|

|

|

|

The Stock Exchange of Thailand (SET) Group facilitates businesses at all sizes across sectors in raising equity capital and is a wealth creation venue where matches investor diverse needs and their risk profiles through SET, Market for Alternative Investment (mai) and LiVE Exchange (LiVEx). The group also provides investors with trading venues for derivatives products through Thailand Futures Exchange (TFEX) and will offer market venue for token products via Thai Digital Assets Exchange (TDX).

Listing destinations for companies

One of ASEAN’s most preferred IPO markets

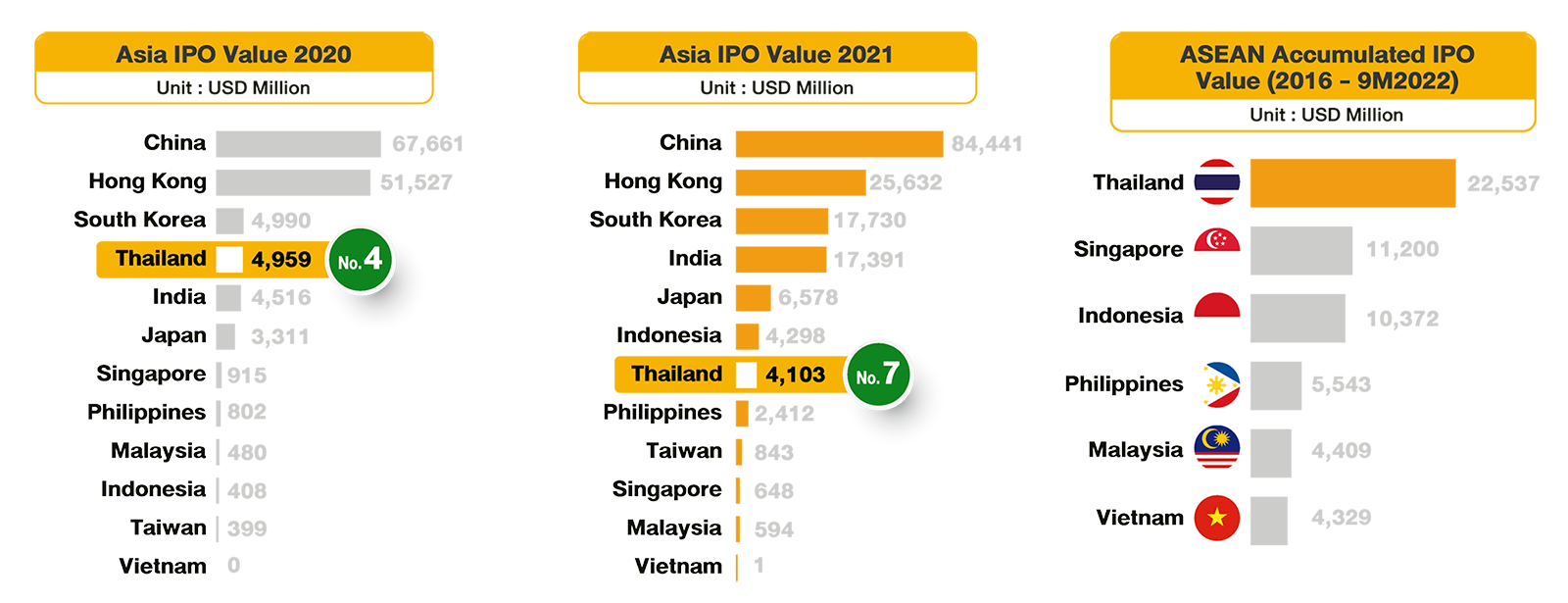

SET together with mai ranked the fourth biggest initial public offering (IPO) market in Asia with IPO value of USD 4.96 billion in 2020 and the seventh with IPO value of USD 4.10 billion in 2021. During 2016 to the first nine months of 2022, the Thai bourse was the top ASEAN IPO venue with a combined value of USD 22.54 billion, more than doubling the second at USD 11.20 billion.

