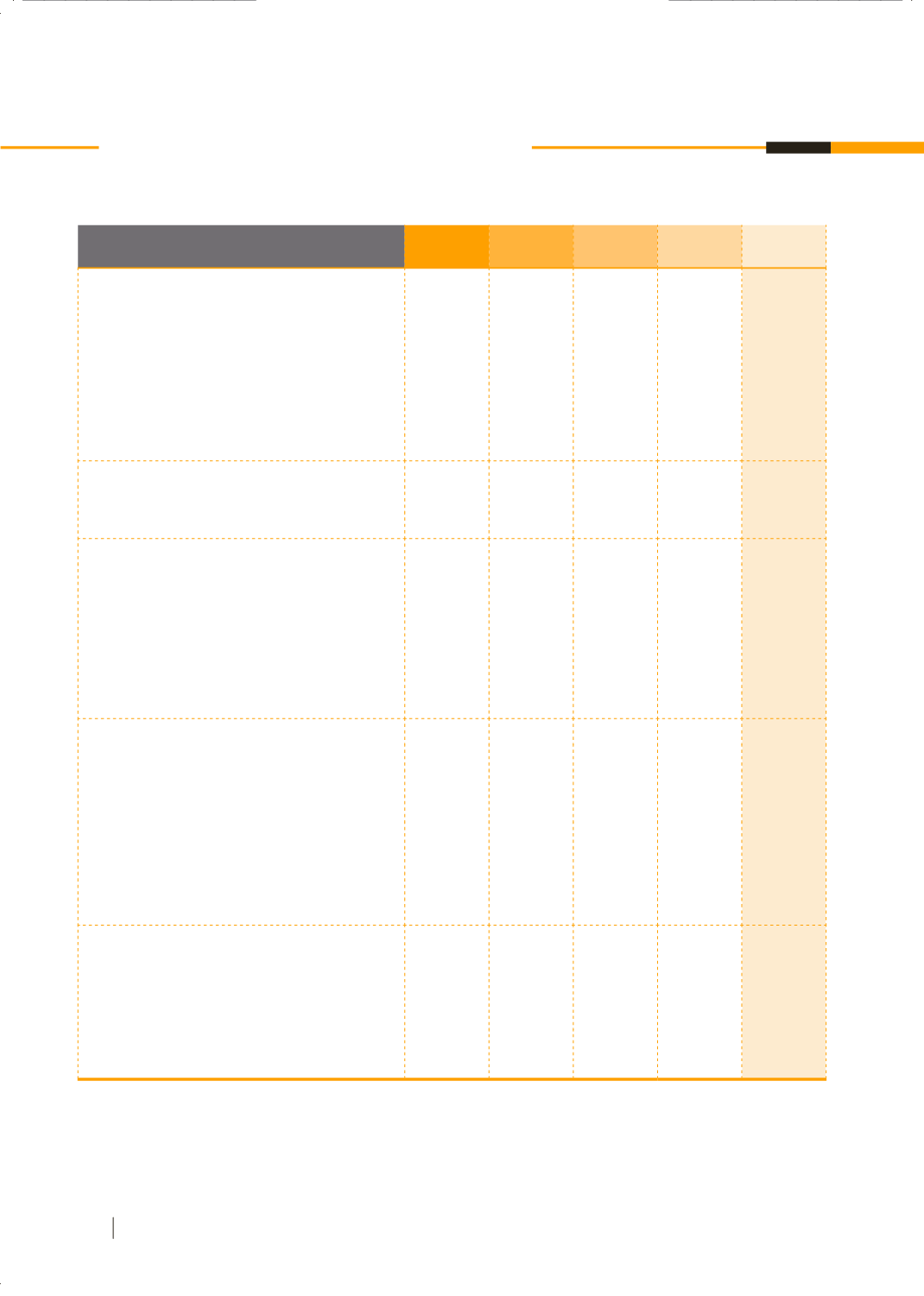

SET group

financial highlights

(InMillionBaht)

2015

2014

2013

2012

2011

Consolidated statements of revenues and

expenses

Total revenues

5,215

5,237

5,302

4,499

4,135

Operating revenues

4,518

4,201

4,309

3,365

3,245

Investment income, net

492

871

821

982

752

Other income

205

165

172

152

138

Total expenses

3,335

3,082

2,976

2,599

2,545

Revenues over expenses, net

1,382

1,535

1,661

1,365

1,110

Consolidated statements of cashflows

Net cash provided by operating activities

636

1,051

1,096

621

512

Net cash provided by (used in) investing activities

(331)

(1,503)

(329)

118

(651)

Consolidated statements of financial position

Total current assets

1

17,326

18,012

22,965

16,077

16,502

Long-term investments

9,263

8,690

5,126

8,315

5,329

Total assets

36,136

34,452

34,039

29,937

27,019

Total current liabilities

1

10,760

10,346

11,515

8,596

7,494

Total liabilities

12,747

12,213

13,386

10,451

9,151

Fund balances

23,389

22,239

20,653

19,486

17,868

Key financial ratio

Revenue growth (%)

(0.42)

(1.23)

17.85

8.80

0.83

Operating revenue growth (%)

7.55

(2.51)

28.05

3.70

22.96

Expenses to revenues ratio (%)

63.95

58.85

56.13

57.77

61.55

Net profit margin

2

(%)

26.50

29.31

31.33

30.34

26.84

Return on fund balance (%)

5.91

6.90

8.04

7.01

6.21

Current ratio (Times)

1.61

1.74

1.99

1.87

2.20

Debt to fund ratio (Times)

0.54

0.55

0.65

0.54

0.51

1

Other current assets and other current liabilities

included margin deposits and benefits at the same

amount. (as the guarantee for derivative contracts

of the clearing house)

Assets / payables of margin deposits and benefits

8,830

8,054

9,362

6,810

6,053

2

Net profit margin calculated by revenues over

expenses, net / total revenues

14

Annual Report

2015