530

(10,096)

7,837,836 10,632,814 7,837,836 10,586,614

Opening balance

Purchases

Disposals

Classification of investments (Note15)

Unrealised gain (loss) on available-for-sale securities

(Allowance for impairment losses) reversal

Closing balance

(Unit: Baht’000)