Annual Report 2014

34

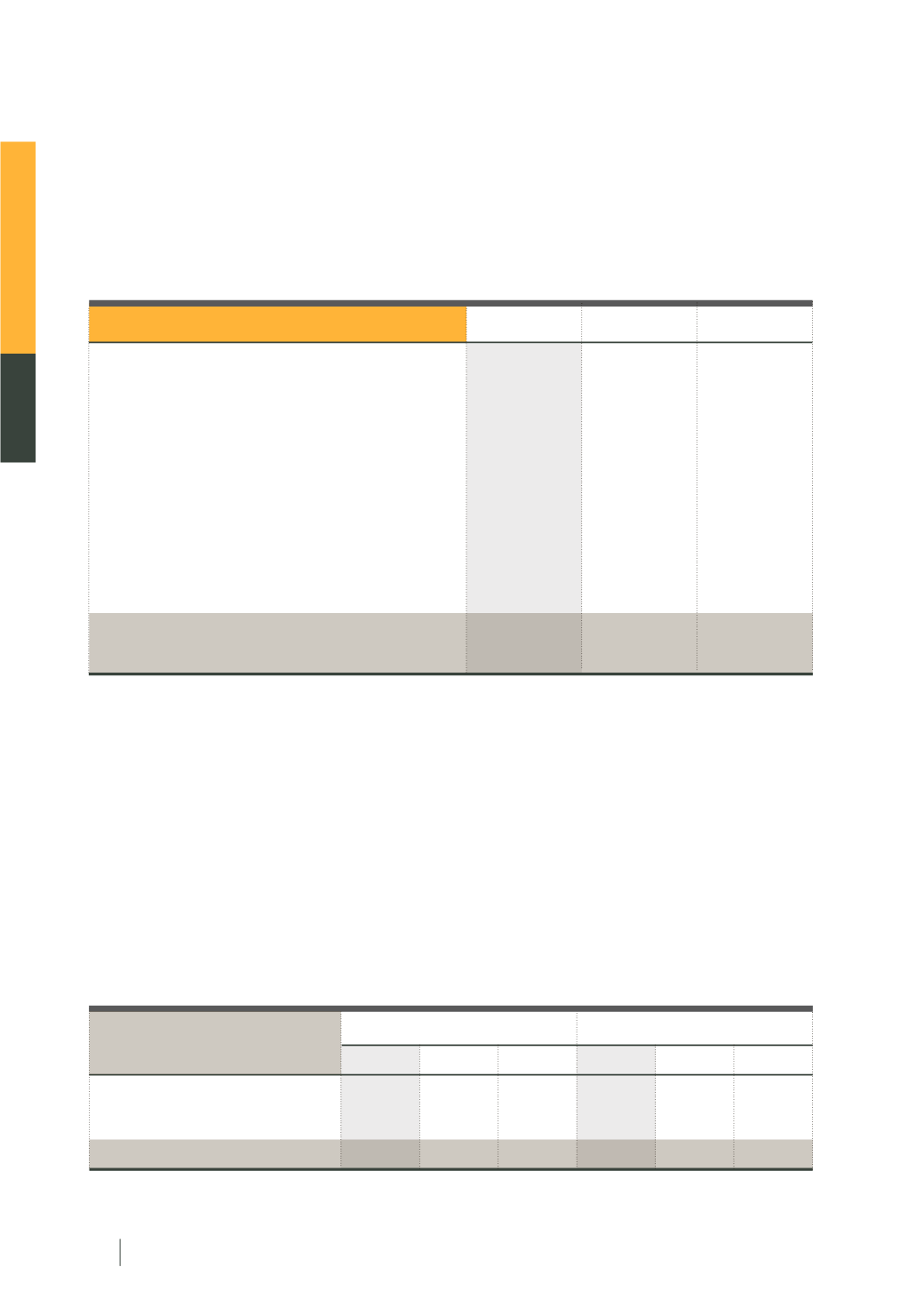

2012

52,467

257,936

310,403

2012

24

133

157

2013

191,600

166,010

357,610

2013

38

178

216

2014

113,990

166,880

280,870

2014

37

159

196

The derivatives market activity also rose favorably.

In 2014, the daily average trading volume surged to

147,026 contracts per day, up by 116.2 percent from 2013. The increase was mainly due to an increase in trading activities

of single stock futures and the modification of SET50 futures contract to a smaller contract size in May 2014. Number

of derivatives trading investors also grew significantly, increased to 100,650 accounts, up by 14.78 percent in 2013.

Daily average trading volume of TFEX (unit: contracts)

Source: SETSMART

Equity capital raising activity was very active in 2014. Initial public offerings (IPOs) continued to be the highest

in the region for two consecutive years.

Equity capital raising in both SET and mai accounted for THB 280.9 billion

(USD 8.5 billion) in 2014, down by 21.46 percent from the previous year. Of which, the initial public offerings

amounted to THB 114.0 billion (USD 3.5 billion), or THB 304.8 billion (USD 9.2 billion) in terms of market

capitalization. This was bolstered by the launch of the Impact Growth Real Estate Investment Trust (IMPACT),

Thailand’s first Real Estate Investment Trust (REIT), of THB 15.7 billion (USD 476 million). Moreover, listed

companies raised funds of about THB 166.9 billion (USD 5.1 billion) in secondary offerings.

Source: SETSMART

Capital raising of SET and mai

*calculated by IPO price multiplied by the number of newly issued equities)

Derivatives Trading

Equity Capital Raising

Initial public offering

Secondary offering

Total

Number of companies

Value* (unit: THB million)

Products

SET 50 Index Futures

SET 50 Index Options

Single Stocks Futures

50 Baht Gold Futures

10 Baht Gold Futures

Oil Futures

Silver Futures

Interest Rate Futures

USD Futures

Sector Index Futures

Total

Trading volume growth (y-o-y)

2012

16,467

221

8,849

4,267

10,601

603

60

0

2,751

4

43,823

6.51

2014

58,790

444

80,100

974

5,319

133

0

0

1,265

0

147,026

116.20

2013

23,218

267

34,351

2,253

6,757

190

5

0

977

0

68,017

55.21