Funding source for listed companies

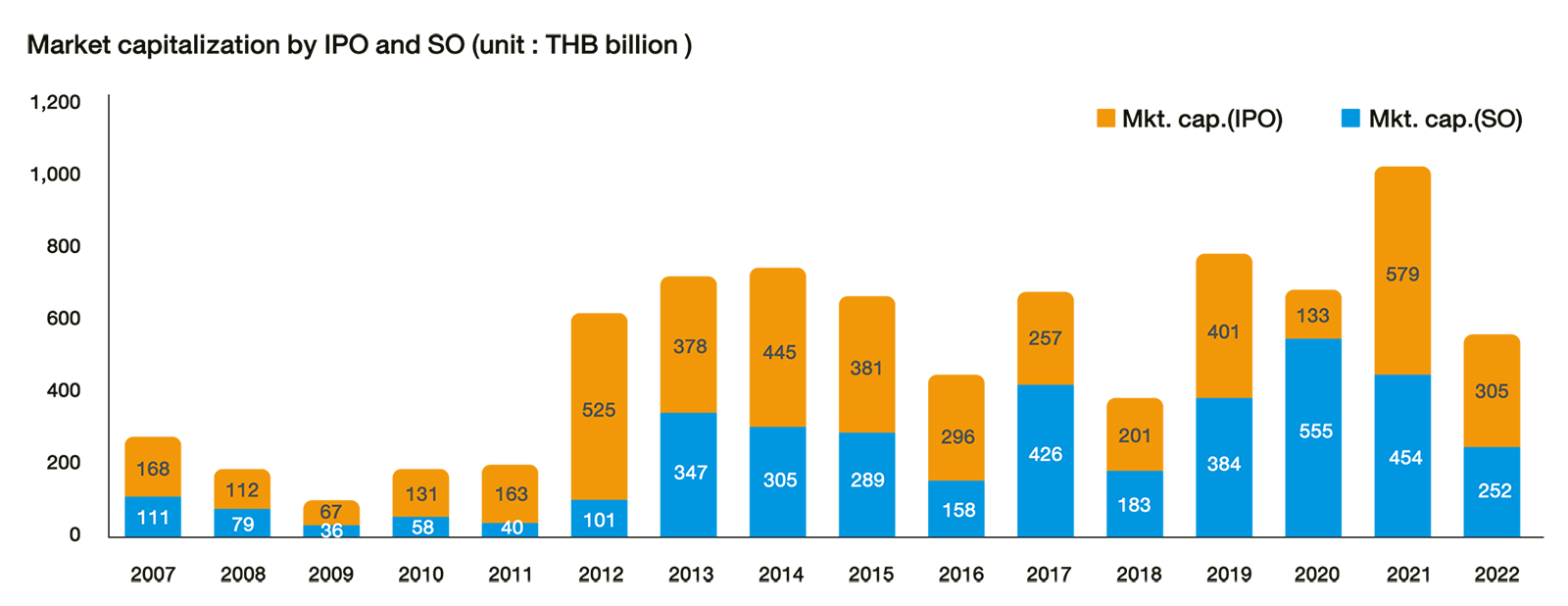

SET is consistent on building up supplies both Initial Public Offering (IPO) and Secondary Offering (SO).

(Data as of September 2022)

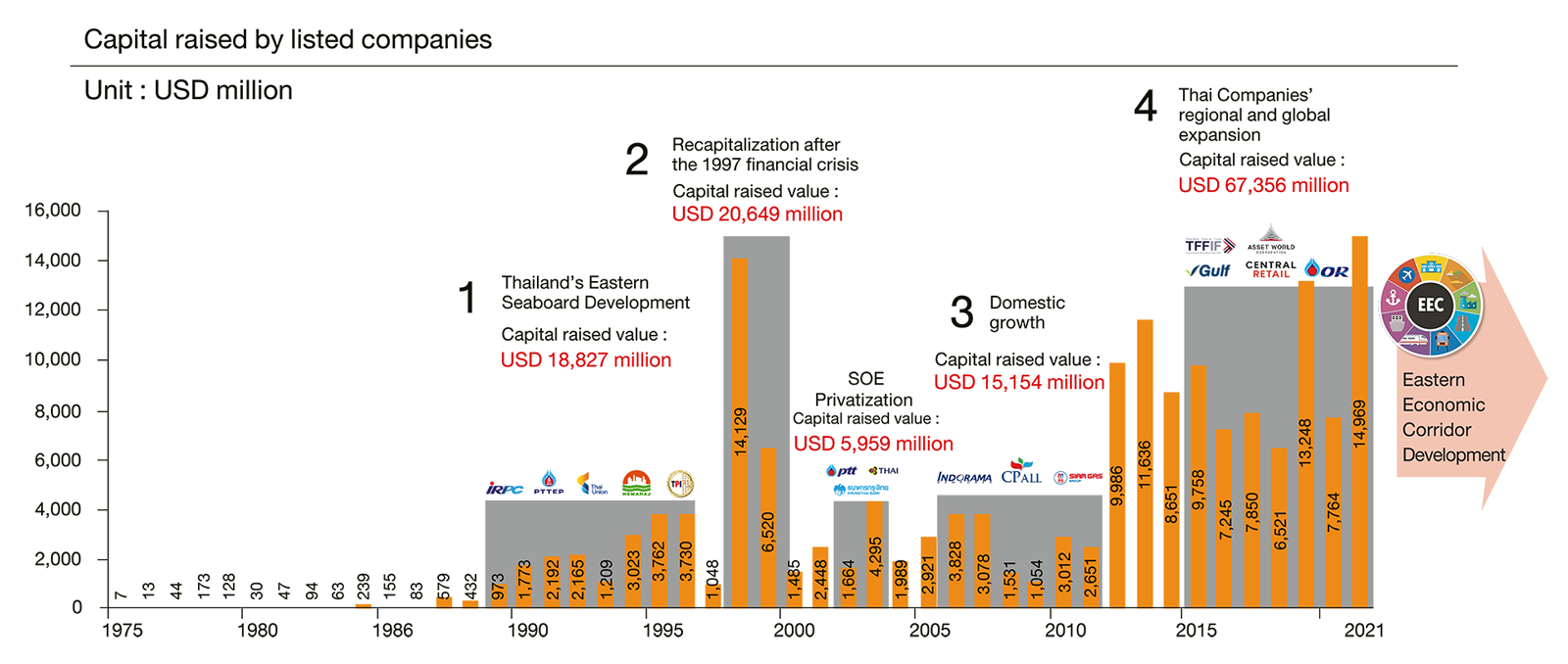

Fund raising pillar for the Thai economy

SET has been the main source of funding during the periods of opportunities and challenges facing the country over the past decades. Thai listed companies raised USD 67.36 billion from stock market during 2015-2021.

10 target industries in crosshairs

SET promotes listing of 10 target industries in accordance with the national strategy and 4 technology and innovation development industries to support the government's s-curved industry policy.

