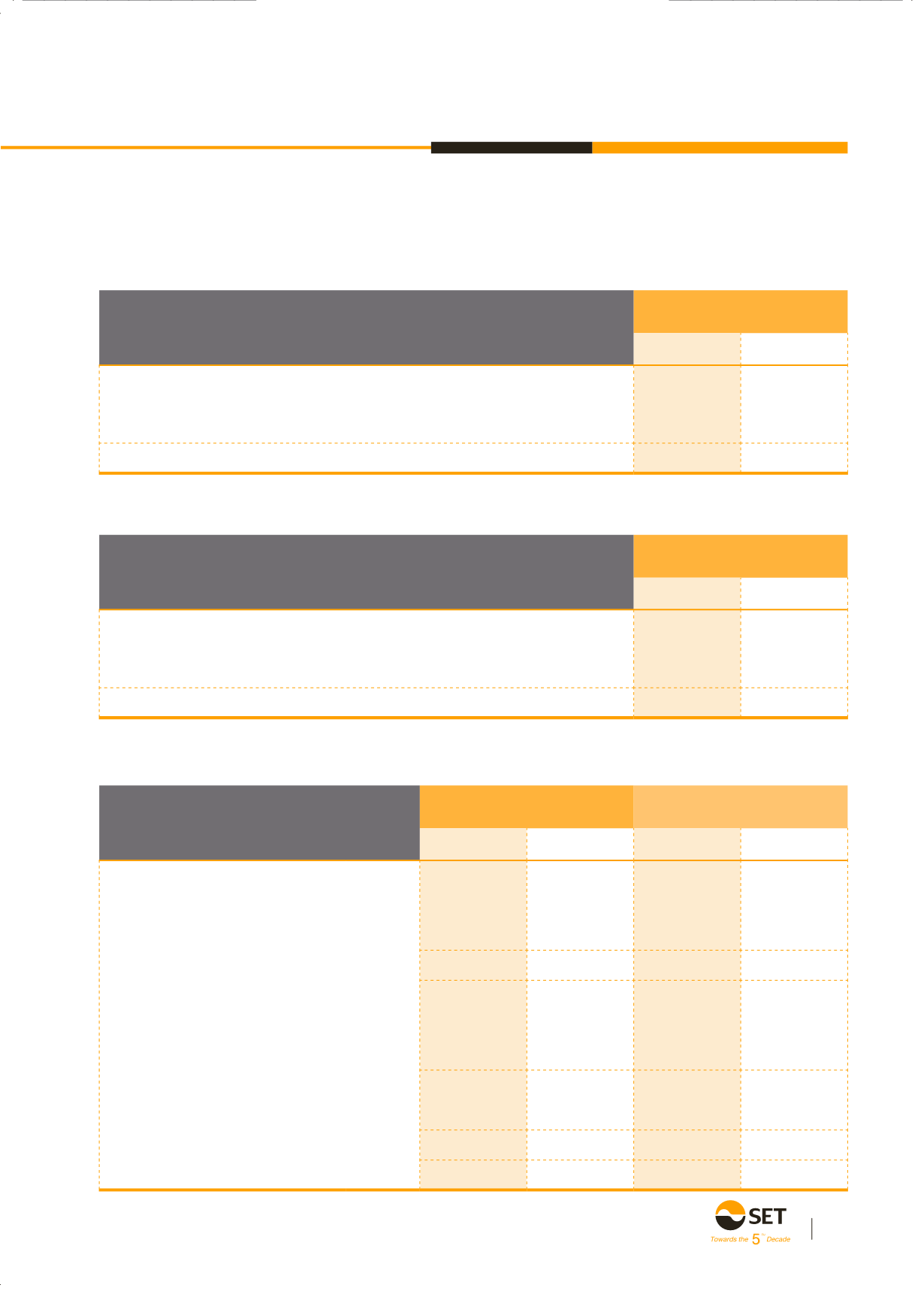

145

Consolidated

2015

2014

Opening balance

2,021

1,953

Charged/(credited) to revenues over expenses

5

68

Tax charged/(credited) directly to fund balance

-

-

Closing balance

2,026

2,021

Consolidated

2015

2014

Opening balance

920

237

Charged/(credited) to revenues over expenses

271

647

Tax charged/(credited) directly to fund balance

-

36

Closing balance

1,191

920

The gross movement of the deferred income tax account is as follows:

Deferred tax asset

Deferred tax liabilities

Note

Consolidated

SET

2015

2014

2015

2014

Accounts payable

Joint venture entity

8

1,300

9,567

1,300

9,567

Other parties

103,002

402,594

102,547

400,514

104,302

412,161

103,847

410,081

Accrued expenses

Subsidiaries

8

-

-

1,331

172

Joint venture entity

8

45,285

887

45,285

887

45,285

887

46,616

1,059

Other parties

1,076,645

1,187,586

1,059,459

1,169,497

1,121,930

1,188,473

1,106,075

1,170,556

1,226,232

1,600,634

1,209,922

1,580,637

(Unit : Baht’000)

(Unit : Baht’000)

(Unit : Baht’000)

21. Accounts payable and accrued expenses