148

Annual Report

2015

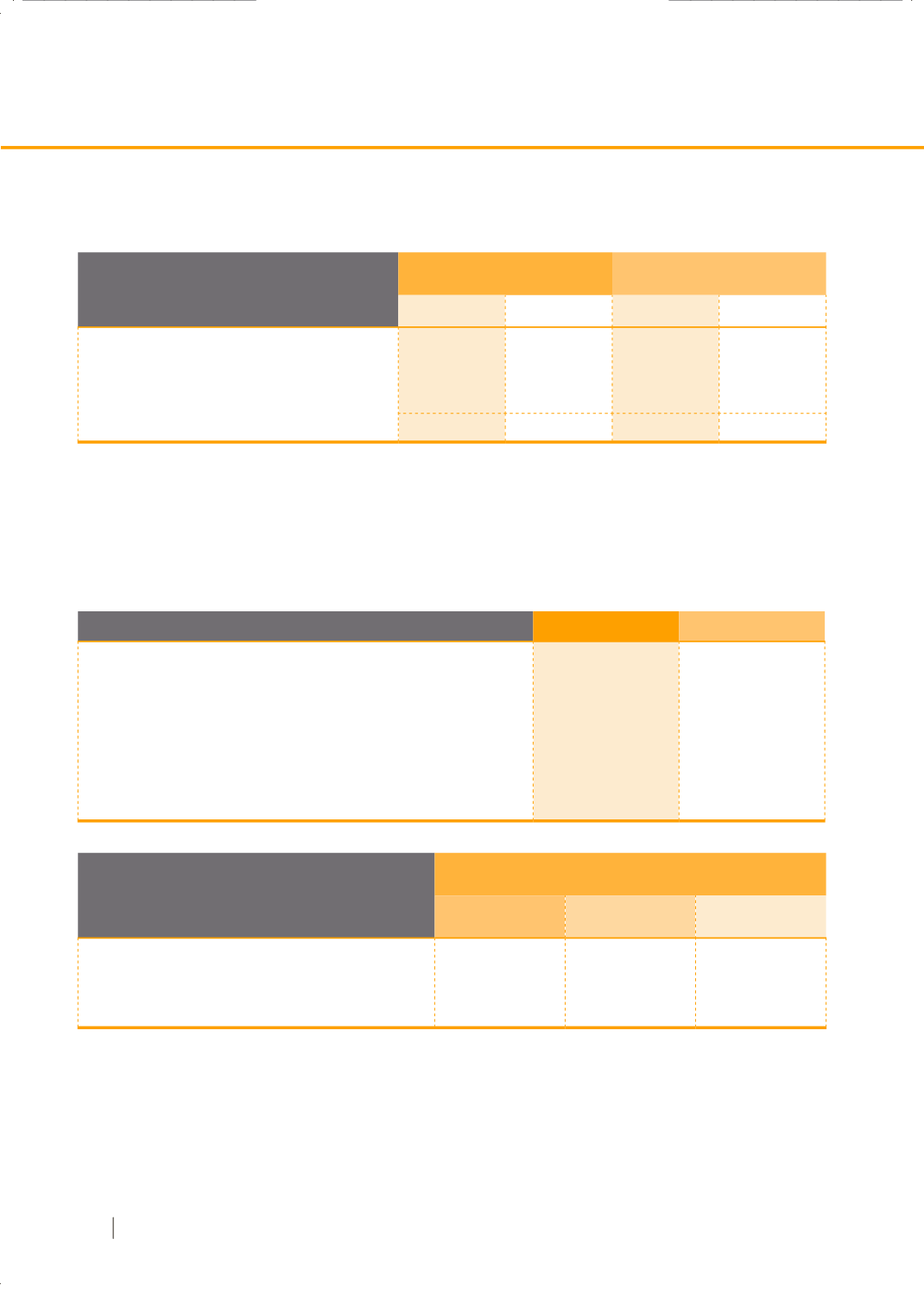

For the years ended 31 December 2015 and 2014, the amounts recognised in the statement of comprehensive revenues

and expense are as follows:

Consolidated

SET

2015

2014

2015

2014

Current service costs

15,945

20,176

15,945

20,176

Interest costs

7,151

7,641

7,151

7,641

Actuarial gain

-

567

-

567

23,096

28,384

23,096

28,384

For the year ended 31 December 2014, the Group recognised actuarial gain amounted for Baht 0.57 million in the

statement of comprehensive revenue and expense. The Group did not retrospective adjust the prior year financial statements since

the amount was not material to the financial statement. The change in the accounting policy has disclosed in Note 3.

For the years ended 31 December 2015 and 2014, the principal actuarial assumptions used were as follows:

2015

2014

Discount rate as of 31 December

3.60%

3.60%

Salary increase rate - permanent employees

5.00% - 10.00% 5.00% - 10.00%

Salary increase rate - contract employees

4.50%

4.50%

Average turnover rate

0.00% - 13.00% 0.00% - 13.00%

Pre-retirement mortality rate

3.00%

3.00%

Retirement age

60 years old

60 years old

Impact on defined benefit obligation

Change in

assumption

Increase in

assumption

Decrease in

assumption

Discount rate

1% Decrease by 11% Increase by 13%

Salary growth rate

1% Increase by 15% Decrease by 13%

Turnover growth rate

20% Decrease by 8% Increase by 9%

The above sensitivity analyses are based on a change in

an assumption while holding all other assumptions constant.

In practice, this is unlikely to occur, and changes in some

of the assumptions may be correlated. When calculating the

sensitivity of the defined benefit obligation to significant actuarial

assumptions the same method (present value of the defined

benefit obligation calculated with the projected unit credit

method at the end of the reporting period) has been applied

as when calculating the pension liability recognised within the

statement of financial position.

(Unit : Baht’000)