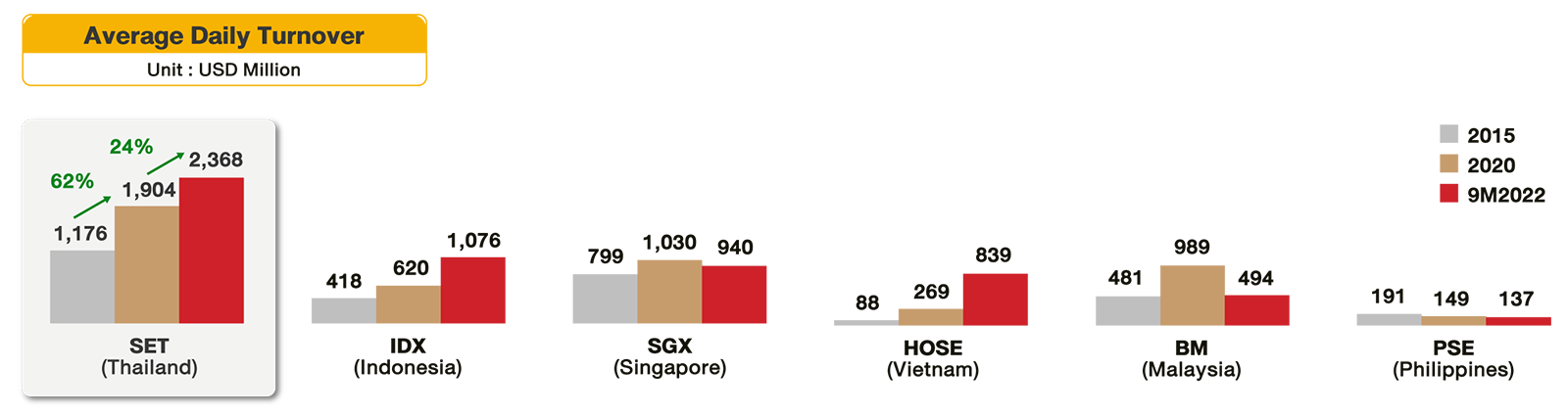

ASEAN’s most liquid stock market

SET along with mai is heading for the 11 consecutive years of being the most liquid stock exchange in ASEAN, with the average daily trading value of around USD 2.37 billion for the January-to-September period.

ASEAN’s third largest stock exchange by market cap

The Thai stock market was the third largest bourse in ASEAN with the total market capitalization of USD 522 billion as of September 2022.

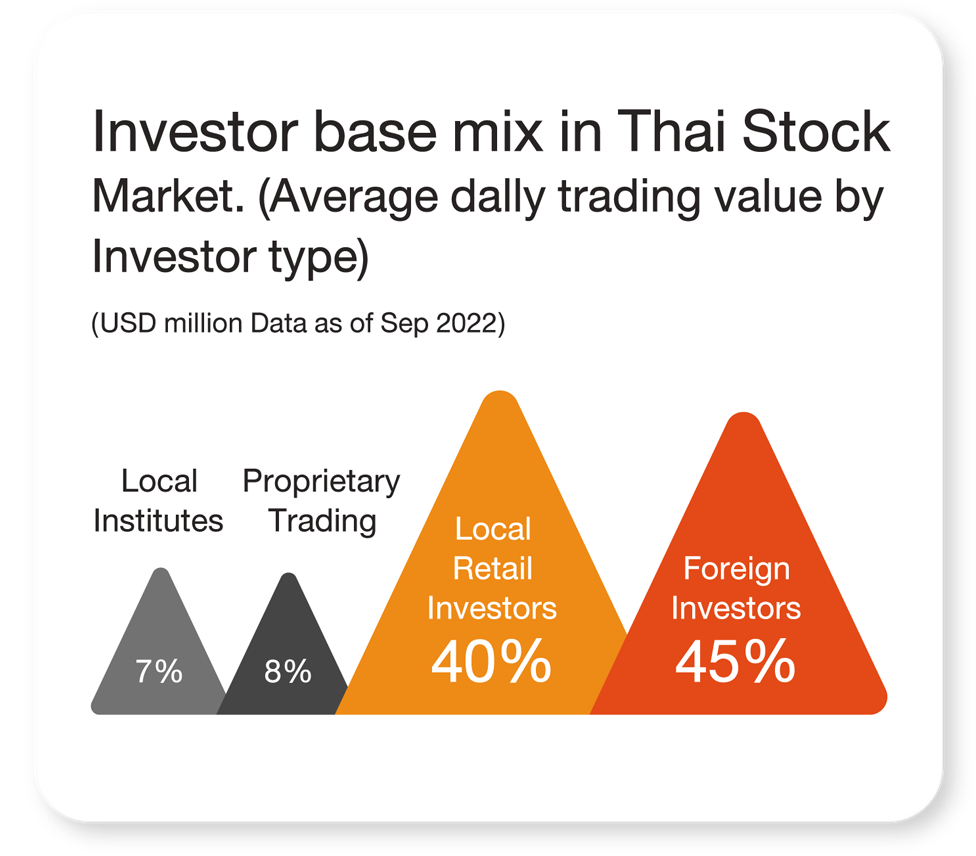

Diversified investor base

Foreign investors had a 45 percent share in the Thai stock market’s average daily trading value, followed by local retail investors at 40 percent. The good mix helps stabilize the stock market from the selling spree of a particular type of investors.

