20

Annual Report

2015

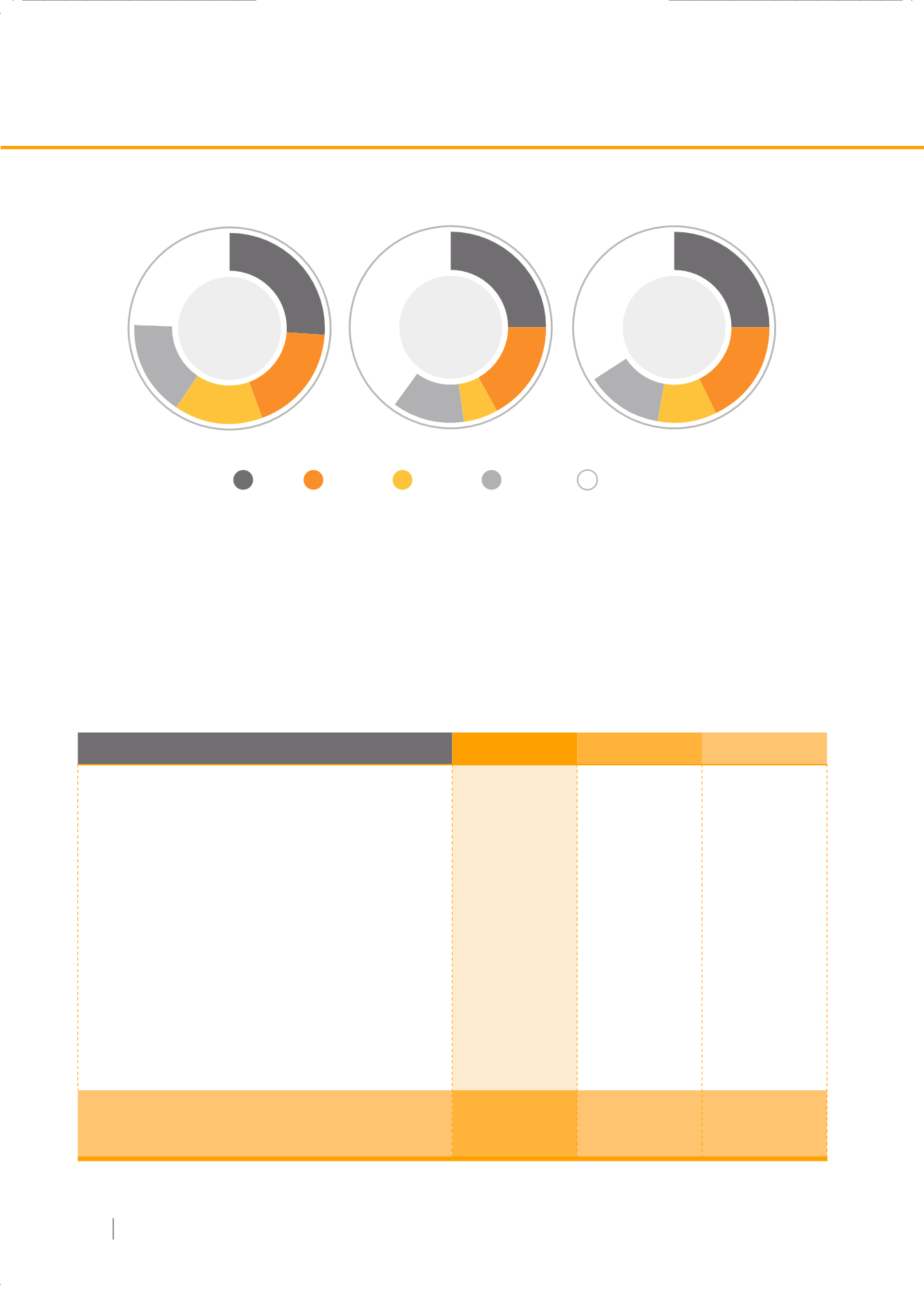

Derivatives Trading

The derivatives market trading activities rose favorably. In

2015, the average daily trading volume was up 35.86 percent

from 2014 with 199,749 contracts per day. The increase was

mainly due to a rise in trading activities of the SET50 Index

Futures and SET50 Index Option contracts. The number of

derivatives trading accounts also grew significantly reaching

113,575 accounts, up by 12.84 percent in 2015.

Average daily trading volume of TFEX

Products

2015

2014

2013

SET 50 Index Futures

110,142

58,790

23,218

SET 50 Index Options

1,264

444

267

Single Stocks Futures

81,103

80,100

34,351

50 Baht Gold Futures

546

974

2,253

10 Baht Gold Futures

5,469

5,319

6,757

Oil Futures

0

133

190

Silver Futures

0

0

5

Interest rate Futures

0

0

0

USD Futures

1,118

1,265

977

Sector Index Futures

0

0

0

Total

199,642

147,025

68,013

change % (y-o-y)

35.86

116.20

55.21

Source: SETSMART

(no. of contracts)

Source: SETSMART

Trading value of SET and mai by stock type (units: THB million, percent)

NON SET 100

SET 31-50

SET 51-100

SET 11-30

SET 10

2013

2014

2015

12,214

(24%)

7,975

(16%)

50,329

9,261

(18%)

8,172

(18%)

13,250

(26%)

15,226

(34%)

7,630

(15%)

5,403

(12%)

5,566

(13%)

4,221

(10%)

7,501

(17%)

18,008

(40%)

3,012

(6%)

11,543

(25%)

11,117

(25%)

45,466

44,302