171

1,953

2,018

68

(65)

-

-

2,021

1,953

1,384,092 1,412,610

2,021

1,953

(920)

(237)

1,101

1,716

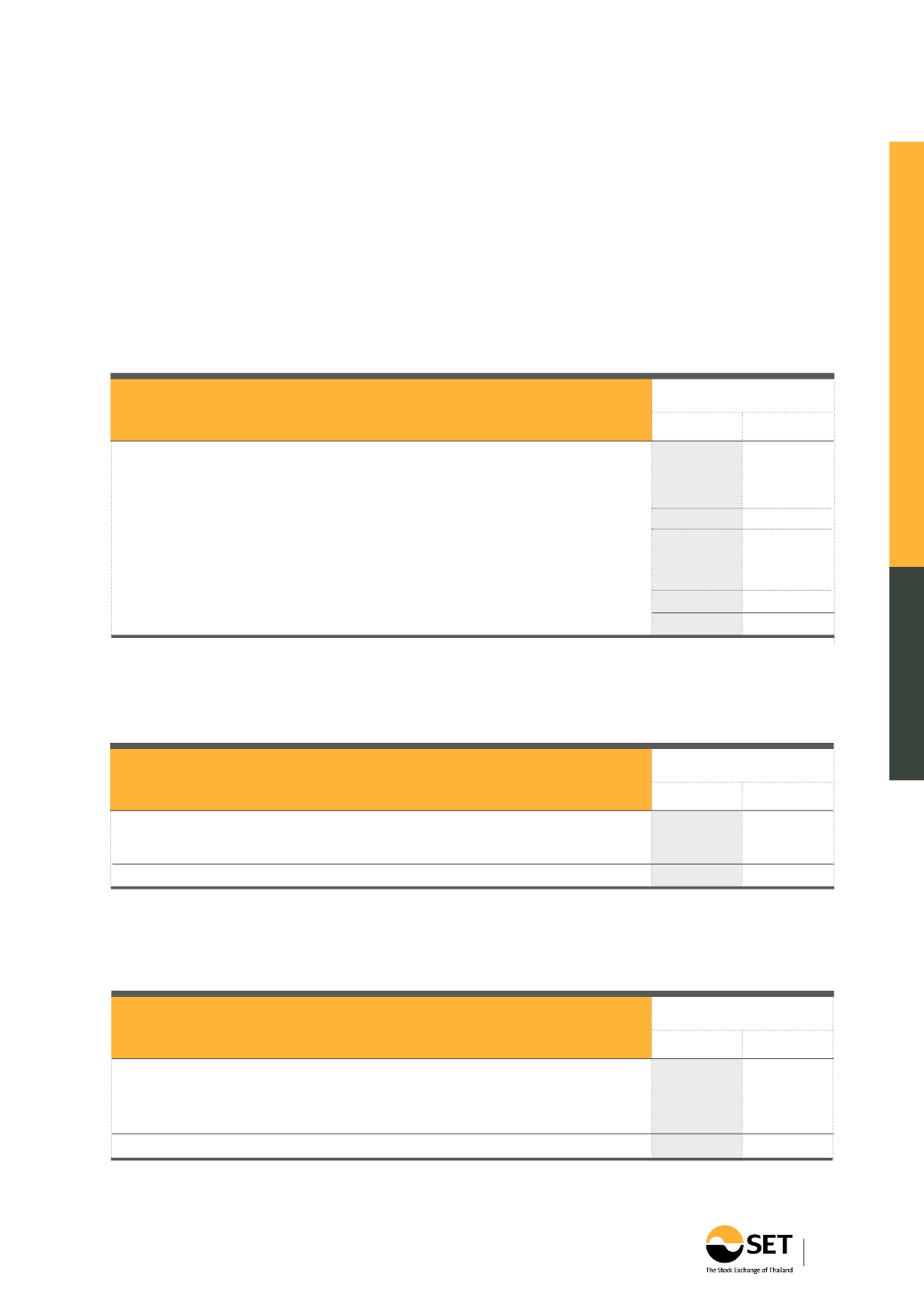

As at 31 December 2014 and 2013, assets for clearing system protection and benefits payables consist of:

The gross movement of the deferred income tax account is as follows:

Deferred tax asset

Investments managed by private fund

Investments in private fund are managed by

1 asset management company (2013: 1 company).

The investments policy of private fund is reference

to the TCH’s regulations in relation to deposits with

20. Deferred income taxes

financial institution and company’s investment policies.

For the year ended 31 December 2014, the investment

in private fund have return rates ranging from 3.17% -

4.95% per annum (2013: from 3.29% - 3.31% per

annum).

Deferred tax assets

Deferred tax liabilities

Deferred income taxes, net

Opening balance

Charged/(credited) to profit or loss

Tax charged/(credited) directly to fund balance

Closing balance

2014

2013

Consolidated

2014

2013

Consolidated

835,000

935,000

8,934

11,937

843,934

946,937

470,712

409,321

69,446

56,352

540,158

465,673

Securities Deposit and benefits

Contributions

Benefits (semi-annually distribute to members)

Clearing fund and benefits

Contributions

Benefits

2014

2013

Consolidated

(Unit: Baht’000)

(Unit: Baht’000)

(Unit : Baht’000)