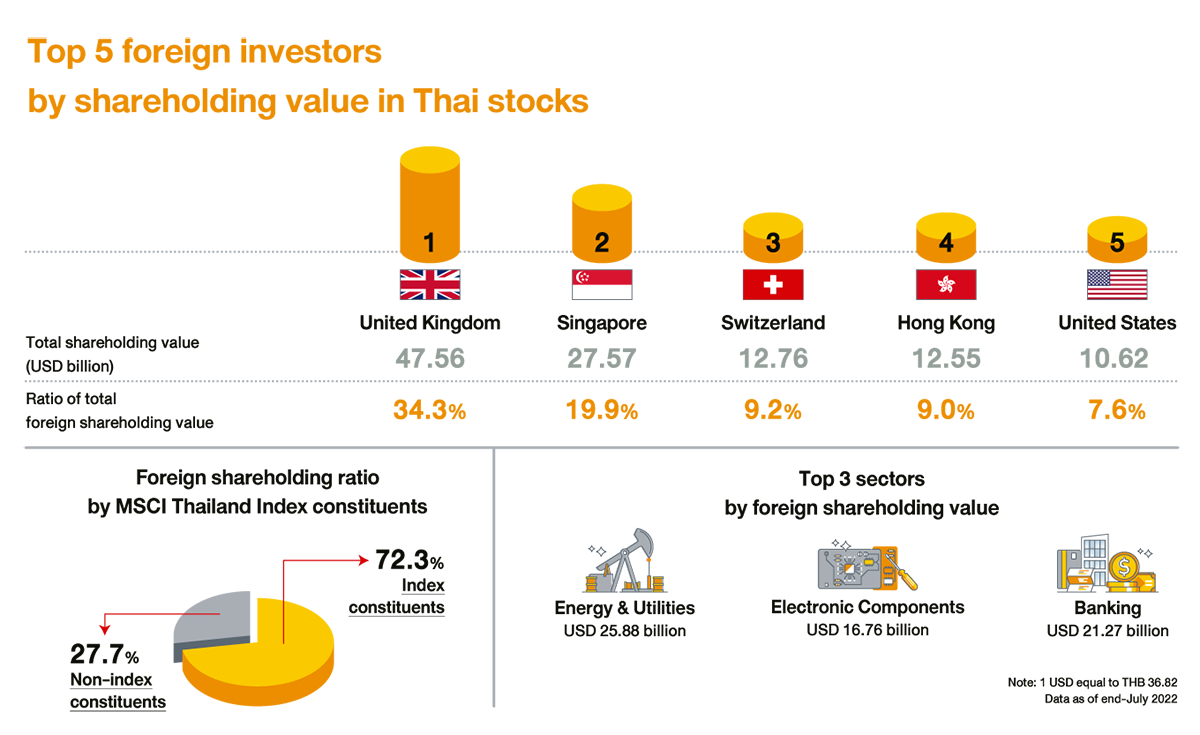

The biggest foreign investors in Thai stock market

Foreign investors' shareholding value hit a four-year high at USD 138.78 billion in July 2022, with investors from the United Kingdom, Singapore, Switzerland, Hong Kong and the United States holding the highest amount in descending order.

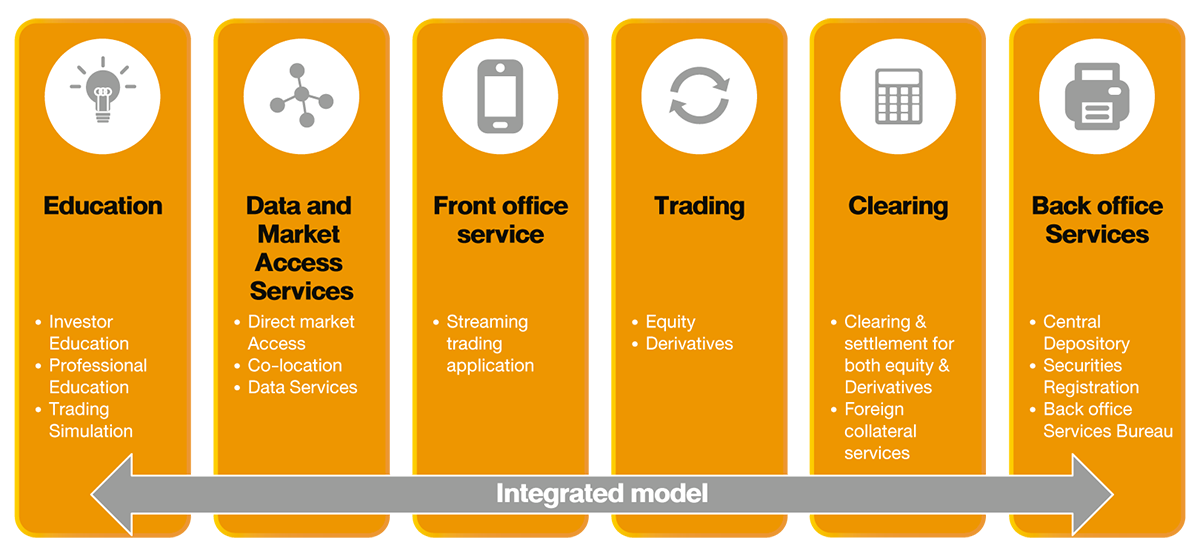

Full board services

SET provides full services to facilitate industry from pre-to-post trading.

