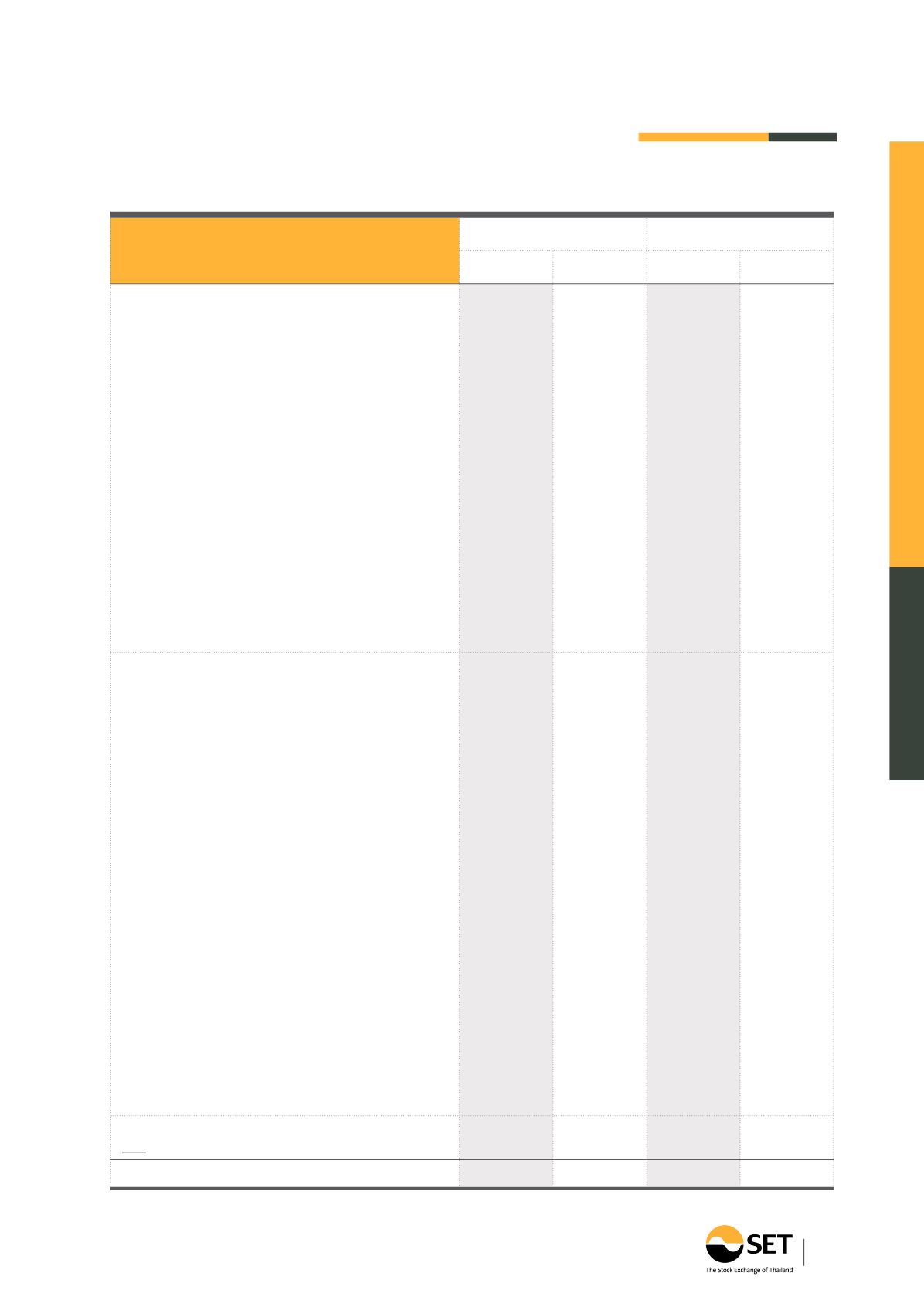

135

1,648,151

1,793,232

1,483,220

1,576,320

16, 17

208,240

189,101

205,890

186,340

27

(847,832)

(816,734)

(1,226,965)

(1,225,544)

25

(14,601)

(15,125)

(14,601)

(15,125)

25

(1,197)

(993)

-

-

27

(2,530)

6,691

(2,530)

6,691

10

332

(1,124)

(35)

(800)

23

32,757

24,252

32,757

24,252

16

(83)

4,185

(83)

4,185

(129)

(450)

(129)

(438)

13

(3,692)

(1,453)

-

-

14

(20,487)

(11,076)

-

-

998,929

1,170,506

477,524

555,881

1,308,203 (2,551,760)

-

-

(78,300)

7,541

(86,666)

50,713

364,894

(127,400)

103,768

(56,709)

24,511

4,911

(4,008)

(3,802)

(33,677)

(12,160)

(33,677)

(12,160)

(6,965)

(58,498)

-

-

-

(127)

-

(127)

(1,308,203)

2,551,760

-

-

256,252

159,182

252,437

162,233

9,478

5,616

26,797

14,930

(310,608)

87,880

(13,422)

(29,928)

(28,518)

(8,714)

-

-

14,196

6,028

14,196

6,028

5,122

7,961

-

-

23

(10,589)

(9,822)

(10,589)

(9,822)

(16,698)

(3,079)

(16,698)

(3,079)

1,188,027

1,229,825

709,662

674,158

(136,787)

(134,085)

-

-

1,051,240 1,095,740

709,662

674,158

The Stock Exchange of Thailand and its Subsidiaries

For the year ended 31 December2014

Statements of Cash Flows

(Unit: Baht’000)

The accompanying notes are an integral part of these consolidated and entity financial statements.

Notes

2014

2013

2014

2013

Consolidated

SET

Cash flows from operating activities

Revenues over expenses before income tax expense

Adjustments for

Depreciation and amortisation

Investment income, net

Income derived from Securities Investor

Protection Fund, net

Income derived from Derivatives Investor

Protection Fund, net

Impairment losses of investments (reversal)

Doubtful debts expenses (reversal)

Provision for employee benefits

Adjust work in process to expenses (revenues)

Gain on disposals of assets

Share of profit of investments in

jointly-controlled entity (net of income tax)

Share of profit of investments in associates

(net of income tax)

Changes in operating assets and liabilities

(Increase) decrease in operating assets

Assets for margin deposits and benefits

Accounts receivable and accrued income

Other current assets

Assets for clearing system protection and benefits

Securities Investor Protection Fund

Derivatives Investor Protection Fund

Refundable deposits

Increase (decrease) in operating liabilities

Margin deposits and benefits payables

Accounts payable and accrued expenses

Fees received in advance

Other current liabilities

Assets for clearing system protection and

benefits payables

Contributions and benefits to Securities Investor

Protection Fund

Contributions and benefits to Derivatives Investor

Protection Fund

Employee benefits paid

Other non-current liabilities

Cash flows generated from operations

Less Income tax paid

Net cash generated from operating activities