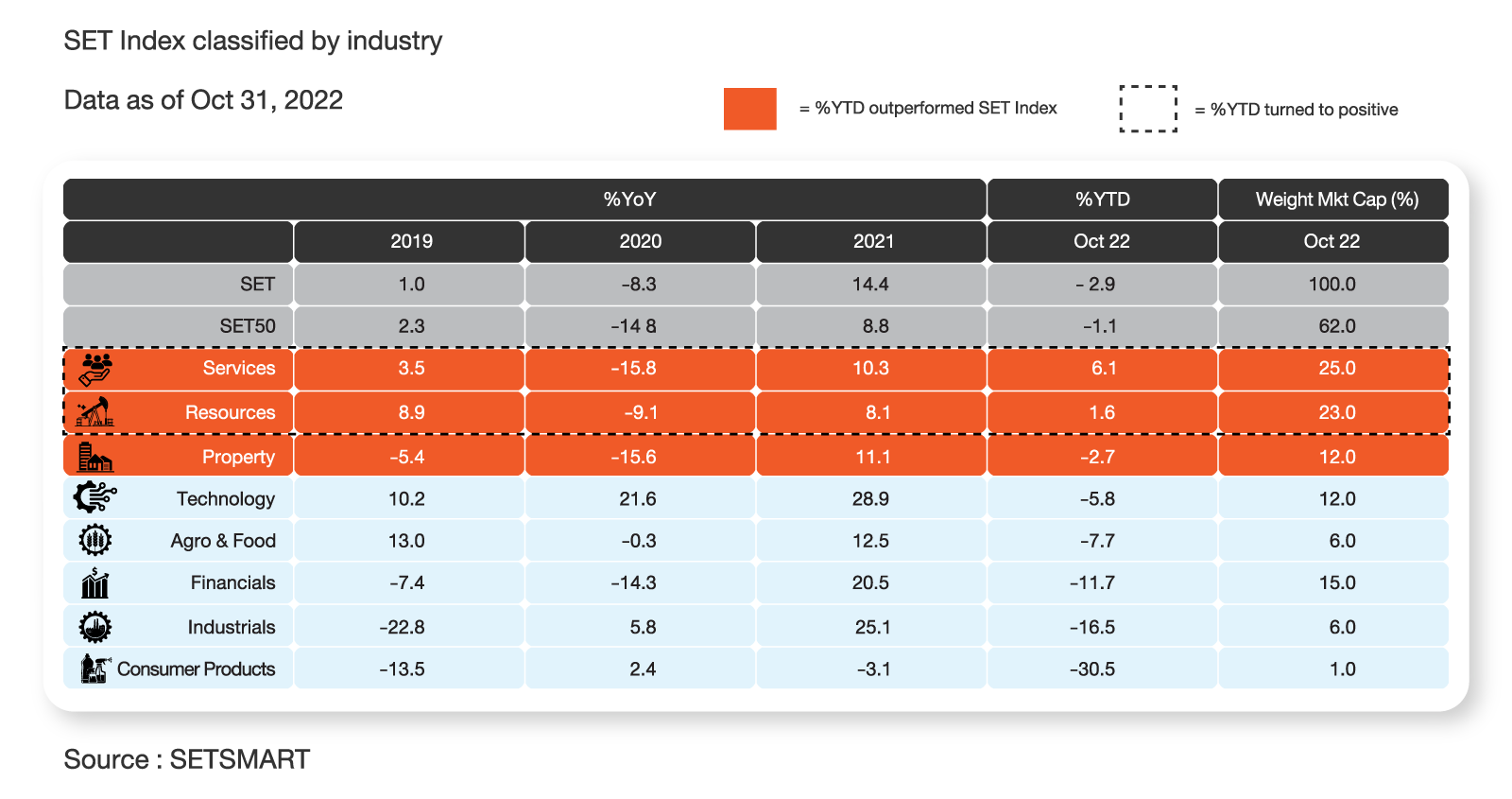

Recovery from the COVID-19 pandemic

Services and Resources industry groups outperformed SET Index in the first eight months of 2022, rising 6.1 percent and 1.6 percent, respectively, from the end of 2021.

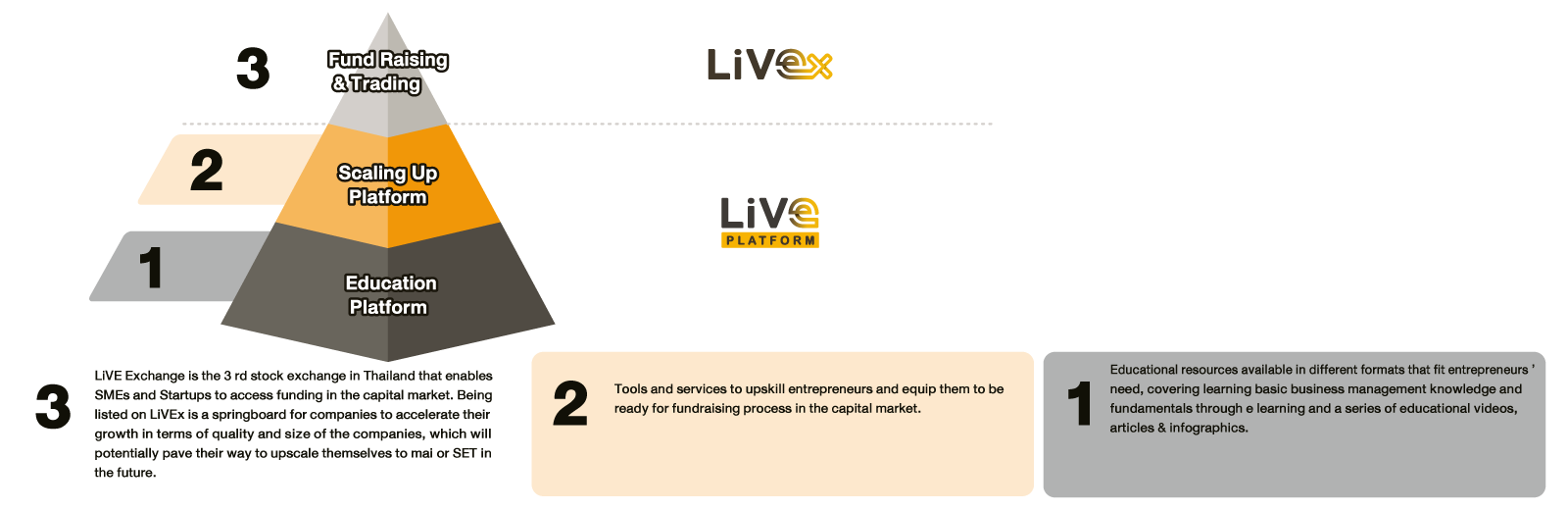

SET promotes SMEs and Startups

LiVE Platform is a knowledge-based platform for SMEs and startups, covering basic management knowledge to prepare them for tapping into fund raising source.

For LiVEx is a new bourse for SMEs and startups to pave the pathway for them to list on SET and mai.

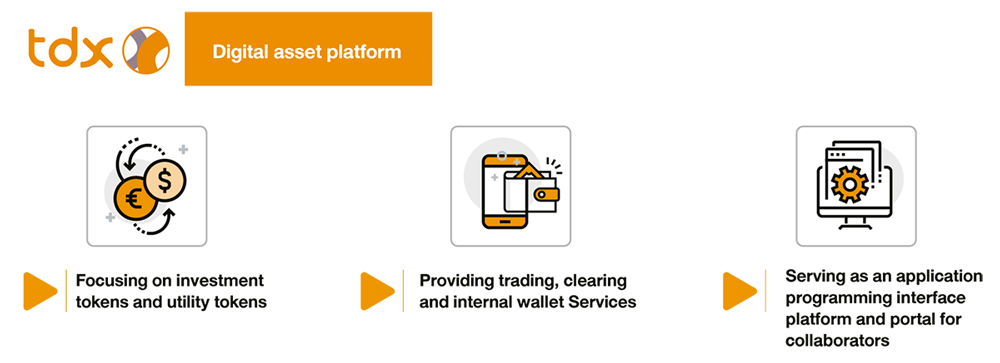

Digital asset exchange

An imminent digital asset exchange, regulated by the Securities and Exchange Commission, will focus on asset-backed utility and investment tokens.

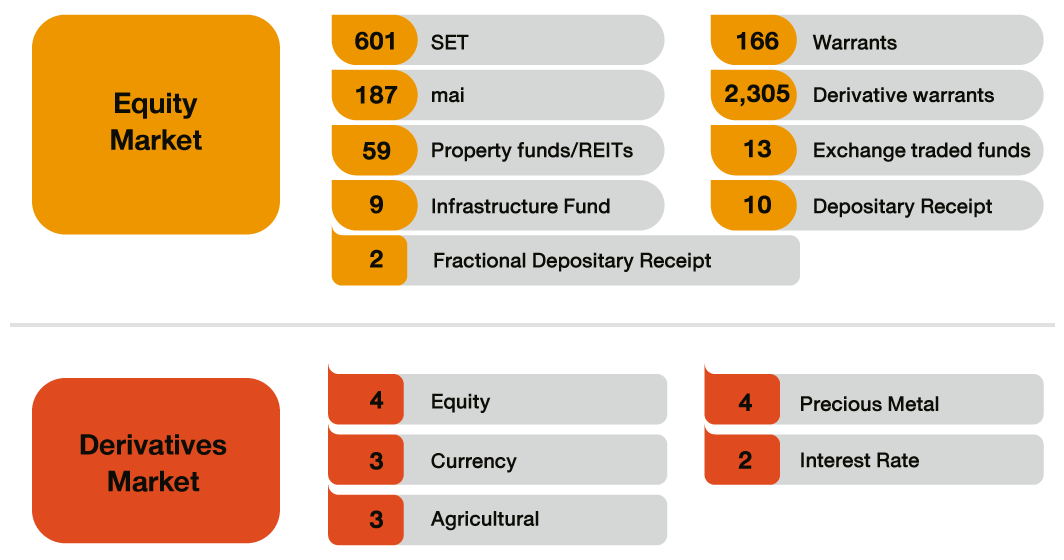

Diversified investment products

SET group offers a wide range of equity and derivatives products to create value and broaden investment opportunities for investors.

Derivatives products

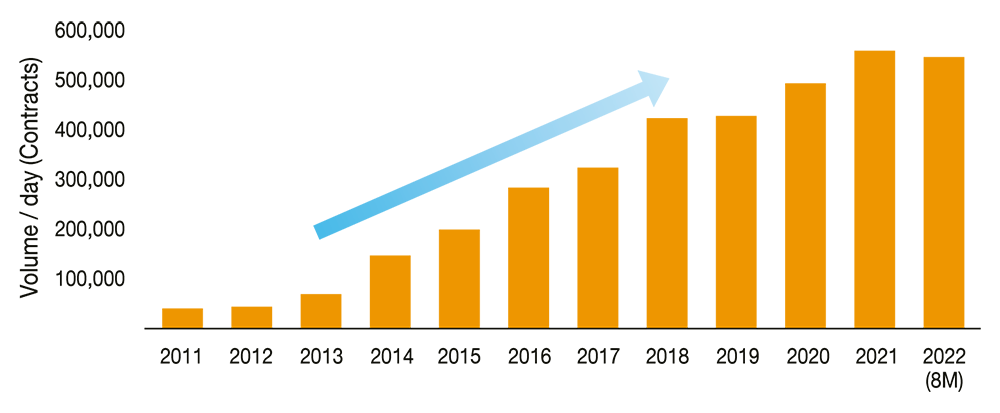

Derivatives products designed to serve needs of entrepreneurs

Consistent growth over the past 10 years

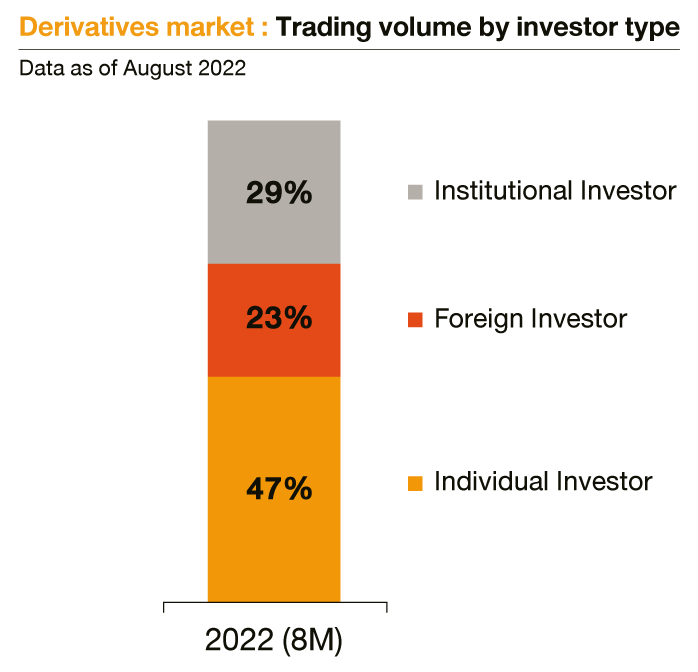

Strong retail base market

Retail investors had the highest trading volume in derivatives market, controlling 47 percent of TFEX’s total volume.

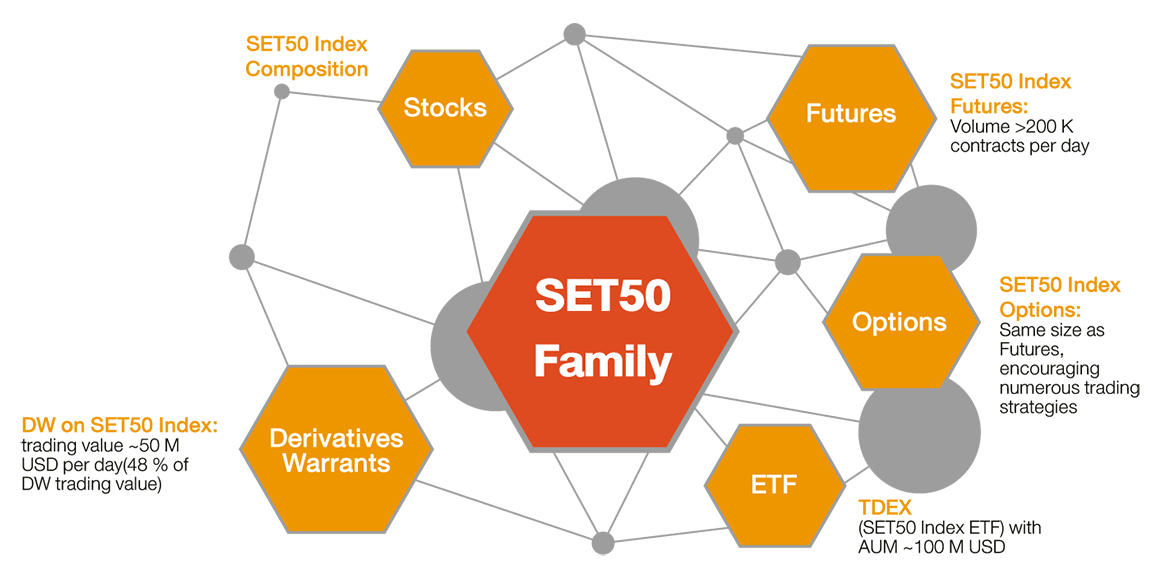

SET50 Index-linked products

SET offers comprehensive SET50 Index related products to enable various trading strategies.

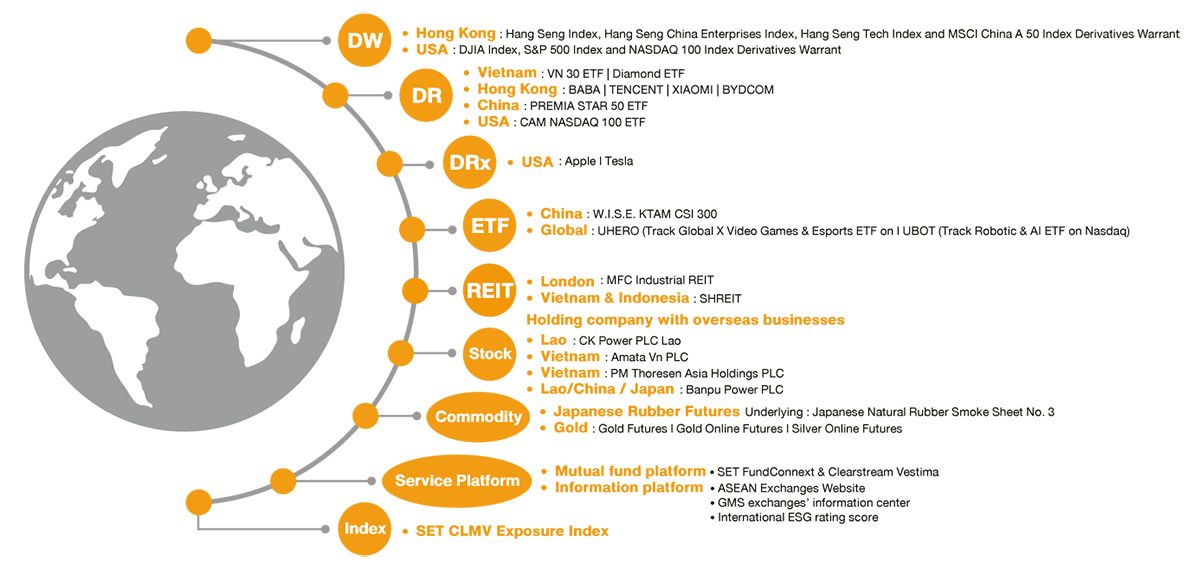

Bring global products to the hand of local investors

SET offers various global linked products across all continents.

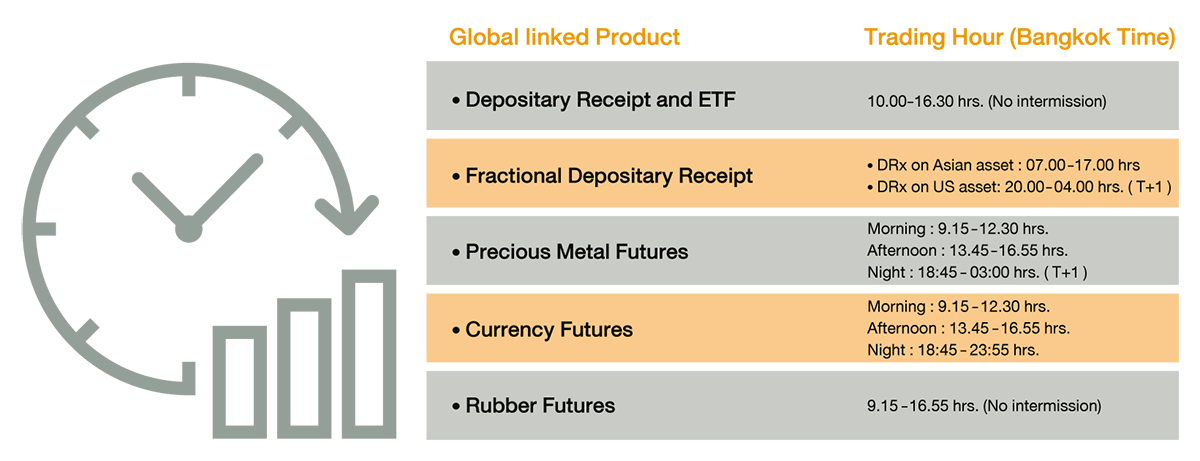

Bridging trading time with the world, offering more trading opportunity

SET group offers off hour trading up to 4 am. next day for global linked products.

Growing demand

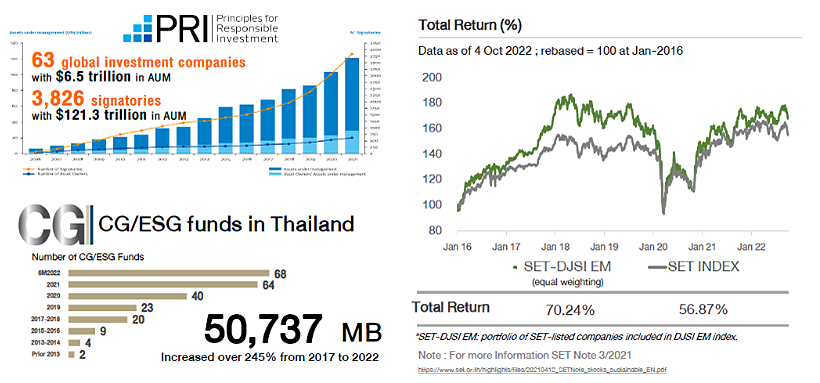

Number of CG-ESG funds in Thailand has increased to 68 as of June 2022 from 64 in 2021 and 40 in 2020 to serve the growing demands in sustainable investing.

Thai listed companies recognized internationally in sustainability practices

SET has continuously enhanced Thai listed companies to embed sustainability into business operations. Local listed companies have been recognized by the globally renowned sustainability benchmarks including Dow Jones Sustainability Index (DJSI) and S&P Global.

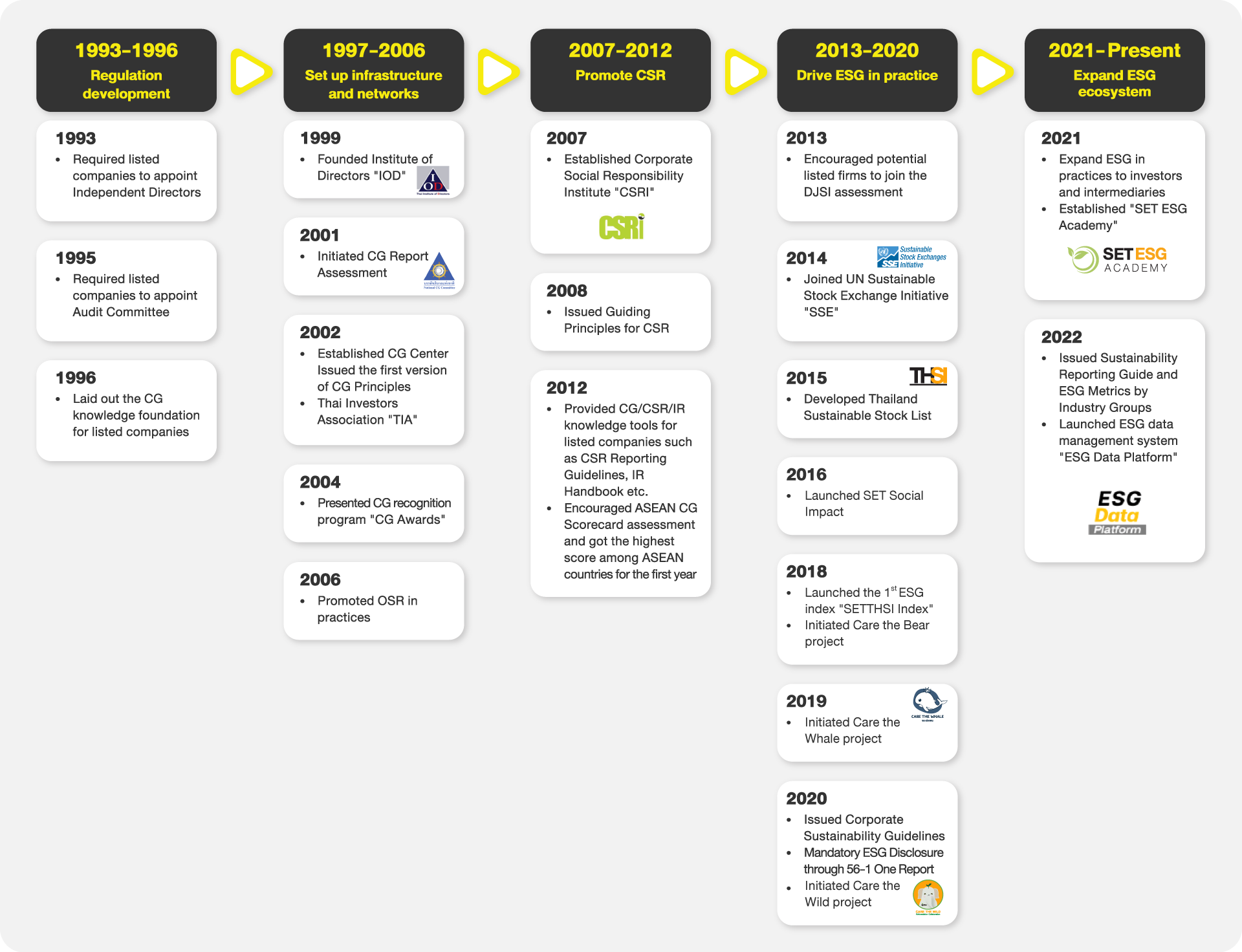

CG and sustainability milestone

SET has adopted corporate governance practices since the 1997 financial crisis

Thai capital market’s ESG ecosystem

ESG ecosystem created by SET covers both issuer and investor sides

Accessible capital market

Settrade offers Streaming, a user-friendly online trading application for stocks and derivatives that allows investors to place orders with their brokers via mobile devices including smartphones or tablets, and PC.

At present, 33 securities and 4 derivatives brokers provide online trading services through Settrade Streaming. The feature-rich platform, including real-time data, market summary, intraday graph, buy/sell placing order, credit limit and credit linem and trading account opening available, enables investors to make better and informed decisions.

Moreover, Streaming Fund+, an online trading app for mutual funds from 22 asset management companies, is available.